edb3_16

Foreword

This article is based on three Fortune and Barron’s articles, describing the top 100 of Euro Fortune 500, Inflation Proof, and Barron’s Top stocks for 2024. The title and links to the articles follow:

Fortune 500 Europe (Top 100)

In raw statistical terms, Europe’s economy trails those of the U.S. and China. But Europe does just as much as its larger counterparts to drive the global business agenda. The inaugural edition of the Fortune 500 Europe, which ranks the biggest companies in Europe by revenue, aims to capture this diverse, dynamic environment. (The flagging euro also affected headline revenue and profit results on this list since Fortune uses dollars as its baseline currency for rankings.) Read more about this year’s list here.

13 inflation-proof stocks to buy for 2024

BY WILL DANIEL AND SCOTT DECARLO

November 28, 2023, at 6:00 AM EST

Fortune asked seven of Wall Street’s most well-respected investors and analysts for their top stock picks for 2024. The diverse mix of companies they mentioned range from sturdy, predictable consumer-staples plays to bets on a new technological revolution. In a time of uncertainty, these picks should provide a mix of safety and opportunity, no matter what happens in the broader economy.

Barron’s 10 Favorite Stocks for 2024

Barron’s list for 2024 includes a diversified mix of familiar stocks and some surprises, once again leaning toward, but not exclusively to, the value camp:

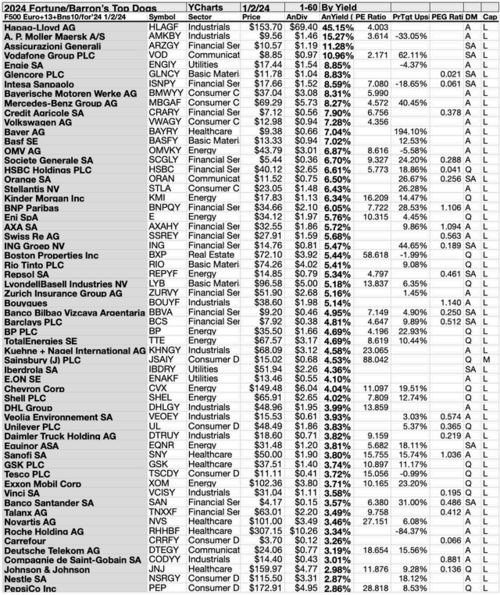

Any collection of stocks is more clearly understood when subjected to yield-based (dogcatcher) analysis, this collection of Fortune and Barron’s articles, is perfect for the dogcatcher process. Below are the 98 January 2, 2024 Fortune/Barron’s To Dogs as parsed by YCharts.

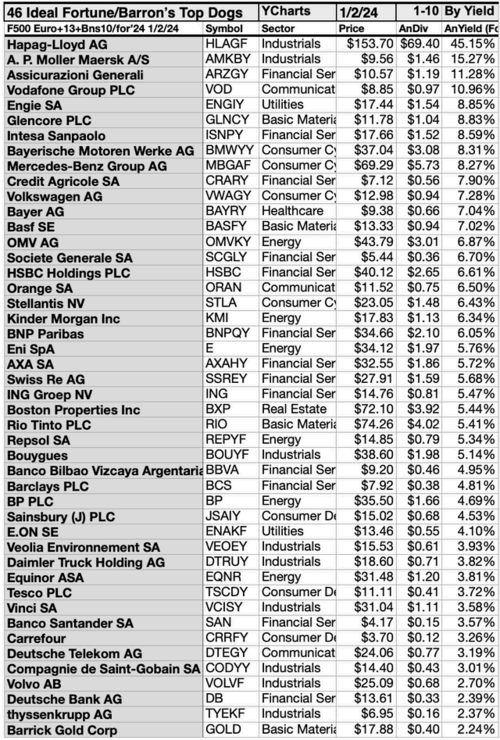

The prices and yields of 46 of the 98 made the possibility of owning productive dividend shares from this collection more viable for first-time investors.

Those 46 Dogcatcher For/Bar Ideal Dogs for 2024 are:

These 46 all live up to the ideal of annual dividends from $1K invested exceeding their single share prices. Many investors see this condition as “look closer to maybe buy” opportunity.

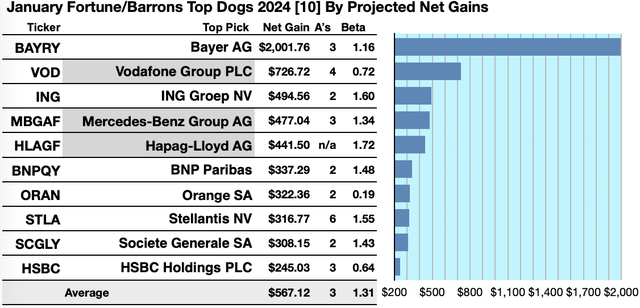

Actionable Conclusions (1-10): Analysts Estimated 24.5% To 200.18% For/Bar Top 10 Net Gains By January 2025

Three of ten top “For/Bar” dividend stocks by yield were also among the top ten gainers for the coming year based on analyst 1-year target prices. (They are tinted gray in the chart below). Thus, the yield-based forecast for these January dogs was graded by Wall St. Wizards as 30% accurate.

Estimated dividends from $1000 invested in each of the highest yielding Fo/Ba 2024 Top Dogs stocks, added to the median of aggregate one-year target prices from analysts (as reported by YCharts), generated the following results. Note: one-year target prices by lone analysts were not included. Ten probable profit-generating trades projected for January 2025 were:

Bayer (OTCPK:BAYRY) was projected to net $2001.76 based on dividends, plus the median of target estimates from 3 brokers, less transaction fees. The Beta number showed this estimate subject to risk/volatility 16% greater than the market as a whole.

Vodafone Group Public Limited Company (VOD) was projected to net $726.72, based on dividends, plus the median of target price estimates from 4 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 28% under the market as a whole.

ING Groep N.V. (ING) was projected to net $494.56, based on dividends, plus the median of target price estimates from 2 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 60% over the market as a whole.

Mercedes-Benz Group AG (OTCPK:MBGAF) was projected to net $477.04, based on the median of target price estimates from 3 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 34% greater than the market as a whole.

Hapag-Lloyd (OTCPK:HLAGF) was projected to net $441.50, based on dividends alone, less broker fees. The Beta number showed this estimate subject to risk/volatility 72% greater than the market as a whole.

BNP Paribas (OTCQX:BNPQY) was projected to net $337.29, based on dividends, plus the median of target price estimates from 2 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 52% under the market as a whole.

Orange S.A. (ORAN) was projected to net $3222.56 based on the median of target price estimates from 2 analysts, plus annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 81% under the market as a whole.

Stellantis N.V. (STLA) was projected to net $316.77, based on dividends, plus median target price estimates from 5 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 55% over the market as a whole.

Société Générale Société anonyme (OTCPK:SCGLY) was projected to net $308.15, based on dividends, plus the median of target price estimates from 2 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 43% greater than the market as a whole.

HSBC Holdings plc (HSBC) was projected to net $245.03, based on the median of target estimates from 3 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 36% less than the market as a whole.

The average net gain in dividend and price was estimated at 56.71% on $10k invested as $1k in each of these ten stocks. These gain estimates were subject to average risk/volatility 31% over the market as a whole.

Source: Open source dog art from dividenddogcatcher.com

The Dividend Dogs Rule

Stocks earned the “dog” moniker by exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest-yielding stocks in any collection became known as “dogs.” More precisely, these are, in fact, best called, “underdogs”.

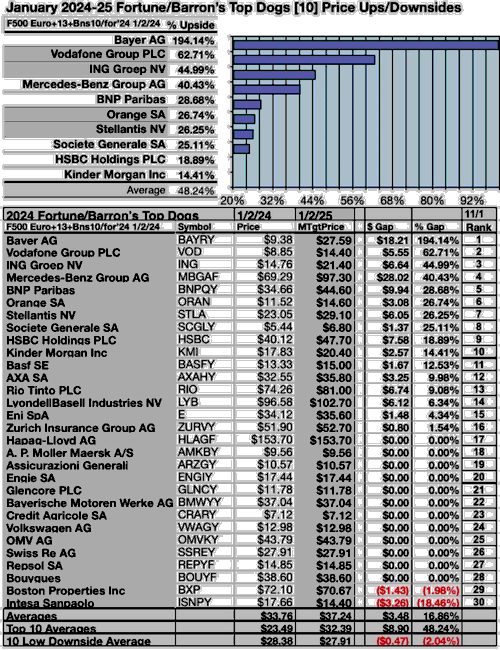

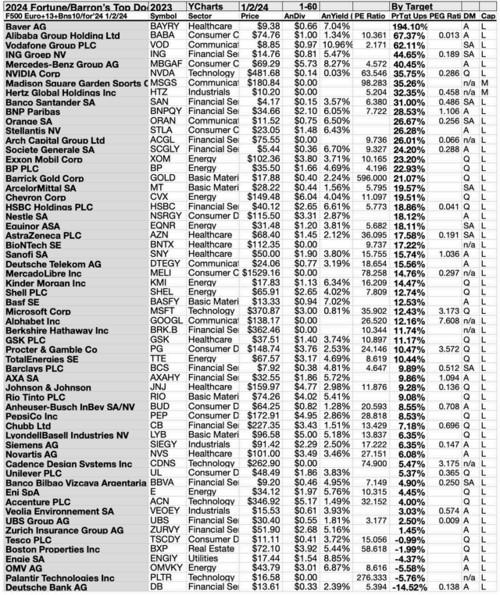

60 For/Bar TopDog Equities For 2024-25 Per January Analyst Target Data

Source: YCharts Source: YCharts

Actionable Conclusions (11-20): Ten Top ‘Pre-Crash Recovery’ Equities

Top ten For/Bar TopDog Equities by yield for 2024 represented six of eleven Morningstar sectors. First place went to one of two industrials sector representatives, Hapag Lloyd AG [1], and A.P. Møller – Mærsk A/S (OTCPK:AMKBY) [2].

Third place went to the first of three from the financial services sector, Assicurazioni Generali (OTCPK:ARZGY) [3]. The other two financials placed seventh and tenth, Intesa Sanpaolo (OTCPK:ISNPY) [7], and Credit Agricole SA (OTCPK:CRARY) [10].

The one communication services representative placed fourth, Vodafone Group [4], and a lone utilities sector member placed fifth, Engie SA (OTCPK:ENGIY) [5]. and one basic materials entity was sixth, Glencore plc (OTCPK:GLNCY) [6].

Finally, two consumer cyclical representatives placed eighth and ninth, Bayerische Motoren Werke Aktiengesellschaft (OTCPK:BMWYY) [8], and Mercedes-Benz Group AG [9], to complete the top ten For/Bar TopDog Equities by yield for 2024 as of January 2.

Actionable Conclusions: (21-30) Ten Top ‘For/Bar TopDog‘ Dividend Payers For 2024 Showed 21.15%-36.34% Upsides While (31) No Down-siders Were Recorded For December

To quantify top dog rankings, analyst median price target estimates provided a “market sentiment” gauge of upside potential. Added to the simple high-yield metrics, median analyst target price estimates became another tool to dig out bargains.

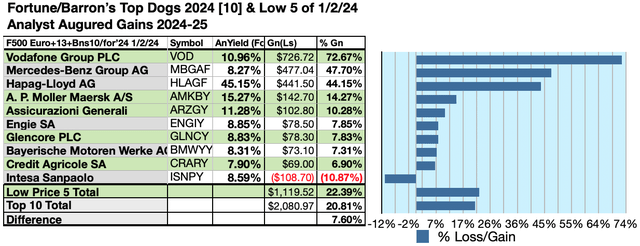

Analysts Forecast A 7.6% Advantage For 5 Highest Yield, Lowest Priced, of 10 ‘For/Bar TopDog‘ Stocks for 2024-25

Ten top Fortune/Barron’s dividend equities for 2024-25 were culled by yield 1/2/24 for this update. Yield (dividend/price) results provided by YCharts did the ranking.

As noted above, top ten Fortune/Barron’s, dividend stocks, as screened 1/2/24, showing the highest dividend yields, represented six of eleven in the Morningstar sector scheme.

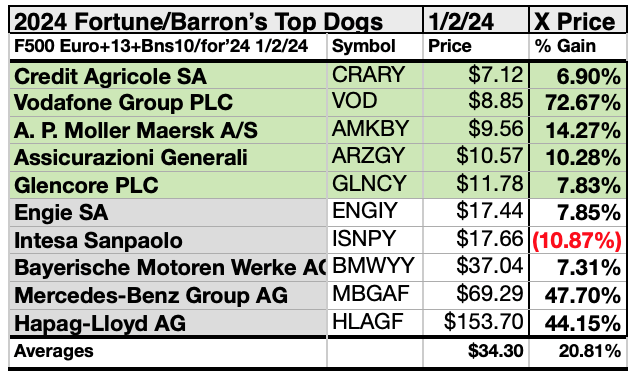

Actionable Conclusions: Analysts Predicted 5 Lowest-Priced Of The Top Ten Highest-Yield ‘For/Bar TopDog‘ Dividend Stocks for 2024-25 (32) Delivering 22.39% Vs. (33) 20.81% Net Gains by All Ten Come January 2025

$5,000 invested as $1k in each of the five lowest-priced stocks in the top ten Fortune/Barron’s dividend Stocks for 2024-25 by yield, were predicted, by analyst 1-year targets, to deliver 7.6% more gain than $5,000 invested as $0.5k in all ten. The second lowest-priced selection, Vodafone Group PLC, was projected to deliver the best net gain of 72.67%.

Source: YCharts

The five lowest-priced top yield, Fortune/Barron’s dividend Top Dog Stocks as of January 2 were: Credit Agricole S.A.; Vodafone Group Public Limited Company; A.P. Møller – Mærsk A/S; Assicurazioni Generali S.p.A.; Glencore plc (OTCPK:GLNCY), with prices ranging from $7.12 to $11.78.

Five higher-priced Fortune/Barron’s dividend Top Dog Stocks as of January 2 were: Engie SA; Intesa Sanpaolo; Bayerische Motoren Werke Aktiengesellschaft; Mercedes /Benz Group AG; Hapag-Lloyd AG, whose prices ranged from $17.44 to $153.70.

The distinction between five low-priced dividend dogs and the general field of ten projected Michael B. O’Higgins’ “basic method” for beating the Dow. The scale of expected gains, based on analyst targets, added a unique element of “market sentiment” gauging upside potential. It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised since analysts are historically only 15% to 85% accurate on the direction of change and just 0% to 15% accurate on the degree of change.

The net gain/loss estimates above did not factor in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of “dividends” from any investment.

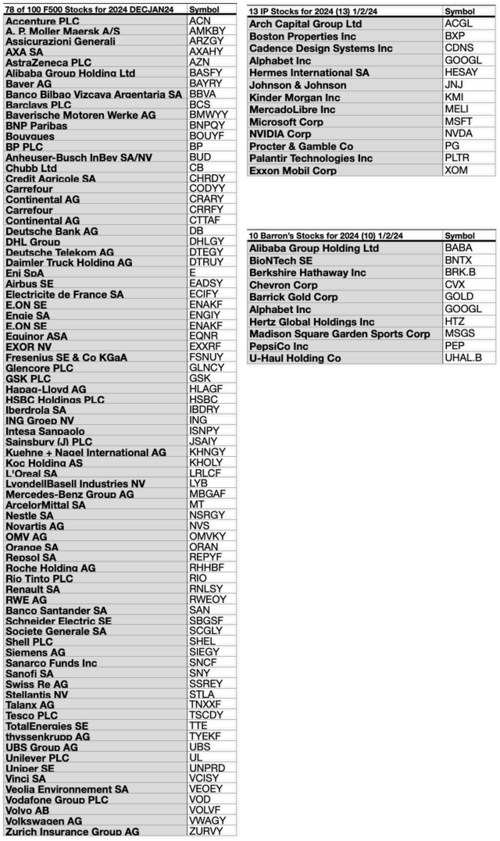

Afterword

This article features 98 Fortune/Barron’s Top Dog selections for 2024-25. The article focuses on the top 30 dividend payers. Thus, nearly two-thirds of the original list of companies is neglected. Therefore, below are the three lists of 98 stocks grouped by source.

Sources: Fortune.com, Barrons.com, YCharts.com

If somehow you missed the suggestion of which stocks are ripe for picking at the start of this article, here is a reprise of the list at the end:

The prices of 46 of these 98 Fortune/Barron’s ‘Top Dog dividend selections for 2024-25 made the possibility of owning productive dividend shares from this collection more viable for first-time investors.

Those 46 Dogcatcher ideal dividend stocks for 2024 are:

Those 46 all live up to the ideal of having their annual dividends from a $1K investment exceed their single share prices. Many investors see this condition as “look closer to maybe buy” opportunity.

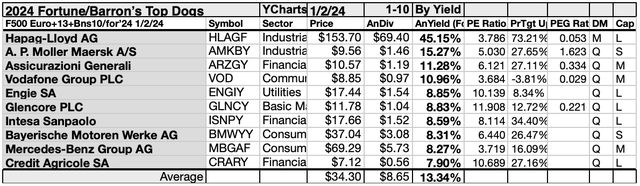

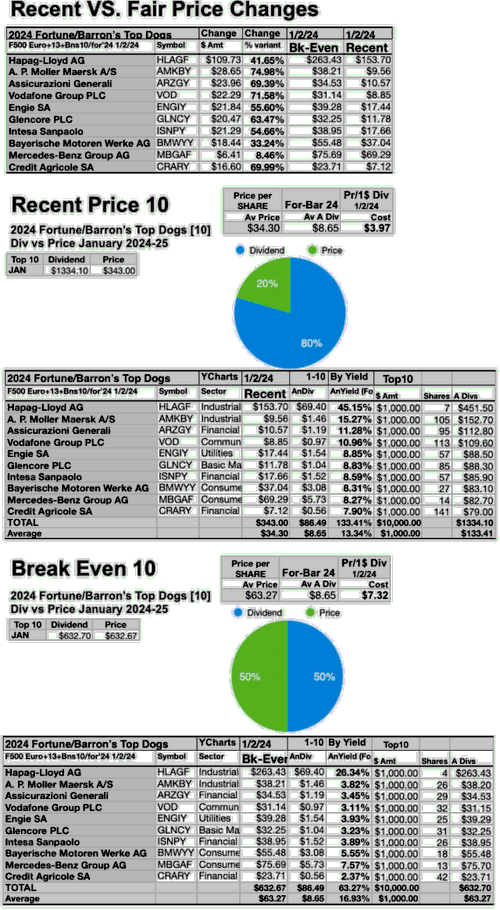

How All Ten Top For/Bar2024 Stocks Could Grow To Marginal Ideal Fair-Priced Dogs

Since all of the top-ten Fortune/Barron’s, Top Dog stocks for 2024 are now priced less than the annual dividends paid out from a $1K investment, the above charts compare those ten against break-even prices.

The dollar and percentage differences between recent and break-even prices are detailed in the top chart. The recent prices are shown in the middle chart with the break-even pricing of all ten top dogs conforming to the dogcatcher break-even ideal are detailed in the bottom chart.

Without downside market pressure all ten highest-yield Barron’s, Bloomberg & Fortune Pre-Crash Recovery Dividend stocks, are better than fair-priced with their annual yield (from $1K invested) exceeding their single share prices. The comparison shows how much the recent stock prices could go up before exceeding the (arbitrary but logical) price limit.

Stocks listed above were suggested only as possible reference points for your purchase or sale research process. These were not recommendations.

Disclaimer: This article is for informational and educational purposes only and should not be construed to constitute investment advice. Nothing contained herein shall constitute a solicitation, recommendation or endorsement to buy or sell any security. Prices and returns on equities in this article except as noted are listed without consideration of fees, commissions, taxes, penalties, or interest payable due to purchasing, holding, or selling same.

Graphs and charts were compiled by Rydlun & Co., LLC from data derived from www.indexarb.com; YCharts.com; Yahoo Finance – Stock Market Live, Quotes, Business & Finance News; analyst mean target price by YCharts. Dog image: Open source dog art from Dividend Dog Catcher.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.