It’s no secret that Costco Wholesale (COST 1.11%) is among the most successful retailing businesses around. An intense focus on efficiency and price leadership allowed the warehouse club giant to build the third-largest retailing empire on the planet, trailing only Walmart and Amazon. Costco achieved this success with a much smaller sales footprint, too, as each store (871 globally) generates over $250 million of revenue per year, on average.

There are other aspects of its business that investors should know before buying the stock this year. Here’s a look at four of the biggest.

1. Costco sales are accelerating

The main piece of good news driving shares higher into 2024 is Costco’s improving growth rates. The company releases monthly sales updates, in contrast with most retailing peers, and that’s why investors know more about how this business performed through the holiday shopping season.

Sales were up an impressive 9% year over year in December, more than double the expansion rate from the prior quarter, executives said in early January.

That acceleration showed up both in Costco’s warehouse division and its e-commerce division, which focuses more on big discretionary purchases, like home furnishings and consumer electronics. That’s an encouraging trend that suggests shoppers are feeling more confident after reigning in their spending through most of last year.

2. Costco’s profitability won’t budge

Wall Street is excited about the potential that Costco will hike its membership fees in 2024. It’s been over six years since the last increase, after all, and renewal rates are sitting at all-time highs today. It’s clear that shoppers are getting plenty of value from their subscriptions, which is great news for a business that generates most of its profits from membership fees.

But investors shouldn’t count on Costco’s profit margin rising along with those fees. Management has made it clear over the years that they intend to direct all extra resources toward keeping the chain’s product prices low. That’s why operating profit margin hasn’t budged from about 3% of sales in the past decade. It’s also a key factor supporting sales growth.

3. Costco’s stock is expensive

Costco stock isn’t cheap, either, when compared with industry peers or judged against its past valuation. You’ll have to pay 1.2x sales for the stock today, or about double the rate for Walmart or Target. That big premium applies to Costco’s price-to-earnings ratio, as well. Shares are priced at nearly 50x profits, compared to Walmart’s 27x.

Costco does tend to earn its premium valuation, thanks to factors like its unusually stable sales and earnings growth. Profit margins are low, sure, but they don’t swing wildly along with consumer spending shifts. Investors prize that level of predictability, which doesn’t happen much in the retailing industry.

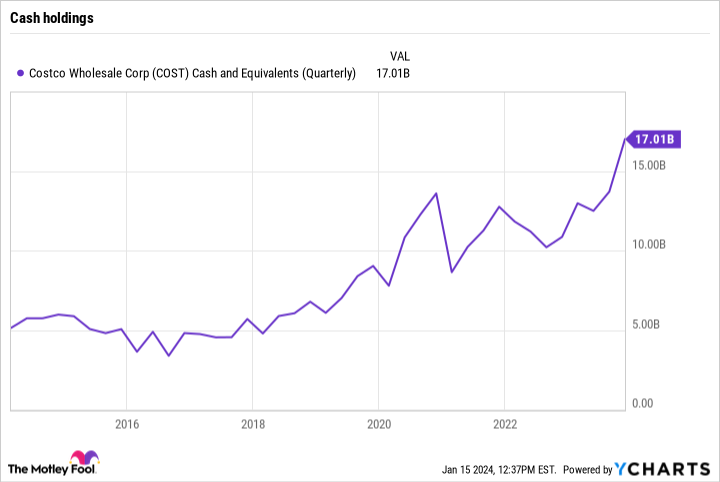

4. Costco just reduced its cash holdings big-time

Costco’s reported cash balances will fall hard when the company reports its next earnings update in early March. Management splurged on a $7 billion one-time dividend payment that arrived in shareholders’ accounts in mid-January, likely taking cash holdings down to around $10 billion.

COST Cash and Equivalents (Quarterly) data by YCharts.

Investors should follow this metric, in addition to the chain’s updated renewal rate, in Costco’s next full earnings update. Continued boosts in both areas will mean faster sales growth and more cash returns to shareholders over the long term, even if 2024 is a muted year in both respects.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Demitri Kalogeropoulos has positions in Amazon and Costco Wholesale. The Motley Fool has positions in and recommends Amazon, Costco Wholesale, Target, and Walmart. The Motley Fool has a disclosure policy.