Income-focused investors have to guard against the emotional risk of buying ultra-high yields that are supported by risky companies. It is very easy to get so caught up in the income stream from the dividend that you overlook the investment risk you are taking on. That’s not a problem with Enterprise Products Partners (EPD -0.36%) and its huge 7.2% distribution yield. Here’s four reasons why Enterprise’s giant yield is for real.

What does Enterprise do?

As a foundation, it’s important to understand that Enterprise operates in the highly volatile energy sector. That sounds risky, but the master limited partnership (MLP) is a midstream player, which means that it helps to move oil and natural gas around the world via a portfolio of vital energy infrastructure. It charges fees for the use of the physical assets it owns, which creates a reliable stream of cash flows. Demand for energy, which is usually strong even when oil prices are weak, is the more important factor in Enterprise’s performance.

Image source: Getty Images.

So, despite operating in a highly cyclical industry, Enterprise is a fairly stable and boring income stock. In fact, it has increased its distribution annually for 25 consecutive years, which is a very impressive feat. That’s the base reason why Enterprise’s big yield is one you can count on. But here are four more you should know about.

1. Enterprise has an investment-grade rated balance sheet

A reliable cash-generating business is important, but a good business foundation isn’t enough. Companies can easily cause themselves massive problems if they use debt too aggressively. Luckily, that’s not the case with Enterprise. Without having to dig into the balance sheet yourself, you can simply look at the analysis provided by the three major credit rating agencies. They have unanimously awarded Enterprise investment-grade ratings. So that strong business foundation is backed up by a strong financial foundation.

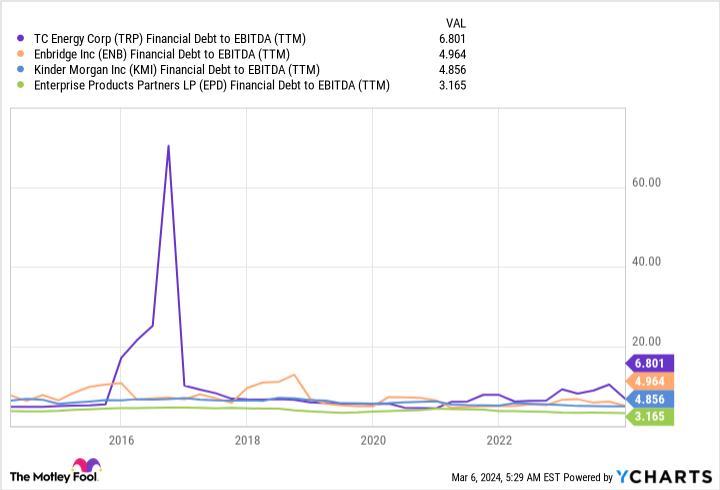

2. Enterprise has low leverage relative to peers

You can find other companies offering high yields in the midstream space. And many of those companies also have strong balance sheets. But Enterprise actually stands out from its closest peers because its debt-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) ratio is roughly 3.1 times. That’s the lowest of the group today. And, perhaps more important, having lower leverage than peers is the norm, as the chart below highlights. Basically, being fiscally conservative is part of Enterprise’s approach.

TRP Financial Debt to EBITDA (TTM) data by YCharts

3. Enterprise covered its distribution by 1.7 times

Adding to the allure is the fact that Enterprise’s distributable cash flow covered its distribution by roughly 1.7 times in 2023. That’s a very strong number. It indicates that distributable cash flow would have to fall materially before the distribution would be at risk of a cut.

To be fair, the figure is so high because Enterprise has been trying to use internally generated funds to support its capital investment projects. However, if faced with a difficult environment, it could easily lean on its balance sheet for a little bit while the coverage ratio temporarily dipped.

4. Enterprise is buying back units

On top of all of this, Enterprise has a $2 billion unit repurchase program in place. It has spent roughly $918 million of that allotment. There’s two notable takeaways. First, each unit it buys reduces the total amount of distributions it has to pay to unitholders. Second, management appears to believe that the units are attractively priced today. Add in the fact that the yield is toward the high end of the historical yield range, and this reliable income stock looks like it is cheap, too.

A high yield worth the “risk”

If you are a dividend investor looking for high-yield stocks, Enterprise has probably popped up on your radar screen. Given the business model, financial foundation, strength relative to peers, and management’s efforts to buy back units, you should feel very comfortable adding this ultra-high-yield midstream giant to your portfolio.