feedough/iStock via Getty Images

Foreword

This article is based on Fortune magazine’s 2023 survey of 500 Largest U.S. Corporations (F500-IL)

“Size matters: the 50 largest companies on this year’s list accounted for 49% of total Fortune 500 revenue and 45% of earnings.” This article covers those 50 and 18 more as industry leaders.

Any collection of stocks is more clearly understood when subjected to yield-based (dog catcher) analysis, this collection ofF500-IL for 2023 is perfect for the dogcatcher process. Below are the November 8 data for the 58 dividend stocks populating those F500IL as parsed by YCharts.

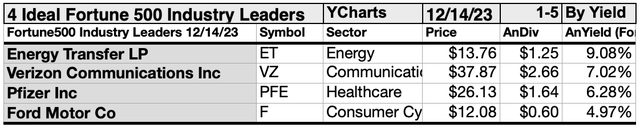

The prices of 4 of the 58 dividend selections made the possibility of owning productive dividend shares from this collection a reality for first-time investors.

The 4 Dogcatcher ideal best to buy December stocks were: Energy Transfer LP (ET); Pfizer (PFE); Verizon Communications (VZ); Ford Motor (F).

Those four all live up to the ideal of having their annual dividends from a $1K investment exceed their single share prices. Many investors see this condition as “look closer to maybe buy” opportunity.

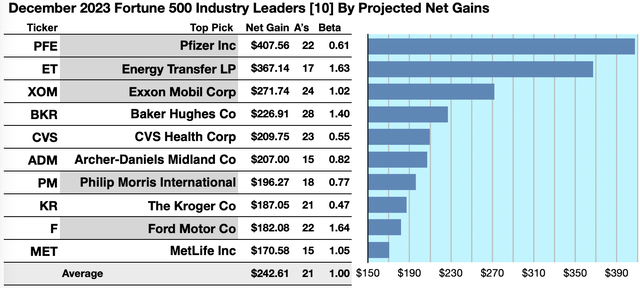

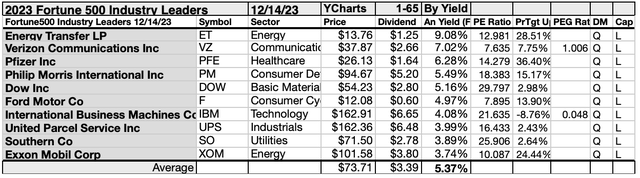

Actionable Conclusions (1-10): Analysts Estimated 17.06% To 40.76% Net Gains From Ten F500-IL Dividend Stocks Into December 2024

Five of ten top F500-IL dividend stocks by yield were also among the top ten gainers for the coming year based on analyst 1-year target prices. (They are tinted gray in the chart below). Thus, the yield-based forecast for these December favorites was graded by Wall St. Wizards as 50% accurate.

Source: YCharts.com

Estimated dividends from $1000 invested in each of the highest yielding F500-IL stocks, added to the median of aggregate one-year target prices from analysts (as reported by YCharts), generated the following list. (Note that one-year target-prices by lone-analysts were not included.) Thus, ten probable profit-generating trades projected to December, 2024 were:

Pfizer Inc was projected to net $407.56 based on the median of target price estimates from 22 analysts, plus annual dividend, less broker fees. The Beta number showed this calculate subject to risk/volatility 39% less than the market as a whole.

Energy Transfer LP was projected to net $367.14, based on the median of target price estimates from 17 analysts, plus dividends, less broker fees. The Beta number showed this calculate subject to risk/volatility 63% greater than the market as a whole.

Exxon Mobil (XOM) was projected to net $271.74, based on dividends, plus the median of target price estimates from 24 analysts, less broker fees. The Beta number showed this calculate subject to risk/volatility 2% greater than the market as a whole.

Baker Hughes (BKR) was projected to net $226.91, based on dividends, plus the median of target price estimates from 28 analysts, less broker fees. The Beta number showed this calculate subject to risk/volatility 40% greater than the market as a whole.

CVS Health (CVS) was projected to net $209.75 based on the median of target estimates from 23 analysts, plus dividends, less broker fees. The Beta number showed this calculate subject to risk/volatility 45% less than the market as a whole.

Archer-Daniels-Midland (ADM) was projected to net $207.00, based on dividends, plus median target price estimates from 15 analysts, less broker fees. The Beta number showed this calculate subject to risk/volatility 18% less than the market as a whole.

Philip Morris International (PM) was projected to net $196.27 based on dividends, plus the median of target estimates from 18 brokers, less transaction fees. The Beta number showed this calculate subject to risk/volatility 23% less than the market as a whole.

The Kroger Co. (KR) was projected to net $187.05, based on the median of estimates from 21 analysts, plus dividends, less broker fees. The Beta number showed this calculate subject to risk/volatility 53% less than the market as a whole.

Ford Motor was projected to net $182.08, based on dividends, plus the median of target price estimates from 22 analysts, less broker fees. The Beta number showed this calculate subject to risk/volatility 64% greater than the market as a whole.

MetLife (MET) was projected to net $170.58, based on dividends, plus the median of target price estimates from 15 analysts, less broker fees. The Beta number showed this calculate subject to risk/volatility 5% over the market as a whole.

The average net gain in dividend and price was estimated at 24.26% on $10k invested as $1k in each of these ten stocks. These gain estimates were subject to average risk/volatility equal to the market as a whole.

Source: Open source dog art from dividenddogcatcher.com

The Dividend Dogs regulate

Stocks earned the “dog” moniker by exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as “dogs.” More precisely, these are, in fact, best called, “underdogs”.

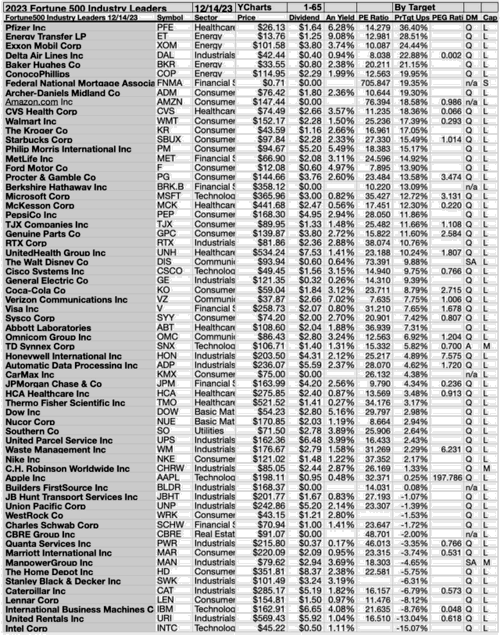

65 F500-IL In December Per Analyst Target Data

Source: YCharts.com

65 F500-IL Per December Yields

Source: YCharts.com

Actionable Conclusions (11-20): Ten Top F500-ILBy Yield For December

Top ten F500-IL by yield for December represented nine of eleven Morningstar sectors. First place was held by the first of two energy representatives, Energy Transfer LP [1]. The other energy firm placed tenth, Exxon Mobil [10].

A communication services member placed second, Verizon Communications. Then, third place went to the healthcare representative, Pfizer [3].

Fourth place was claimed by the lone consumer defensive representative, Philip Morris International [4]. One basic materials sector member placed fifth, Dow (DOW) [5].

A consumer cyclical member took the sixth position, Ford Motor [6]. The lone technology firm in the top ten placed seventh, International Business Machines (IBM) [7].

One industrials member placed eighth, United Parcel Service (UPS) [8]. Finally, in ninth place was the utilities member, Southern Company (SO) [9], to complete the top ten F500-IL of 2023 dividend pack for December.

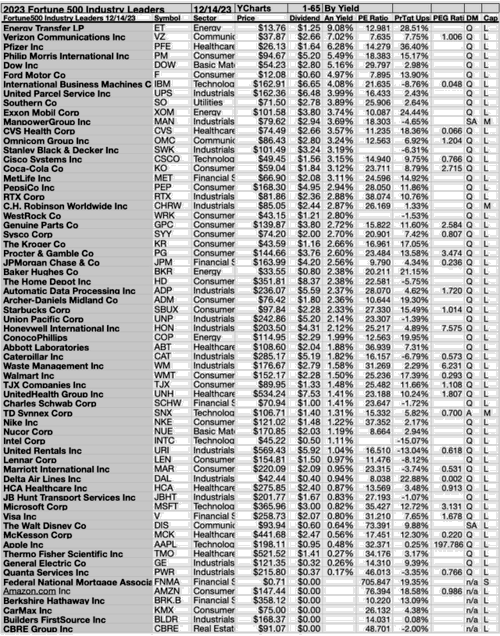

Actionable Conclusions: (21-30) Ten Top F500-IL For December Showed 14.24% to 35.48% Upsides While (31) Five Down-siders Sagged -1.51% to -8.96%

Source: YCharts.com

To gauge top dog rankings, analyst median price target estimates provided a “market sentiment” gauge of upside potential. Added to the simple high-yield metrics, median analyst target price estimates became another tool to dig out bargains.

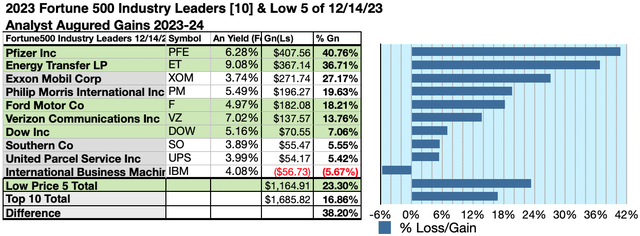

Analysts Forecast A 38.2% Advantage For 5 Highest Yield, Lowest Priced, of 10 F500-IL Dividend Stocks For December

Ten top Fortune F500-IL yield (dividend / price) results provided by YCharts produced the following ranking.

Source: YCharts.com

As noted above top ten F500-IL stocks for 2023 screened 12/14/23, showing the highest dividend yields, represented nine of eleven in the Morningstar sector scheme.

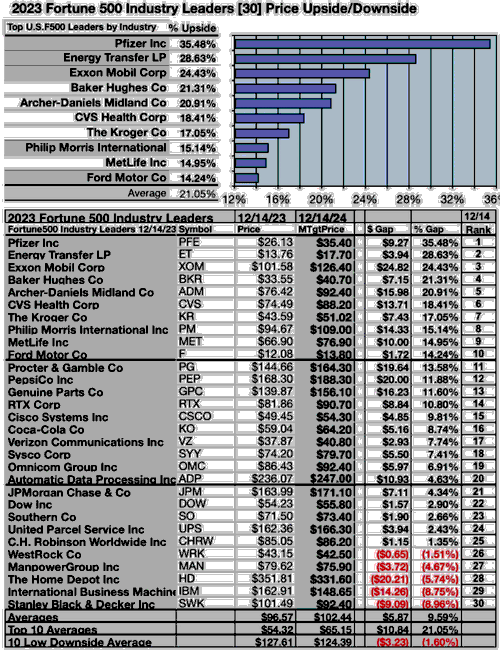

Actionable Conclusions: Analysts Predicted 5 Lowest-Priced Of The Top Ten Highest-Yield F500-IL for 2023 (32) Delivering 23.3% Vs. (33) 16.86% Net Gains by All Ten Come December, 2024

Source: YCharts.com

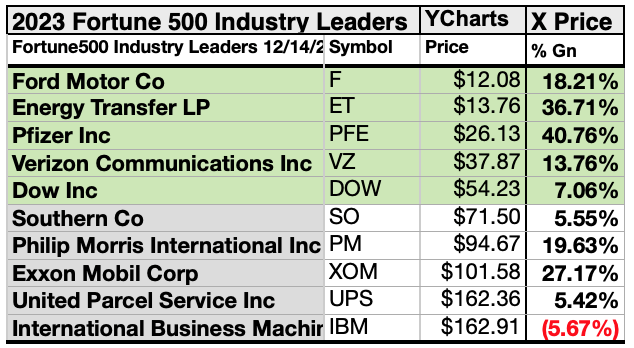

$5000 invested as $1k in each of the five lowest-priced stocks in the top ten F500-IL for 2023 by yield were predicted by analyst 1-year targets to deliver 38.2% more gain than $5,000 invested as $.5k in all ten. The third lowest-priced selection, Pfizer, was projected to deliver the best net gain of 40.76%.

Source: YCharts.com

The five lowest-priced top-yield F500-IL for 2023 Dividend Dogs as of December 14 were: Ford Motor; Energy Transfer LP; Pfizer; Verizon Communications; Dow, with prices ranging from $12.08 to $54.23.

Five higher-priced F500-IL for 2023 Dividend Dogs as of December 14 were: Southern Co; Philip Morris International; Exxon Mobil; United Parcel Service; International Business Machines, whose prices ranged from $71.50 to $162.91.

The distinction between five low-priced dividend dogs and the general field of ten reflected Michael B. O’Higgins’ “basic method” for beating the Dow. The scale of projected gains based on analyst targets added a unique element of “market sentiment” gauging upside potential. It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised, since analysts are historically only 15% to 85% accurate on the direction of change and just 0% to 15% accurate on the degree of change.

The net gain/loss estimates above did not factor in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of “dividends” from any investment.

Afterword

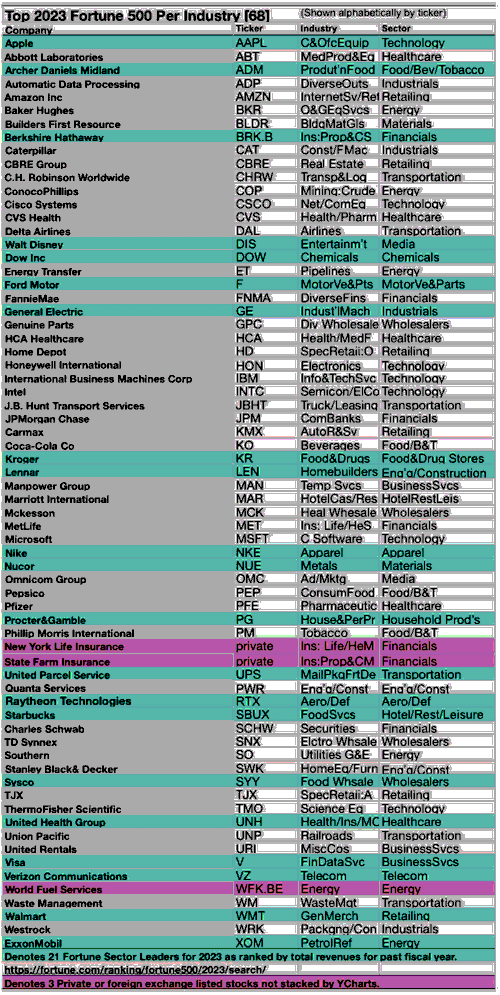

This article features Fortune 500 Industry Leaders for 2023 and focuses on the top 30 for December. Therefore, near half the original list of 58 dividend paying companies is neglected. To treat this condition, the following is provided

A Complete List of 68 Fortune 500 Industry Leaders for 2023

Sources: Fortune.com, YCharts.com

(Stocks are grouped alphabetically by ticker, in ascending order.) The bluish-greenish tinted stocks are Sector Leaders. The three wine tinted listings are privately owned or foreign exchange listed stocks not included in the YCharts listings.

If somehow you missed the suggestion of which stocks are ripe for picking at the start of this article, here is a reprise of the list at the end:

Source: YCharts.com

The prices of 4 of these 68 F500-IL for 2023 made the possibility of owning productive dividend shares from this collection more viable for first-time investors.

Those four all live up to the ideal of having their annual dividends from a $1K investment equal or exceed their single share prices. Many investors see this condition as “look closer to maybe buy” opportunity.

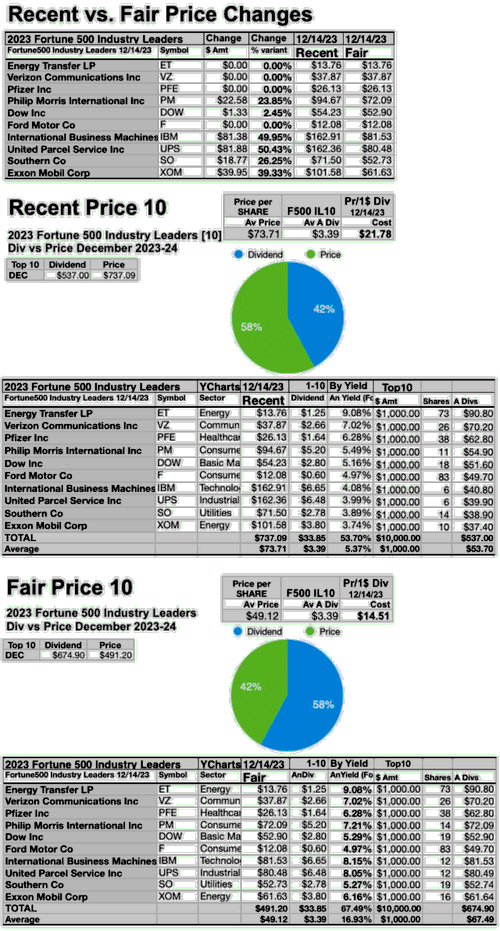

How All Ten Top F500-IL For 2023 Stocks Could Become Ideal Fair Priced Dogs

Source: YCharts.com

Four of the top ten F500-IL stocks for December 2023 are priced less than the annual dividends paid out from a $1K investment. The dollar and percentage differences between recent and fair prices are detailed in the top chart. Four ideal fair-priced stocks plus the six at current prices are shown in the middle chart. Finally, the fair pricing of all ten top dogs conforming to that ideal are the subject of the bottom chart.

With renewed downside market pressure to 50.5%, it is possible for all ten highest-yield F500-IL for 2023 stocks, to become fair-priced with their annual yield (from $1K invested) meeting or exceeding their single share prices. This pack got a nice head-start with four of ten already fair priced.

Stocks listed above were suggested only as possible reference points for your purchase or sale research process. These were not recommendations.

Disclaimer: This article is for informational and educational purposes only and should not be construed to constitute investment advice. Nothing contained herein shall constitute a solicitation, recommendation or endorsement to buy or sell any security. Prices and returns on equities in this article except as noted are listed without consideration of fees, commissions, taxes, penalties, or interest payable due to purchasing, holding, or selling same.

Graphs and charts were compiled by Rydlun & Co., LLC from data derived from www.indexarb.com; YCharts.com; finance.yahoo.com; analyst mean target price by YCharts. Dog image:Open source dog art from dividenddogcatcher.com.