pinstock/E+ via Getty Images

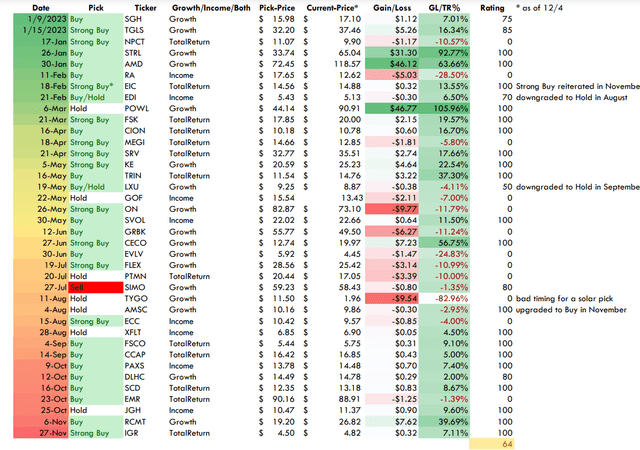

Now that we are in the month of December and the end of the year is approaching, I decided to look back at my recommendations published on Seeking Alpha since the start of 2023. I put together a spreadsheet to keep track of all 38 tickers that I reviewed, several of which I reviewed more than once. Out of the 38, 7 were Hold recommendations, 1 was a Sell, the remaining 30 were Buy or Strong Buy.

In some cases, I may be asked to write an update on a ticker that I have previously covered, and in several cases, I have been asked by someone to cover some of the tickers that I write about. The remainder are ones that I have considered for my own investments. Most of the Hold ratings were tickers that I was asked to cover. The Sell recommendation was also about a ticker that I was asked to supply an update on. Most of the Buy and Strong Buy ratings are tickers that I wanted to own or have owned in the past, many of which I still own today.

If I rated it a Buy, Strong Buy, or Hold and the ticker had a positive Total Return, I gave myself a rating from 75 to 100, depending on the accuracy (how well did it perform). If my rating was wrong, I gave myself a 0. Overall, I did fair with about a 2 out of 3 correct rating (64 out of 100). My success was better in the first 3 months of the year (January through March), and the last 3 months (September through November). In the summer months my picks were basically a coin toss, with only about half correct calls.

I also tend to relish writing more about Income and Total Return investments lately, as opposed to Growth stocks. Now that I have reached retirement age, and my focus is more on income compounding investments that has become my focus with my writing as well.

Growth Stocks

When I was younger and more focused on growing my total portfolio value, I was more interested in Growth stocks that generally do not pay dividends. Some of my better Growth picks this year were several that I identified early in the year admire TGLS, STRL, and AMD. Then in March I rated Powell Industries (POWL) a Hold and it has since taken off, more than doubling in price over the past 7 months. I also made good calls with KE in May, CECO in June, and RCMT in early November.

I missed a few calls on Growth stocks this summer. I got LXU half right when I downgraded my May Buy rating to a Hold in September, so I gave myself a 50 rating on that call. I offered a Strong Buy call on onsemi (ON) in late May, and it tumbled -11% since then. I also thought Green Brick (GRBK) would outperform when I wrote the June article, and it is also down about -11%. Evolv (EVLV) and Flex (FLEX) were other disappointments that I called wrong.

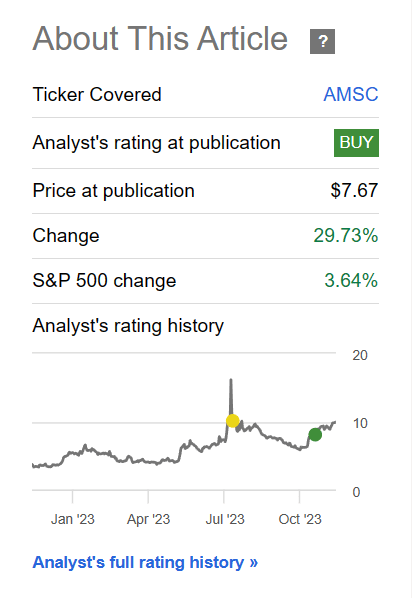

Even though AMSC looks admire a miss, I got the Hold call correct, and my upgrade to a Buy rating has paid off so far with almost a 30% gain since I upgraded to a Buy, so I rated myself 100 on that ticker.

Seeking Alpha

My one Sell rating on Silicon Motion (SIMO) was a requested update from Seeking Alpha editors, that was written just after the merger with MaxLinear (MXL) was terminated. The stock has traded sideways since July with a loss of about -1% as of today, so I called that an 80% win.

My Hold rating on TYGO was a bad miss, so I got zero for that call. I was hesitant to write about the newly public small cap solar stock but it was another ask from the editors at SA so I wanted to deliver something that readers could benefit from. I did the research and wrote my honest evaluation. The timing was very bad when I wrote the article because they reported a bad quarter and the whole solar energy sector collapsed over the summer. The TYGO article was published in August and that is about the time that the whole sector started to crash as illustrated by this chart of TAN.

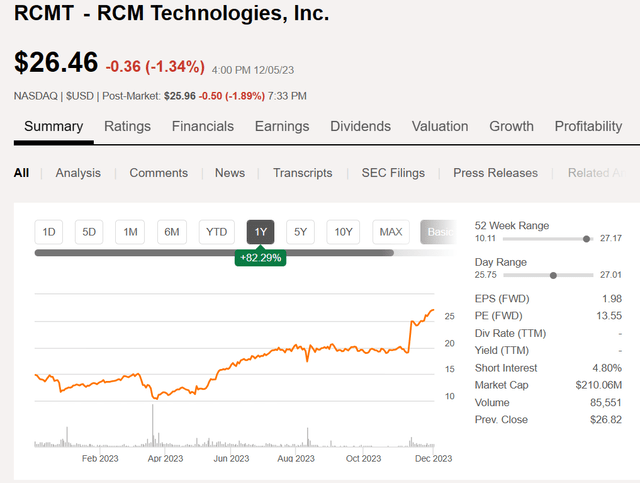

My best pick this year for a Growth stock was probably the one most unnoticed by readers. Just a month ago I published a Buy recommendation on RCMT, “RCM Technologies: Reaching A Tipping Point,” and the stock is up nearly 38% in that time. It is not too late to get in on the action with a market cap of $210M and forward P/E of 13.55.

Income and Total Return picks

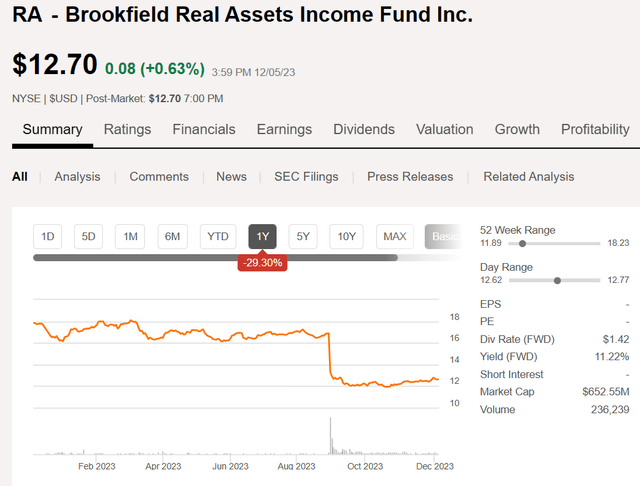

First of all, there is not much difference between an Income pick versus a Total Return one. Just in my mind, I guess, I expect the Total Return to enhance in price and pay a dividend. Whereas with my Income picks, I do not expect much, if any price appreciation as long as the high yield payout continues without a cut. Unfortunately, I had one pick this year, RA, that did suffer a distribution cut a few months after I recommended buying the stock back in February, and the price subsequently dropped by more than 20% at the end of August after the cut was announced. The price has since recovered a bit and now trades at a discount to NAV of -13.7% while paying a distribution yield of 11%.

I rated myself 0 on my RA pick with a total return as of 12/4 of -28.5%. My worst pick this year, for sure.

I started out the year with a Strong Buy recommendation on NPCT in January. It was a relatively risky pick as the fund just went public in 2021. It was another case of bad timing as I discussed in this article that mentioned all 12 CEFs that went public in 2021. The total return as of 12/4 was -10.5% so I got another 0 rating on that pick.

In February I wrote my first of 2 articles this year on Eagle Point Income fund (EIC). I rated it a Strong Buy then and reiterated my Strong Buy recommendation in November. The total return since February is 13.5% and it is up 5% since my November 15 article, “EIC: 15% Annual Returns For Past 3 Years And Still Soaring.”

My next Buy recommendation back in February for an Income pick was EDI, which I later wrote an update in August downgrading the pick to Hold. The Total Return is 6.5% since February so I rated myself 70 for getting it mostly right. I have received some nice income during that time and the fund has yet to complete the merger with EDF, which is expected to be final this month. I am now long EDF instead of EDI and believe that the discount will close once the merger is completed, when EDI will stop trading and the remaining fund will be EDF, currently yielding 16.5%.

Business development companies, or BDCs, were on sale at the end of March and early April so I covered two of them, both good picks with a Strong Buy for FSK and a Buy for CION. The total return from FSK is 19.5% and 16.7% for CION so I got 100 scores for those two.

I then gave MEGI a Strong Buy rating in April and got hammered when utilities crashed this summer. It was another Dirty Dozen CEF from 2021 that is suffering the same fate as the other 11, down, down, down. Although it is now starting to come back up in November. So, the total return as of 12/4 is not terrible at -5.8%. Did not help my rating though and I gave myself a 0 for that pick, which was just bad timing really.

Then there was SRV, which I actually wrote about twice, first in April and then a follow-up in May. I gave it a Strong Buy rating in April and did not change it in May, so I just recorded it as one pick, which is up 17.6% so I got that one right. That fund is now in the midst of a rights offering that expires December 14, so I will be watching the price for a potential buying opportunity.

I decided to cover another BDC in May when I wrote a Buy recommendation for TRIN. It shows a total return as of 12/4 of 37.3% so got my 100 with that pick. I think the young BDCs admire TRIN, CION, CCAP, and RWAY, which all went public just within the past 2-3 years, have plenty of upside and pay nice yields.

I followed that up with a Hold on GOF, which is a good thing because I wanted to propose it was a Buy having never cut the dividend since inception. But shortly after my article came out, the fund had some strong negative price action, eliminating the premium temporarily before starting to advance higher again in November. The total return is -7% as of 12/4 so I rated myself 0.

Then SVOL came on my radar, and I wrote a Buy article on it in late May. The total return since then is over 11% so that one gets my 100 score. I still admire SVOL for the Income although several recent articles have suggested that it changed its portfolio allocation strategy which makes me question the future for SVOL. I am still holding but reduced my exposure by trimming some shares for a small profit.

In July I was asked by the editorial staff to supply an update on the BDC Portman Ridge (PTMN). I decided to rate it a Hold even though I was not liking what I saw when I wrote the update. Since that time, it has struggled to keep up with other BDCs that are performing better this year, and the total return was -10% as of 12/4. So, I gave myself a 0 because it lost value when others in the category gained in value.

I next wrote a Strong Buy recommendation for Eagle Point Credit Company (ECC) in August. To my surprise it has lost -4% in total return since then, although I still really admire the fund. I own ECC for the income and I DRIP the distributions to take advantage of any discount (up to 5%) and continue to grow my future income stream with the 17.5% yield. I am not looking for much price appreciation but a little would be nice.

Another fund that invests in CLOs that I rated a Hold in August is XFLT. It is up 4.5% since then so I gave myself a 100. The XFLT fund offers a nice 14.8% yield with potential for some price appreciation and a well-covered distribution.

In September I rated FSCO and CCAP both Buys and both have seen positive total returns since then. Two more in the win column.

In October my Income pick was PAXS which I recommended to Buy, and it is now up 7.4% so that was another check in the correct score column.

The CEF with symbol SCD was new to me in October and when I discovered it they had just changed from quarterly to monthly dividends. My Buy rating was another good call, and it is now up 8.7% since my article came out.

My choice for Best Value pick for 2023 was EMR but again my timing was off, and I did not make a good call with a -1.4% return in the six weeks since I rated it.

Another CEF that I rated a Hold in October was JGH. This was another fund that I was asked to cover, and I liked what I saw but not enough to rate it a Buy. Nonetheless, the pick is up almost 10% in just over a month, so I did give myself a 100 score for that pick.

My final Strong Buy recommendation for 2023 in the Income/Total Return column was IGR. In just one week the fund is up 7% and pays a distribution yield of 15%. As real estate recovers and the end to rising interest rates nears, I propose keeping an eye on IGR and you may wish to consider adding to your holdings on any dips.

Summary

That just about sums up my year in review for 2023. There were lots more CEFs, BDCs, and other high yield income picks that I wrote about in other articles. But these 38 picks were all focused articles that highlighted a single ticker and made a Buy, Hold, or Sell recommendation. I think that I did pretty well considering that some are in various stages of recovering from recent bottoms in prices at the end of October. In another month more of my picks may turn out to be correct, but until then it is time to start planning for the new year.

My next article will be focused on ideas for 2024 for Income and Total Return investments. I may sprinkle in a couple of Growth picks here and there too, just to keep things interesting. I still relish finding undiscovered gems, or special opportunities and sharing those ideas with my followers.

I hope that 2023 has been as good for you as it has been for me. Please follow me if you admire what you read and want more good ideas for growing your portfolio.