Artificial intelligence (AI) is a hot area to invest in the stock market now for a good reason: The limits of AI are seemingly boundless. However, all that hype can lead to many stocks becoming overvalued, leading to disappointments when they crash back down to reality. These bubbles occurred throughout stock market history and are nothing new.

But plenty of AI stocks still haven’t seen the hype and are ready to explode higher. So, if you’re looking for a few under-the-radar AI stocks to buy, here’s a great starter list.

AI is a bonus for each of these companies

The three stocks I think have the potential to pop are UiPath (PATH 0.93%), Upstart (UPST 0.56%), and Adobe (ADBE -1.32%). All of them are highly exposed to the AI trend and have reasonable valuations, priming them to see a quick uptick with large enough investor interest.

UiPath is a robotic process automation (RPA) leader, which isn’t an AI technology in itself. RPA records repetitive tasks and then automates them, freeing employees to do more complex and creative tasks. It also integrates nicely with AI, as AI widens the scope of processes it can automate. Additionally, UiPath can utilize artificial intelligence to monitor activity to pinpoint tasks that could be automated.

Upstart is an alternative to the FICO credit score model operated by Fair Isaac. Instead of using a handful of metrics to judge a borrower’s creditworthiness, it uses other factors like employment history, education level, and other in-depth metrics that provide lenders with a much better picture of the risk it is taking on. Upstart’s use of AI in evaluating borrowers sets it apart in its industry, and many personal and auto loan banks have deployed its product.

Adobe is better known than the other two, but its AI prowess isn’t. Adobe’s Firefly AI is a true game-changer, as its users can type a prompt into Firefly, and then it can convert the command into modifying an image. This has massive implications, as advertisers could effortlessly tailor their marketing image to different audiences.

None of these uses of AI are impractical, and each company is at the tipping point of artificial intelligence making a drastic business impact. But their stocks aren’t caught up in the AI investment hype.

The stocks don’t trade at sky-high valuations

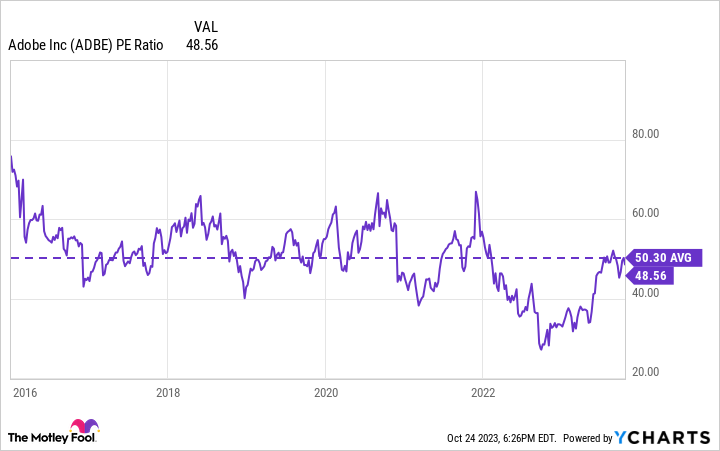

Adobe is the only profitable company of this trio, and its stock can be purchased for 32 times forward earnings. While that’s not necessarily cheap, Adobe’s stock never is. Since its change to a subscription business model stabilized in 2016, Adobe’s stock has traded for about 50 times trailing earnings, on average.

ADBE P/E Ratio data by YCharts.

Granted, Adobe’s growth rate during that time frame was about 20% versus the latest quarter’s 10% growth rate. But if Firefly AI takes off, don’t be surprised to see Adobe’s growth return to these rapid levels.

UiPath and Upstart are both unprofitable, so we’ll use their price-to-sales (P/S) ratio to value them. Because both stocks were on the public market in 2021, they’ve already experienced a bubble.

UPST P/S Ratio data by YCharts.

However, each stock is now valued at a reasonable level, with Upstart trading at a much lower valuation than UiPath. That’s because it isn’t necessarily an AI story; it’s also an interest-rate story. Due to high interest rates, the loan demand is less than just one year ago. As a result, Upstart’s loan volumes tumbled, with Upstart only originating 109,000 loans in the second quarter versus 321,000 in last year’s Q2. When interest rates decrease, it will be a huge catalyst for Upstart, and the growth and profitability it enjoyed last year should return.

UiPath is just waiting to be noticed, although some already have. Cathie Wood and her team at Ark Invest have made UiPath their third-largest holding, with 6.1% of the resources tied up in the stock. With the global RPA market opportunity expected to expand from $2.6 billion in 2022 to $66 billion by 2032, according to Polaris Market Research, UiPath is positioned to post explosive growth over the next decade. Combine that with the catalyst of artificial intelligence, and UiPath looks like an incredible investment opportunity.

Keithen Drury has positions in Adobe, UiPath, and Upstart. The Motley Fool has positions in and recommends Adobe, UiPath, and Upstart. The Motley Fool recommends Fair Isaac and recommends the following options: long January 2024 $420 calls on Adobe and short January 2024 $430 calls on Adobe. The Motley Fool has a disclosure policy.