Investing in global megatrends can be a great way to deliver strong returns over the long term. A variety of hard-to-predict factors make it impossible to know where the market will go in the short term, or how individual stocks will perform over the long term.

However, you can set yourself apart from other investors by recognizing the major trends that will shape the global economy over the next decades. If you have an extra $1,000 to invest, consider holding some of the stocks that should benefit from the big economic shifts on the horizon.

1. Artificial intelligence

You might be tired of hearing about artificial intelligence (AI) if you’ve been following financial and technology news over the past year, but there’s a reason that the topic is getting so much attention. AI is a disruptive force that’s going to have major economic ramifications moving forward, and investors should at least consider investing in some of the businesses that will benefit from the proliferation of this technology.

Image source: Getty Images.

AI software will have a wide range of ramifications, but one of the primary impacts will be to improve efficiency for businesses across most industries. Automation reduces costs associated with repetitive or time-consuming tasks, and machine learning can unlock insights by assisting data analysis.

That should translate to improved profit margins or more competitive prices for companies that successfully implement AI resources. It can also allow high-growth businesses to scale more quickly by reducing the hiring burden during expansion phases.

There are a number of different ways to invest in the AI growth trend.

- Big tech companies like Microsoft (MSFT 1.00%), Amazon (AMZN -0.36%), and Alphabet (GOOGL 0.40%) (GOOG 0.40%) are among the usual suspects developing AI software for a variety of applications. Those companies have diverse operations, and this emerging tech could be an important growth driver moving forward.

- Semiconductor stocks such as Nvidia, Taiwan Semiconductor, and AMD produce hardware needed to run advanced AI applications. They should experience increased demand as more businesses and consumers utilize the software.

- More specialized tech companies like Adobe and Palantir are improving their offering by weaving AI capabilities into their market-leading products. This should solidify their competitive standing and customer value propositions, which is great news for cash flows moving forward.

- C3.ai, IBM, and Alteryx provide outsourced AI software to other businesses on a subscription basis.

If you have $1,000 to invest in a megatrend, consider spreading it among the stocks listed here and their peers.

2. Global economic shifts

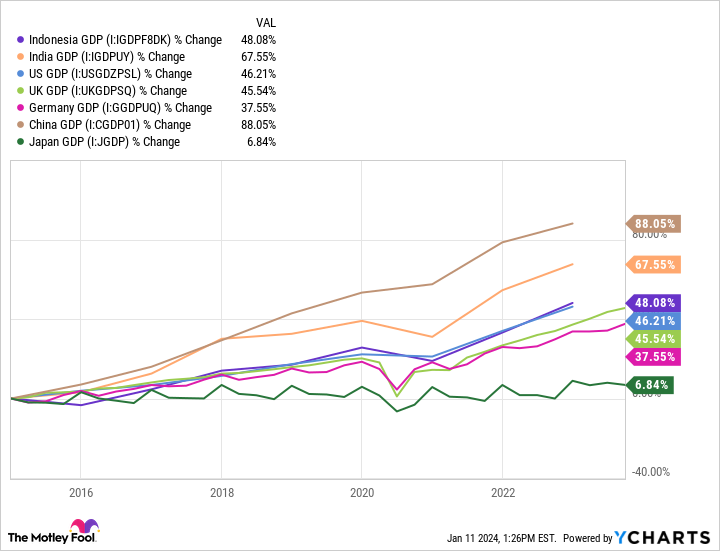

The balance of economic power is shifting, and a number of emerging market economies are assuming a larger role in the global landscape. Developed economies will continue to be enormously influential on global economics and corporate results. However, markets like China, India, and Indonesia are rapidly closing the gap.

Expanding middle classes outside the traditional developed markets will create new opportunities for businesses that serve consumers in countries like China, India, Indonesia, Egypt, Vietnam, and Mexico. There will also probably be a number of new businesses that form and grow rapidly as those economies expand. Investors should recognize the opportunities for returns created by these shifts.

This doesn’t mean that you should go crazy loading up your portfolio with international exposure, but it’s a good idea to earmark some of your asset allocation for emerging markets. At some point, businesses that operate in these high-growth economies are likely to outpace ones that only serve customers in the U.S. and Western Europe.

There are a number of great foreign stocks that provide access to that upside potential. You can also remove company-specific risk with an exchange-traded fund (ETF) like Vanguard Ftse Emerging Markets ETF (VWO 0.47%) or the iShares Core Msci Emerging Markets ETF (IEMG 0.39%). Keep in mind that there are risks associated with emerging market investments, including currency translation and geopolitical conflict.

3. Connectivity

The Internet of Things and big data were major investment topics when they first emerged a few years ago. Other trends have since taken over the headlines as analytics and hyperconnectivity became more commonplace, but it’s still an area that’s ripe for transformational, disruptive growth moving forward.

That could result in meaningful returns if you invest $1,000 in some of the businesses that are enabling a digitally connected world. Connectivity is a broad concept that encompasses a few different industries.

- The Internet of Things (IoT) refers to physical devices that use software and data to enhance the user experience. That includes wearable electronics, cars, medical devices, thermostats, doorbells, home appliances, and a wide variety of industrial equipment. Apple, Cisco Systems, and DexCom are among the IoT stocks worth a look for interested investors.

- Cloud computing businesses are essential for storing, accessing, and managing the enormous volume of data being generated. The top cloud computing stocks include Amazon, Alphabet, and Microsoft, but there are also more focused players in this industry, such as Snowflake and ServiceNow.

- As more data is shared, there’s a greater need for cybersecurity services to ensure that sensitive information isn’t accessed by malicious parties. There are a number of great cybersecurity stocks on the market for investors, or you can buy shares of an industry-focused ETF like the First Trust Nasdaq Cybersecurity ETF (CIBR 0.66%). There are many facets to digital security and fierce competition among the providers, but the industry is sure to see strong demand moving forward.

All this means there are a wide variety of exciting stocks that have major opportunities thanks to increasing digital connectivity, and they could deliver nice gains for investors who have $1,000 to allocate.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Ryan Downie has positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Adobe, Advanced Micro Devices, Alphabet, Alteryx, Amazon, Apple, Cisco Systems, Microsoft, Nvidia, Palantir Technologies, ServiceNow, Snowflake, Taiwan Semiconductor Manufacturing, and Vanguard International Equity Index Funds – Vanguard Ftse Emerging Markets ETF. The Motley Fool recommends C3.ai, DexCom, and International Business Machines and recommends the following options: long January 2024 $420 calls on Adobe and short January 2024 $430 calls on Adobe. The Motley Fool has a disclosure policy.