Evergreen business models make it easier to hold for the long run.

Buying a stock with the intention of never selling it, or perhaps only selling it in a few decades, requires a level of conviction that most investments simply don’t warrant. It’s not enough to believe that a business is doing well today, or that its management team right now is doing an effective job.

What’s necessary is a rock-solid business model that’s already withstood different turns of the market and different economic regimes. Here are three stocks that I’m comfortable buying today and holding until retirement at the very earliest.

1. Vertex Pharmaceuticals

While I don’t own Vertex Pharmaceuticals (VRTX -1.46%), I’d be willing to buy it right now and then hold it forever if I had capital to spare.

Investing in Vertex means getting exposure to the upside from its research and development (R&D) programs, which is largely true for most pharmaceutical companies. The thing that makes Vertex different is that it has a lock on the market for cystic fibrosis (CF) therapies as a result of improving those therapies again and again over the course of years.

Rather than allow its market share to be eaten by generic medicines, the company is constantly advancing its candidates through clinical trials such that it has a new drug for CF coming out on a regular basis. Most of its CF medicines are now combinations of its previously commercialized medications, some of which are paired with newer molecules that are more effective. In the first quarter, sales of those drugs brought in nearly $2.7 billion, up 13% from a year prior.

Because other drugmakers lack a presence in the CF market, it’s essentially Vertex’s home territory. With such a deep understanding of CF, and plenty of medicines bringing in steady revenue from patients who need them on a perpetual basis, the business thus has extra income to devote to riskier forays into other markets.

And that process serves as an insurance policy to guarantee the future growth of the business, which is another reason to be bullish.

2. Costco Wholesale

Costco Wholesale (COST 1.43%) makes up a large proportion of my portfolio, and I plan to keep adding to my position for at least the next two decades, assuming my investing thesis remains valid.

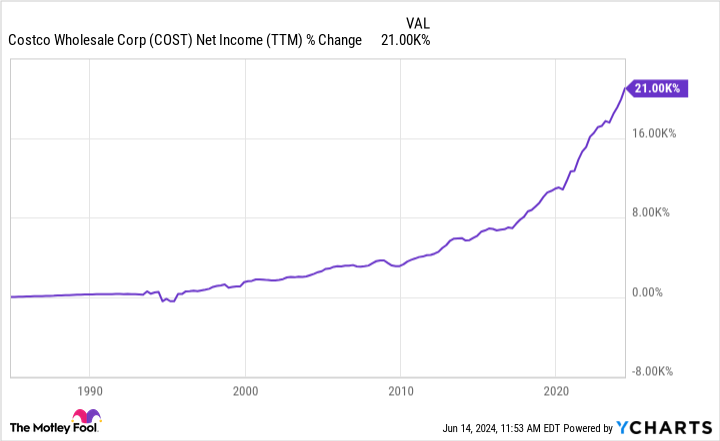

There are a lot of quantitative arguments for why Costco is a smart stock to buy and hold, most of which boil down to this chart:

COST Net Income (TTM) data by YCharts

As you can see, its trailing-12-month net income, which is currently $6.8 billion, has grown consistently, and more or less without interruption, for the company’s entire tenure as a public entity. This is the kind of performance that Warren Buffett dreams of. It’s all made possible by a dead-simple business model wherein Costco sells groceries and consumer goods in bulk at a very narrow profit to members, who pay for the right to shop at its warehouses.

But steady earnings growth doesn’t occur in a vacuum. Costco is a rare business because it does right by its customers, its employees, and its shareholders.

Customers get low prices, membership benefits, and excellent customer service. Employees are better compensated than they would be at other retailers, and as the company prefers to promote from within, they tend to stick around and provide their experience for the long haul in progressively more important roles. And shareholders get a regular and steadily rising dividend, plenty of share repurchases, as well as a fat special dividend payout once every few years.

What’s not to like?

3. Apple

Apple (AAPL 1.97%) is the last stock I’m willing to continue buying and holding for years and years.

The thesis for Apple is that its collection of revenue streams from its phones, tablets, computers, cloud services, and apps will continue to power the company’s growth, as customers tend to become loyal and buy from it again and again.

Although it’s true that Apple products tend to be priced at a premium, that clearly hasn’t been a major barrier to adoption for its iPhones or its Macs. Much like Costco, it has a history of steadily hiking its dividend, pursuing extensive share buybacks, and consistently adding to its earnings.

Apple’s trailing-12-month net income is $100.4 billion, up 160% from 10 years ago. It has plenty of growth opportunities and tailwinds to keep the party going for years to come.

For one, it hasn’t even begun to delve into implementing artificial intelligence (AI) in its products or operations in a serious way — but, per its recent announcement regarding a collaboration with OpenAI, it soon will. Then, once it has captured billions in value from that, it will move on to the next thing, perhaps related to its augmented reality (AR) Apple Vision ecosystem.

And it’s that process of product innovation and capturing value for years afterward that gives me the confidence that the company will be around, and profitable to hold, for the foreseeable future and also beyond.