Growth stocks in general did well in 2023, but that doesn’t mean there aren’t still major opportunities in 2024. The momentum behind companies like Airbnb (ABNB -0.22%), Block (SQ -0.04%), and Celsius Holdings (CELH -1.22%) is too strong to ignore, and I think they’re still screaming buys today.

1. Airbnb

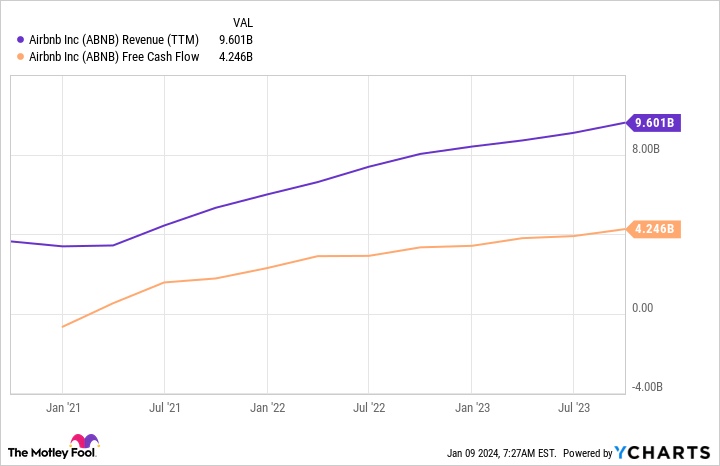

The pandemic put a dent in Airbnb’s business in 2020, but since coming public in late 2020, the company has been on fire. You can see below that revenue has surged to $9.6 billion over the past year, and free cash flow is nearly half of revenue.

ABNB revenue (TTM) data by YCharts; TTM = trailing 12 months.

There doesn’t seem to be a lot stopping Airbnb, either. The company’s two-sided marketplace of renters and travelers is well established and getting bigger. In the third quarter, listings rose 19%, and there is still a lot of room to grow in international markets.

I think Airbnb is just scratching the surface of its potential, and this could be a great growth stock to hold for decades.

2. Block

There are a lot of companies in the payments space, giving Block plenty of competition. However, nearly the entire group of stocks has seen significant price declines in recent years. That has made valuations more attractive, particularly given the growth prospects for Block.

Block’s gross payment volume rose 10% in the third quarter to $55.7 billion, but that’s only part of the story. Cash App payment volumes reached $113 million in September 2023, and the merchant side (Square) along with the consumer side (Cash App) make this a formidable company in the fintech space.

Gross profit jumped 21% in the third quarter to $1.9 billion, split almost evenly between Square and Cash App. What management hasn’t done well is contain operating costs. But that could change in 2024, with management guiding for $2.4 billion in adjusted earnings before interest, taxes, depreciation, and amortization, and $875 million in adjusted operating income.

3. Celsius

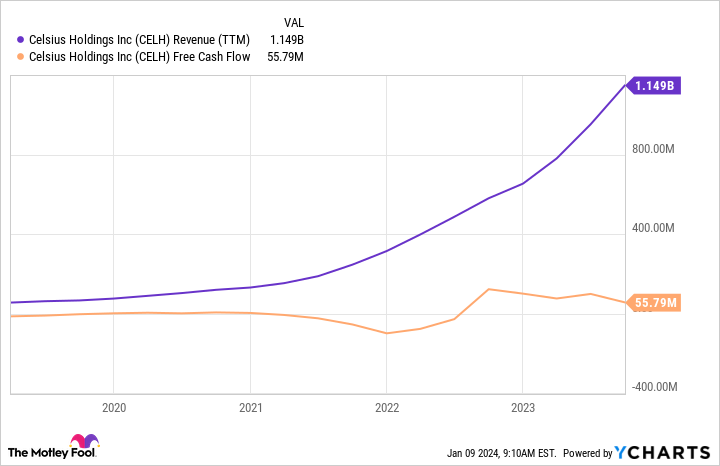

Celsius has come out of nowhere in the past three years to become the hottest drink brand in the energy segment, and a capital-light business model is allowing it to grow profitably.

CELH revenue (TTM) data by YCharts.

In 2024, I think the momentum will continue as retailers reconfigure their stores and put hot-selling brands front and center. Celsius should benefit from this and has noted it as a point of growth for the next year.

On top of better placement, the company is making its way into fast-casual restaurants and more geographic areas in general. And it doesn’t have to spend to build out manufacturing capacity since it works with bottlers that prepare its products and then uses PepsiCo as the company’s main distributor.

I think there’s a lot of potential for Celsius in existing channels even before taking international growth into consideration. This is a growth stock for potentially decades to come.

The outlook in 2024

Airbnb, Block, and Celsius all have growth tailwinds to ride in 2024 and beyond. I don’t think there’s any stopping short-term rentals, fintech, or the “healthy” energy drink trend. That’s why I think they’re all screaming buys right now.

Travis Hoium has positions in Airbnb, Block, and Celsius. The Motley Fool has positions in and recommends Airbnb, Block, and Celsius. The Motley Fool has a disclosure policy.