Artificial intelligence (AI) was a hot market last year, and that trend is expected to continue in 2024. Forecasts indicate the AI industry will skyrocket from $207.9 billion in 2023 to nearly $2 trillion by 2030.

But just because an organization uses AI doesn’t mean it can deliver multiple years of results. To find stocks with long-term potential, invest in companies with track records of success with it.

Here are three such companies to consider: Amazon (AMZN 0.80%), Alphabet (GOOGL 0.72%) (GOOG 0.66%), and Palantir Technologies (PLTR -1.53%). Not only has each achieved impressive results with AI, but they also operate in different industries, providing you with a diversified portfolio. Here is why these companies make compelling investments.

1. Amazon

The e-commerce retailer uses AI to manage the army of robots in its warehouses, where they work around the clock to help achieve lightning-fast delivery speeds, sometimes within hours of a customer order.

Amazon’s AI technology also can predict which products are in demand based on location and when customers will want them. This enables the company to work with suppliers to make sure these products are in stock when needed.

AI also helps third-party sellers on Amazon’s site to create product listings. The success of these sellers is important: They delivered $34.3 billion of Amazon’s $143.1 billion in third-quarter sales. That’s more than the $23.1 billion in third-quarter revenue generated by Amazon Web Services (AWS), the company’s cloud computing platform.

AWS provides AI services to other businesses, such as United Airlines, helping AWS to maintain its position as the global leader in cloud computing.

That enabled Amazon to achieve a 13% year-over-year jump in third-quarter sales to $143.1 billion. The company expects fourth-quarter sales to reach at least $160 billion, a 7% increase over the previous year.

2. Alphabet

Alphabet uses AI across an array of services. For example, its YouTube receives over 500 hours of content every minute. That requires AI to ensure all videos comply with YouTube policies, and over 95% of removed videos were detected by AI.

The technology is also strengthening its position in the search-engine space. If you have used Google to perform a search with a photo, it was Alphabet’s AI that analyzed the image.

AI is also a component of the company’s all-important advertising business, which accounted for $59.6 billion of Alphabet’s $76.7 billion in third-quarter revenue. It helps advertisers create digital ads, and as of the third quarter, around 80% of advertisers were using the company’s AI products.

This year is shaping up to be a momentous one as it plans to change how its Chrome web browser targets consumers with digital ads. On top of that, forecasts suggest a strong year in 2024 for digital advertising, with predictions calling for 13% growth in digital ad spending, which is higher than the past two years. This suggests it will be a windfall year for Alphabet’s ad business.

3. Palantir

Last year, data analytics company Palantir released its new Artificial Intelligence Platform (AIP), and it’s been a boon. Businesses are using it to boost operations, such as improving procurement efficiencies, and increasing the fill rate for online orders.

Palantir nearly tripled the number of businesses using AIP in the third quarter alone as its customer count jumped 34% year over year.

Its AI capabilities only strengthen Palantir’s economic moat since its systems were built to handle classified government intelligence data. This enabled the company to win customers such as the U.S. government’s Special Operations Command (SOCOM), which awarded Palantir a multiyear contract to help its AI-powered mission command platform.

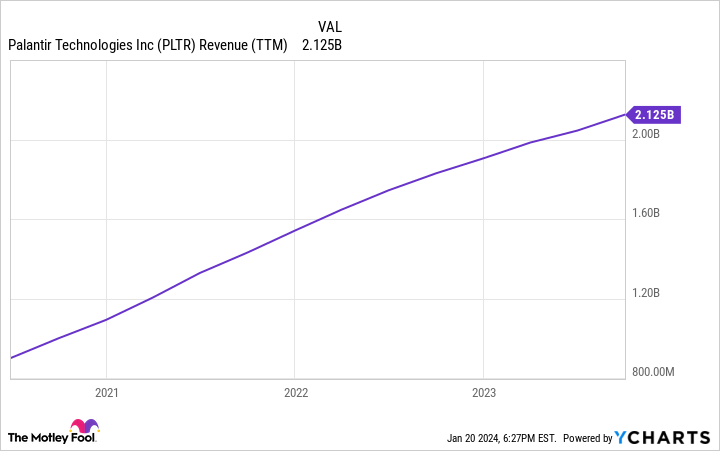

The demand for Palantir’s AI feature helped to deliver strong results. In the third quarter, the company enjoyed double-digit revenue growth as sales rose from $477.9 million in 2022 to $558.2 million. And this is just the latest in years of rising revenue.

Data by YCharts.

The company also achieved what CEO Alexander Karp called, “the most significant profit in our company’s 20-year history” as third-quarter net income reached $73.4 million, a dramatic turnaround from the prior year’s net loss of $123.9 million.

And exiting the third quarter, Palantir’s balance sheet was impressive. Total assets were $4.2 billion with $3.3 billion of that in cash, cash equivalents, and marketable securities. Contrast this with total liabilities of $921.5 million.

The secular trend of artificial intelligenceis delivering meaningful results for Palantir, Alphabet, and Amazon. As a result, these three companies are well positioned to deliver ongoing revenue growth over the long term.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Robert Izquierdo has positions in Alphabet, Amazon, and Palantir Technologies. The Motley Fool has positions in and recommends Alphabet, Amazon, and Palantir Technologies. The Motley Fool has a disclosure policy.