It surprised no one, but it was still welcome news for investors to see. Last week, PepsiCo (PEP -0.92%) announced it was increasing its dividend, just as it has dozens of times as part of its yearly fourth-quarter earnings update. The payout hike marked the 52nd consecutive annual boost for the beverage and snack giant, in fact.

There will be more payout increases ahead for this dominant business. But the higher dividend reflected both good and bad news about its recent operating trends. Here’s what investors need to know about Pepsi’s new quarterly cash payout.

1. Slowing down

Pepsi raised its annual dividend by 7% to $5.42 per share, which translates into a 3.2% forward yield. As generous as that hike might sound, it’s a slowdown compared to last year, when management issued a 10% raise to shareholders.

Investors don’t have to hunt for reasons why Pepsi is feeling a bit stingier here in early 2024. Management said that industry demand growth is slowing and that sales trends will be further pressured by the expected end of inflation-based price increases.

Volume was down 3% in the most recent quarter, too, meaning growth came entirely from rising prices through most of the year. These negative factors all help explain why Pepsi is projecting an organic sales uptick of 4% in 2024, or less than half of this past year’s boost.

2. Higher profits

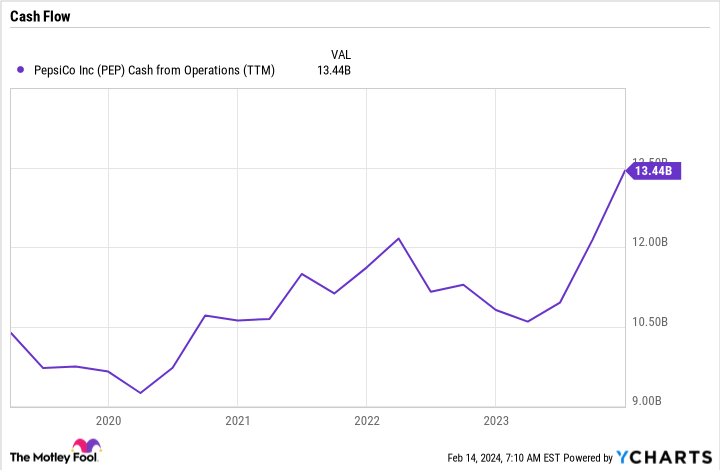

There’s more uniformly positive news around Pepsi’s finances. The company generated $13 billion of operating cash this past year, up from $11 billion in 2022. Cost cuts are helping lift this metric, but so are those price increases that have combined with a recent slowdown in raw material inflation.

PEP Cash from Operations (TTM) data by YCharts

In other words, while margins were squeezed in late 2022 and early 2023 when inflation kicked into high gear, the opposite is occurring today. Pepsi is projecting that earnings will rise at an 8% rate this year, or roughly double the pace of sales increases expected in 2024. That’s likely a big factor behind the generous dividend boost that Pepsi just announced.

3. Price and payoff

PepsiCo’s stock entered the year trading at a reasonable price, and its discount has only become more attractive in recent months. You’ll have to pay 2.5 times sales for this consumer staples business, down from 2023 highs of over 3 times sales. Toss in a 3%-plus dividend yield, and you have several factors that could support excellent returns for patient shareholders.

Risk-averse investors might want to watch the stock for signs that PepsiCo can continue growing sales without the help of significant price increases in 2024 and beyond. Management warned that demand trends are slowing back down to pre-pandemic levels, after all, in part because inflation-based price boosts are done providing their sales lifts.

On the other hand, the stock has a chance to rally as profit margin improves, potentially laying the groundwork for big earnings growth (and a more rapidly expanding dividend) beginning in 2025.

Sure, Pepsi likely won’t deliver the nearly double-digit sales growth that investors saw through most of the last three years. But earnings and cash flow are strong, and organic sales are still rising at a healthy pace. That’s why investors can expect this dividend to keep growing, even if the stock price stays volatile into 2024.