SIphotography/iStock via Getty Images

“Something is rotten in the state of Denmark.”

It’s one of the most famous lines from Shakespeare’s Hamlet, right up there with “Get thee to a nunnery” and “To be or not to be.”

The funny thing is that, while the latter two are made by Hamlet himself, the “rotten” comment, to quote Spark Notes, “is spoken by Marcellus in Act I, scene iv (67),” a minor character. It’s while:

“… he and Horatio debate whether or not to follow Hamlet and the ghost [of his father] into the dark night. The line refers both to the idea that the ghost is an ominous omen for Denmark and to the larger theme of the connection between the moral legitimacy of a ruler and the health of the state as a whole. The ghost is a visible symptom of the rottenness of Denmark created by Claudius’s [Hamlet’s uncle and mother’s new husband] crime.”

Something was rotten indeed.

Now, that early in the play, it’s not clear exactly what’s the matter behind the matter. It’s not until the next scene when we realize that Claudius, the new king of Denmark, is in fact the worst of the worst: a man who would (and did) kill his own brother to steal his crown and wife.

Now, I’m not accusing the following three real estate investment trusts, or REITs, of anything so “foul,” as Hamlet’s father calls it. But there’s something rotten nonetheless about the following REITs that need to be recognized.

Don’t Put Your Profits in Peril

Personally, I’m happy there’s not a 100% correlation between the two. Because that would mean I was one very unhappy ghost.

As it is, I’m very alive and pretty pleased with my current situation. My brother isn’t after my head or my wife. I have five wonderful children, two sons-in-law, and a grandson I’m insanely proud of. I own a house, a business, and income-producing rental properties, not to mention a portfolio full of dividend-paying REITs.

I know last year was a rough one for REITs on the short-term stock-price appreciation scale. But I expect this year to be much more positive in that regard.

And even if it isn’t, the positions I have are overwhelmingly in strong companies with solid management. Therefore, they promise long-term stock gains and steady, growing dividend payments.

This is very important.

Like any other investor out there, I don’t want to own just any old shares. I want to own the best of the best that drive up my profits in the most meaningfully sustainable ways possible.

That’s everyone’s goal, though we admittedly all have different takes on what those “meaningfully sustainable ways” look like.

This is okay to some degree. We all have our different personalities, wants, needs, responsibilities, income levels, etc. that need to be considered.

But those diverse considerations only need to be considered so far. There are certain risks that are just never worth taking, no matter your specific situation.

When something is rotten, it’s rotten.

And it would be foolish to try to shrug off those warning signs. Ignoring them will only put you and your profits in peril.

A Bet Worth Avoiding

“But, Brad,” you might be saying, “Hamlet didn’t ignore the rottenness in Denmark, and he still ended up dead. So why not dance with the devil?”

That’s true, but remember that this isn’t a perfect analogy at all. In this case, not only am I not a very unhappy ghost… you’re also not expected to avenge anything or anyone.

You only need to recognize what’s very, very wrong and avoid it.

Don’t be swayed by the chance of recovery. It’s too slim to take seriously.

Don’t be swayed by high dividend yields. They’re high because they’re unsustainable. And once the company in question finally admits as much, that dividend will come crashing down.

The stock price will suffer, too. This is inevitable. It’s never “priced into the stock already,” as too many investors tell themselves too many times.

In the same vein, don’t tell yourself that “this time is different.” It almost never is. So you’re much, much, much better off avoiding these kinds of companies altogether and putting your capital into the kind of strong, solid, steady assets I already mentioned.

Did you get lucky before? That’s great. I’m happy you didn’t get burned. But you can’t base your long-term success on getting lucky again.

Personally, I wouldn’t recommend basing your short-term success on it again, either.

Take a page from Hamlet in remembering “that one may smile and smile and be a villain” still.

Though, with all due respect to that play, character, and the author behind them… I don’t think the real question is “to be or not to be.” It should actually be, “to be wise or not to be wise.”

My recommendation is to choose the former every time. In which case, just say no to the following three REITs.

Industrial Logistics Properties Trust (ILPT)

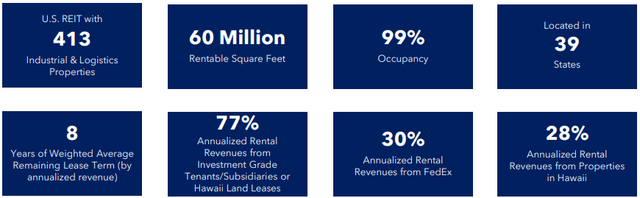

ILPT is an industrial REIT that is externally managed by The RMR Group and specializes in the ownership and leasing of industrial and logistics properties.

The externally managed REIT has a market cap of approximately $268.0 million and a 60.0 million SF portfolio comprised of 413 properties located across 38 mainland states and the island of Oahu, Hawaii.

226 of their properties are located on the island of Oahu, Hawaii and consist of buildings, land parcels for lease, and easements. As of their most recent update, almost a third of their annualized rental revenues (“ARR”) came from their Hawaii properties, with their Hawaii properties generating 28% of the REITs ARR.

At the end of the third quarter, ILPT properties were 98.9% leased, served 304 tenants, and had a weighted average lease term (“WALT”) of 8.2 years.

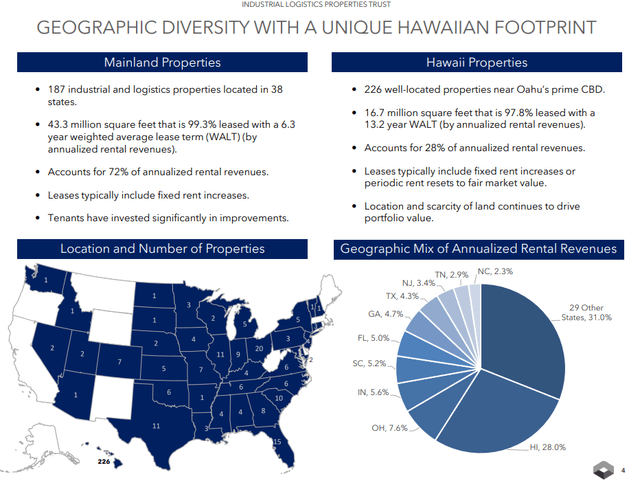

One thing that differentiates ILPT from its industrial peers is its extensive footprint in Hawaii. The industrial REIT breaks down its portfolio between its mainland and its Hawaiian properties.

Its mainland portfolio consists of 187 properties located across 38 states and totals 43.3 million SF. The mainland properties are 99.3% leased, have a WALT of 6.3 years, and generated 72% of the REITs total ARR.

Its Hawaiian portfolio consists of 226 properties located near Oahu’s central business district (“CBD”) and totals 16.7 million SF. The Hawaii properties are 97.8% leased with a WALT of 13.2 years and as previously mentioned, accounts for approximately 28% of ILPT’s ARR.

Now before I go any further, I mentioned that ILPT was externally managed by The RMR Group (RMR), which is an alternative asset management company with roughly $36 billion in assets under management (“AUM”) and a 35-year history in the real estate industry.

I’m not going to go into too much detail here, but suffice it to say I’m not a big fan of RMR.

Generally speaking, the problem with external management is that too often there is a misalignment of interests between the external manager and the shareholders. This oftentimes results in enriching the management team at the expense of shareholders.

A common example of this is that some external managers are paid fees related to the amount of assets under management, almost like a private equity firm, which incentivizes external managers to make acquisitions and grow the REITs asset base, even if by doing so dilutes earnings on a per share basis.

This is what I call “growing for growths sake” and it is a giant red flag for any REIT that is externally managed.

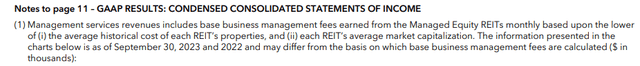

As laid out in RMR’s financials, their management fees are based upon the lower of the average historical cost of the REIT’s properties and the REIT’s average market cap.

So RMR’s management fees are based on the historical cost of the properties, or the REITs average market cap, depending on which is lower.

Notice how there is no mention in their fee structure regarding cash flow per share or acquisitions that are accretive on a per share basis.

So while poor investments can be made and adjusted funds from operations, or AFFO, per share can fall, RMR still gets their base management fees based on the properties acquired or the REIT market cap.

While a REIT’s market cap is not directly related to the amount of assets in its portfolio, there is a correlation between the two, at least in asset-intensive industries such as real estate.

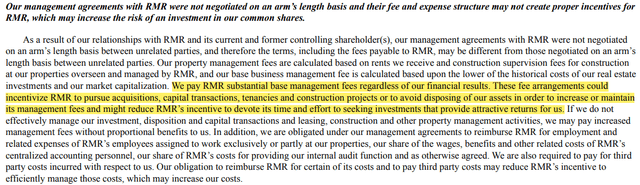

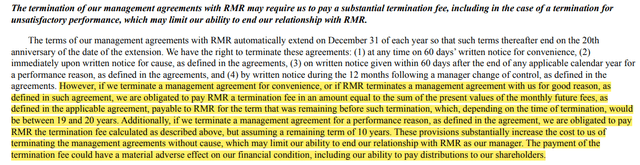

In its 2022 Form 10-K, Industrial Logistics Properties Trust lists the following in its Summary of Risk Factors:

“We pay RMR substantial base management fees regardless of our financial results. These fee arrangements could incentivize RMR to pursue acquisitions, capital transactions, tenancies and construction projects or to avoid disposing of our assets in order to increase or maintain its management fees and might reduce RMR’s incentive to devote its time and effort to seeking investments that provide attractive returns for us.”

Another red flag to look for is how the terms of the management agreement deals with dissolving the relationship between the REIT and its external manager. Are terms included that make it prohibitively expensive to exit the relationship, or for the REIT to internalize its management?

Well, here again we have an example where RMR has structured the relationship for its own benefit and at the expense of ILPT shareholders.

Once again, in its 2022 Form 10-K, ILPT lists the following in its Summary of Risk Factors:

“The termination of our management agreements with RMR may require us to pay a substantial termination fee, including in the case of a termination for unsatisfactory performance, which may limit our ability to end our relationship with RMR.”

It goes on to say:

“The terms of our management agreements with RMR automatically extend on December 31 of each year so that such terms thereafter end on the 20th anniversary of the date of the extension.”

And then:

“However, if we terminate a management agreement for convenience, or if RMR terminates a management agreement with us for good reason, as defined in such agreement, we are obligated to pay RMR a termination fee in an amount equal to the sum of the present values of the monthly future fees, as defined in the applicable agreement, payable to RMR for the term that was remaining before such termination, which, depending on the time of termination, would be between 19 and 20 years.”

So ILPT pays its external manager a substantial base fee regardless of the REIT’s operating performance.

The agreement renews automatically at the end of each year for a fresh set of 20 years, so that the agreement is perpetually ranging between 19 and 20 years.

ILPT can decide to terminate the management agreement, but in doing so they would likely be obligated to pay a termination fee which is equal to the present value of monthly management fees for the duration of agreement, which would automatically be somewhere between 19 and 20 years.

Yikes! I wonder whose lawyers wrote up the management agreement….

Spoiler alert: All 3 Rotten REITs discussed in this article are externally managed by The RMR Group. I’m not going break down the management agreements for each REIT, but I think this will at least give you a taste of how The RMR Group operates.

Honestly, we don’t even need the management agreements to see that these are rotten REITs… the bottom line results are more than sufficient.

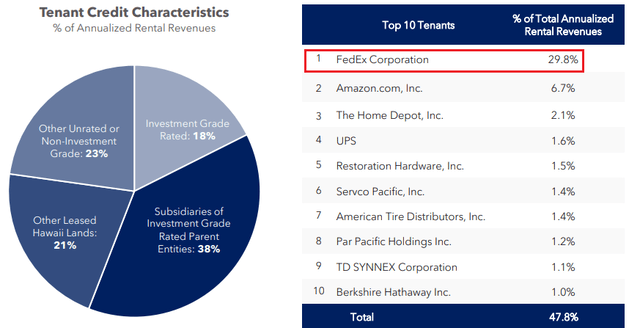

Before we get into ILPT’s operating performance, I wanted to point out that they have high tenant concentration with their top tenant, FedEx, making up almost 30% of their total annualized rental revenues.

One other thing to be aware of is that the externally managed REIT is loaded with debt, with approximately $4.3 billion of debt on its balance sheet compared to its equity market cap of roughly $268.0 million.

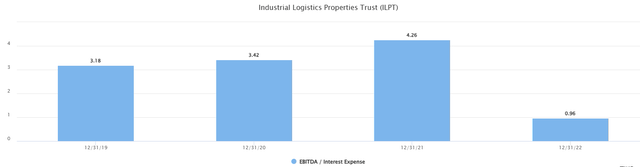

Their consolidated debt to adjusted EBITDAre is very high at 12.3x, their long-term debt to capital ratio is high at 85.85%, and their EBITDA can barely cover their interest expense, with an EBITDA to interest expense ratio of 0.96x at the end of 2022. This has slightly improved to 1.06x for the last-twelve-months (“LTM”).

So, let’s see how shareholders have made out over the last several years…

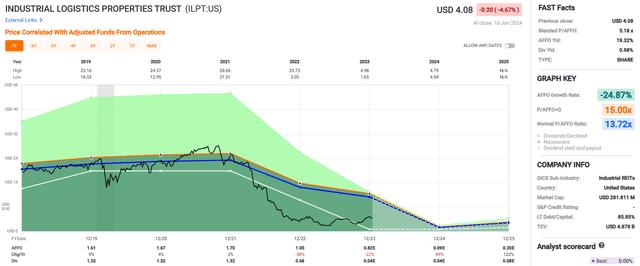

Since 2019, ILPT has had an average AFFO growth rate of negative -24.87%. This is a blended growth rate which includes past earnings along with analysts’ future earnings estimates.

The company was doing alright and even maintained its dividend during the pandemic in 2020, but then in 2022 AFFO per share fell by -38%. AFFO per share in 2023 is expected to fall by -22%, and analysts expect AFFO per share to fall by -89% this year.

Analysts also expect AFFO per share to increase by 122% in 2025, but even if that pans out, it will result in AFFO per share of $0.20 in 2025, compared to $1.61 per share in 2019.

The dividend has done no better with a cut in 2022 that reduced ILPT’s dividend from $1.32 to $0.68 per share, representing a -48.48% cut, only to be followed by -94.12% dividend cut in 2023, bringing the dividend rate down to $0.04 per share.

Currently the stock pays a 0.98% dividend yield and trades at a P/AFFO of 5.18x which is cheap by most measures. However, as displayed by RMR’s management of ILPT, poor management can erode shareholder value and make something cheap, even cheaper.

We rate Industrial Logistics Properties Trust “AVOID.”

Office Properties Income Trust (OPI)

The office sector has been a tough environment over the last several years, even for the best-managed office REITs. OPI is an office REIT that is externally managed by The RMR Group.

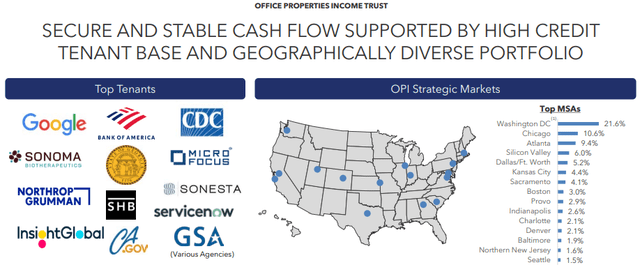

Office Properties Income Trust has a market cap of approximately $177 million and a 20.7 million SF portfolio comprised of 154 properties located across 30 states and Washington, D.C.

Their top tenants include Google (just announced more job cuts in 2024), Bank of America, ServiceNow, Northrop Grumman, and various agencies under the General Services Administration (“GSA”).

OPI is diversified across multiple states within the U.S., and their largest market is Washington D.C., which represents 21.6% of their portfolio. In the footnotes, OPI discloses that their Washington D.C. portfolio includes properties in the District of Columbia, Northern Virginia, and Maryland.

Office Properties Income Trust has a credit rating of CCC+ (junk rated) and is highly leveraged with approximately $2.6 billion of debt on their balance sheet compared to a total market capitalization of roughly $178 million.

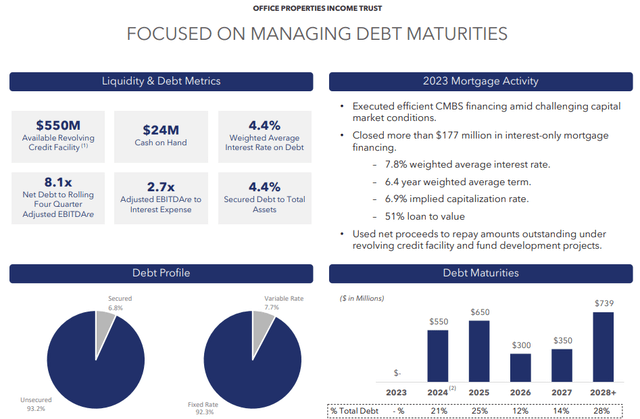

OPI’s total debt is 93.2% unsecured and 92.3% fixed rate. While these metrics are solid, OPI has a high leverage ratio with a net debt to rolling 4Q Adj EBITDAre of 8.1x, a long-term debt to capital ratio of 65.55%, and an Adj EBITDAre to interest expense of 2.7x.

The leverage and coverage ratios could definitely be better, but my real concern is that 21% of their debt matures in 2024 and 25% matures the following year. Given OPI’s market cap, amount of debt, and junk credit rating, it would likely be costly for OPI to refinance their upcoming maturities.

To address its liquidity concerns and improve its financial flexibility, OPI announced in January that it was cutting its quarterly dividend to just $0.01 per share. This is down from $0.25 per share in the previous quarter and down from $0.55 per share paid in the first quarter of 2023.

The reduced dividend announced in January represents a dividend cut of approximately -96.0%, compared to the previous quarter.

This is not the first time, either. Between the fourth quarter of 2018 and the first quarter of 2019 the quarterly dividend was cut from $1.72 to $0.55 per share, representing a 68.02% dividend cut.

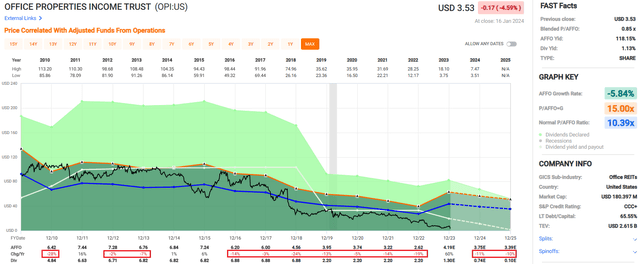

OPI has had a tough time maintaining its dividend due to its earnings performance. AFFO per share has fallen 10 times since 2010, while it has only increased on a per share basis in 3 of the years (2011, 2014, 2015).

In 2016, AFFO came in at $6.20 per share. Just two years later, in 2018, OPI’s AFFO had fallen to $4.56 per share. By 2022, AFFO fell to $2.62 per share, a significant reduction compared to their earnings just several years prior.

Analyst expect AFFO per share to increase by 60% for the full year 2023, but then expect AFFO per share to fall by -11% in 2024 and then fall by -10% in 2025. In total, OPI has averaged a negative AFFO growth rate of -5.84% since 2010.

Currently the stock pays a 1.13% dividend yield and trades at a P/AFFO of 0.85x, compared to their average AFFO multiple of 10.39x. If this office REIT were internally managed, I might take a speculative swing at it due to extremely low AFFO multiple. However, that OPI is managed by RMR gives me pause, even at the discount the stock is currently trading at.

We rate Office Properties Income Trust “AVOID.”

Service Properties Trust (SVC)

SVC is a REIT that is externally managed by The RMR Group and specializes in hotels and service-oriented retail net lease properties.

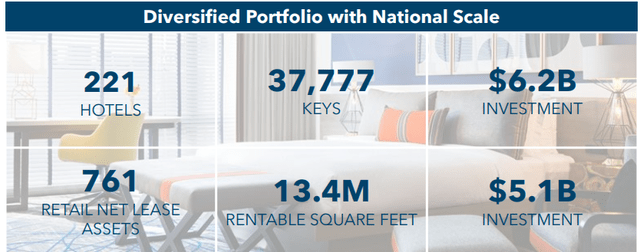

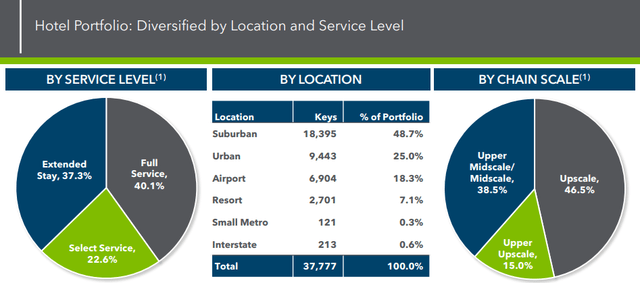

The lodging REIT has a market cap of approximately $1.33 billion and a portfolio comprised of 221 hotels containing more than 37,000 rooms which are located in the United States, Canada, and Puerto Rico.

Additionally, their portfolio holds 761 service-oriented net lease retail properties that cover 13.4 million SF across 46 states.

SVC’s hotel portfolio includes full service, extended stay, and select service. Its extended stay and select service hotels typically range from midscale to upscale, while their full service hotels typically range between upscale to luxury.

During the third quarter, SVC’s full service hotels generated almost $42 million of hotel EBITDA, extended stay generated around $24 million, and select service hotels generated almost $11 million of hotel EBITDA.

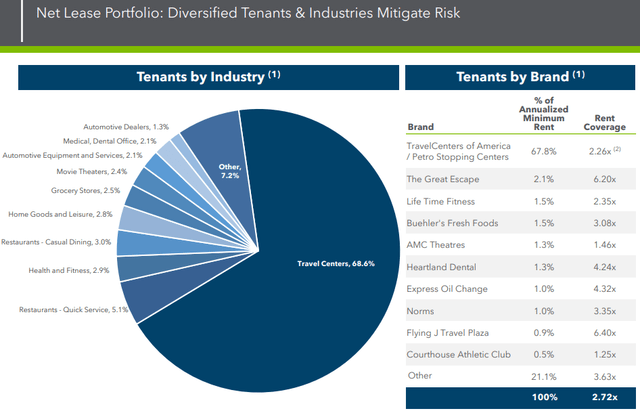

SVC’s service-oriented net lease properties had a rent coverage of 2.72x, a WALT of 9.1 years, and a 95.8% occupancy rate as of their most recent update.

Its net-lease tenants operate across 21 industries and includes well known businesses such as Burger King, Pizza Hut, Express Oil Change, Popeyes, Arby’s, and the Travel Centers of America.

While SVC’s net-lease properties are diversified across 21 industries, the overwhelming majority of their net lease annual rent comes from Travel Centers.

As an industry, Travel Centers represents approximately 69% of their net-lease portfolio and their top tenant, TravelCenters of America, made up almost 68% of their of their net-lease portfolio’s annual rent.

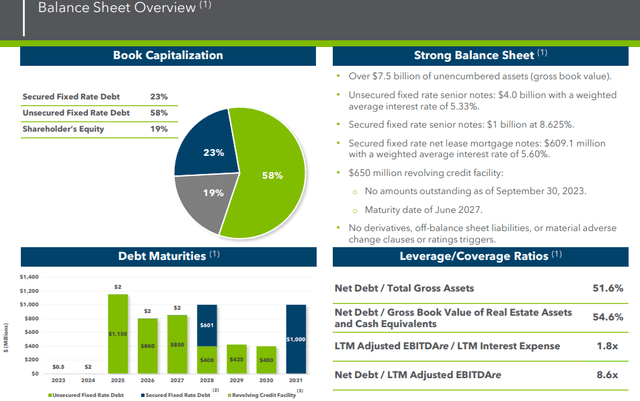

Service Properties Trust has a B+ credit rating (junk rated) and debt metrics that could be better. The company has approximately $5.7 billion in debt on its balance sheet compared to a total market cap of $1.33 billion.

Additionally, it is highly leveraged with a net debt to adjusted EBITDAre of 8.6x, a long-term debt to capital ratio of 64.73%, and an Adj EBITDAre to interest expense ratio of 1.8x.

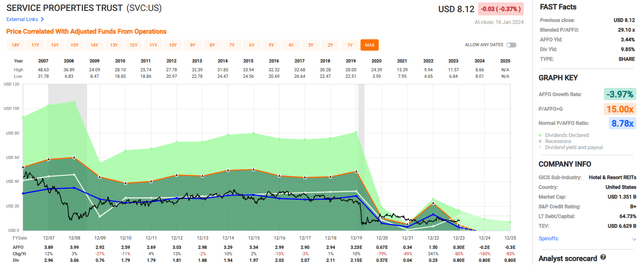

Going all the way back to 2007, SVC has a blended average AFFO growth rate of negative -3.97%. In 2007, the REIT’s AFFO came in at $3.89 per share compared to AFFO of $0.30 per share expected in 2023. Talk about value erosion.

As one could expect, the lodging REIT suffered a severe setback in 2020 during the pandemic as no one stayed at hotels. In 2020, SVC’s AFFO per share fell by -79%, going from $3.23 in 2019, to just $0.67 per share in 2020. By 2023, analyst expect SVC’s AFFO to come in at $0.30 per share.

From 2012 to 2019, SVC increased its dividend each year but had to cut it by approximately 77% in 2020, and then had to cut the dividend again by almost 93% in 2021. In 2019 SVC paid a dividend of $2.15 per share. In 2020, the dividend had been cut to $0.57 per share and in 2021 the dividend was cut down to $0.04 per share.

SVC did increase its dividend in 2022 and 2023 and currently pays a 9.85% dividend yield, but their AFFO expected in 2023 does not come close to covering its 2023 dividend. Analyst expect AFFO to come in at $0.30 per share in 2023 compared to a dividend of $0.80 per share, resulting in an AFFO payout ratio of 266.67%.

In spite of this, the stock is trading well above its average multiple, with a current P/AFFO of 29.10x, compared to its average AFFO multiple of 8.78x. Service Properties Trust is not within our coverage universe, but we recommend investors avoid this externally managed REIT.

We recommend investors “AVOID” Service Properties Trust.

In Closing

I suppose that I should dedicate this article to my high school English teacher who taught me about Shakespeare.

I would have never imagined that I would be able to use references to Shakespeare in my REIT analysis.

What’s a sucker yield?

“All that glisters is not gold.” Shakespeare.

Stay humble folks,

“My pride fell with my fortunes.” Shakespeare.

And finally, thank you for reading this article, and avoid these 3 REITs!

“Something is rotten in the state of Denmark.” Shakespeare.