Each year, Wall Street becomes enamored with different market themes. In 2022, stable, dividend-paying companies were a beacon of safety amid a widespread downturn in the major indexes. Last year, mega-cap growth stocks, especially big tech, led to market exuberance and an outperforming year for the Nasdaq Composite.

It’s too early to tell what 2024 will bring. But Coca-Cola (KO -0.55%), Procter & Gamble (PG -0.39%), and Target (TGT 0.54%) all lost value last year despite the S&P 500‘s gain of 24%. However, all three companies are Dividend Kings, having paid and raised their dividends for over 50 consecutive years.

Investors looking for safe, out-of-favor stocks have come to the right place. Here’s why each stock is worth buying no matter what happens in the broader market.

Image source: Getty Images.

This beverage behemoth is a beacon of reliability

On Jan. 11, Coca-Cola announced that it will be reporting fourth-quarter and full-year 2023 earnings on Feb. 13. There’s no word yet on a dividend increase. But history shows that Coke tends to raise its dividend in February. Investors should expect the quarterly dividend to rise to at least $0.48 per share, which would mark the company’s 62nd year of consecutive dividend increases.

The dividend is a big reason to own Coke stock. Even without assuming a dividend raise, Coke yields 3.1%, which is higher than the average stock in the S&P 500. Using the SPDR S&P 500 ETF Trust as a benchmark, the S&P 500 yields just 1.4%.

Coke has a resilient business model that can perform well regardless of the market cycle. But this advantage can also be a disadvantage, as Coke doesn’t have a lot of upside even if the economy is thriving.

To achieve steady growth over time, Coke has to grow case volumes (sales), justify price increases, and operate a portfolio of successful brands while also adding brands to the mix to retain market share and diversify into new beverage categories. Overall, Coke has executed this strategy very well.

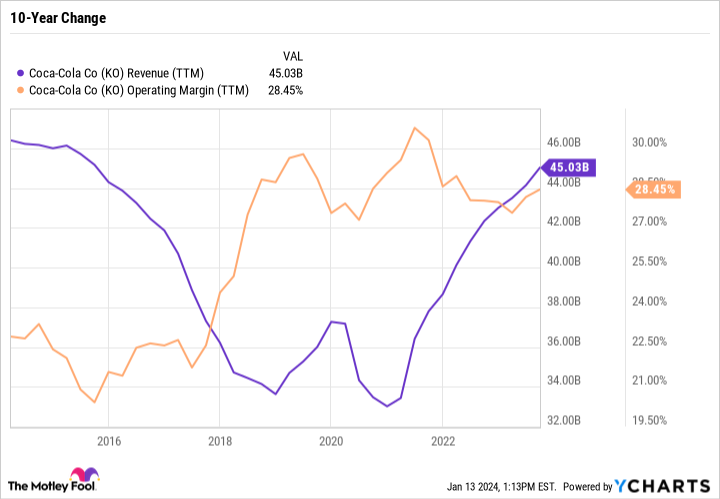

KO Revenue (TTM) data by YCharts

In the chart, you can see that Coke’s revenue is just now returning to levels seen a decade ago. The difference today is that Coke has far higher operating margins, so it’s making much more operating income per dollar of sales.

Part of Coke’s future success will depend on an effective marketing campaign. The company’s “Raising the Bar: Marketing & Innovation” presentation in third-quarter 2023 gave investors details of what to expect from Coke in the years to come. Coke recognizes that people have changing preferences. To maintain its market share, it has to grow its non-soda portfolio while not overspending on marketing and advertising at the expense of margins.

Overall, Coke seems to have a good handle on what it needs to do to keep delivering shareholder returns over time. The brand is strong, the portfolio is diverse, the dividend is solid, and the valuation isn’t terrible, with a price-to-earnings (P/E) ratio of 24.5.

Overall, Coke is a reliable passive income source and a worthy addition to any portfolio.

P&G’s brands are the best in the business

Procter & Gamble is very similar to Coke because it is a Dividend King that can perform well in a weak economy. And although Coke is considered a consumer staple company, soda, tea, coffee, and energy drinks aren’t necessities in the same way as household essentials like toothpaste, detergent, toilet paper, and diapers are.

I like Coke, but I love P&G. The simple reason is that P&G is truly diversified. Whereas Coke covers different parts of the beverage category, P&G sells many different household staples, including beauty and grooming, healthcare, baby, feminine, and family care products, and fabric and home care.

For example, in a category like toilet paper, P&G may be competing with other brands, but it’s still a basic item people will buy no matter what. The same can’t be said for the beverage industry, where folks aren’t simply selecting different options within, say, the soda category, but are deciding between soda and another beverage altogether, as well as whether to consume a beverage out and about or at home.

Some may counter by saying there’s limited pricing power for Tide detergent over a non-P&G competitor like Arm & Hammer (owned by Church & Dwight). But P&G’s pricing power has been in full effect this past year. Despite stagnant or even lower sales volume, P&G was still able to grow sales thanks to sizable price increases.

Brands matter, even for consumer staples, and P&G has proven that time and time again. At 2.5%, the yield isn’t as high as Coke’s. But P&G also has a better track record of buybacks than Coke, as it tends to spend about the same on buybacks as it does on the dividend.

To top it all off, P&G has a solid free cash flow yield of 3.9%, coincidentally the same as Coke. That means that if both companies used all their free cash flow to pay dividends, the dividend yield would be 3.9%. Basically, these are cash cow businesses that directly reward shareholders in a variety of ways. P&G severely underperformed the market last year, and I don’t expect that to happen again in 2024.

Target is recovering

Target carries Coke and P&G products at its stores. But it also sells several higher-margin discretionary products. Target’s product mix makes it more vulnerable to the ebbs and flows of the economic cycle.

The retailer was hit hard by weak consumer spending, a shift in mix away from discretionary toward staples, and supply chain and inventory bottlenecks that took years to resolve. Despite rebounding (big time) from a three-year low in October, Target is still down 47% from its all-time high.

One of the reasons Target has recovered so much in recent months — aside from a rebound in the overall market — is that it finally showed signs of improvement, namely in rising margins and lower inventory.

The company isn’t out of the woods yet. But lower interest rates in 2024 should help drive higher consumer spending and economic growth, which could do wonders for Target’s margins.

Target should have never sold off as much as it did. The company is prone to cycles, but its long-term future is bright. Target has invested heavily in improving the store experience, e-commerce, curbside pickup, and its Target Circle rewards program. The moves have boosted customer loyalty and should help drive a stickier customer base and make the company more resilient to economic cycles.

Target is a Dividend King, which is a testament to its brand power and financial strength, which has allowed it to raise its payout even during challenging times. What’s more, Target stock has a fairly high yield of 3.1%, the same as Coke. But Target has far more growth potential.

Add it all up, and Target is arguably the best Dividend King on this list for folks who can stomach a little more volatility.

Passive income you can count on no matter what

Coke, P&G, and Target aren’t companies that can outperform during a growth-led bull market. After all, it’s easy to ignore a 3% dividend when the market is up double digits in a single year.

But the true value of these companies isn’t in their performance relative to the market, but in their ability to provide investors with an income stream, no matter what the market is doing.

Folks looking for reliable investments to add to their portfolio should consider all three stocks now.