2023 has come to an end, and one thing we can be sure of is that the 2024 winners won’t necessarily be the same as the 2023 winners. But many of them will since great companies that are achieving their goals and leveraging their opportunities are likely to continue performing well and generating investor confidence.

Global-e Online (GLBE -0.62%) closed out the year with a 92% gain, and there are many reasons to believe it can keep it up in 2024. Here are three of them.

1. Just about any e-commerce retailer needs it

Global-e operates a platform for cross-border e-commerce solutions. The main reason Global-e has been growing by leaps and bounds is that its services are a no-brainer for e-commerce retailers. Any e-commerce company serious about expanding can benefit from signing up for one of Global-e’s packages.

Its platform can be used for any size of business, from small web sites with e-commerce capabilities to the largest public companies. It counts top global retailers like Walt Disney and LVMH as clients, but also many smaller companies you may never have heard of before. Whatever the size or industry, clients can plug Global-e’s integration into their websites and offer localized checkout, instant custom calculations, around 100 currencies, and more.

These services open up huge new markets for clients and are obvious ways to increase sales. Global-e has many testimonials about how customers signed up for its services and demonstrated higher sales. It has a robust pipeline of new clients onboarding, such as Tory Burch and Bang & Olufsen in the 2023 third quarter, and its own growth has been phenomenal.

Revenue jumped 27% year over year in the third quarter, and gross merchandise volume was up 35%. Consider that this is a pressured time for retailers, and that’s trickling down to Global-e’s sales. As inflation moderates and spending increases, these numbers should accelerate.

2. It has an advantageous partnership with Shopify

Shopify was an early investor in Global-e, and it’s been working on a new rollout of Global-e’s integration with its merchant client sites. It recently launched Shopify Markets Pro, a white-label service offering Global-e’s platform, and Global-e said it has been “well-received” by the merchant community.

This could offer a big boost for Global-e’s business over the next few quarters. CFO Ofer Koren said that management is anticipating an acceleration in growth over the next year based on this partnership, general business expansion, and improved consumer sentiment.

It doesn’t end with Shopify, though. Global-e also recently inked a deal with Wix.com (NASDAQ: WIX) to offer white-label services, and these kinds of arrangements could be another growth driver for it.

3. It’s getting closer to profitability

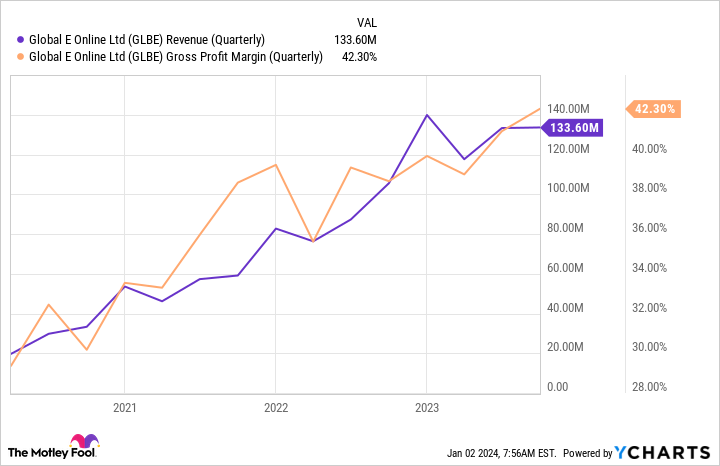

Global-e was near net profitability when it went public, but between stock-based compensation, impairments on warrants related to Shopify’s investment in the company, and overall scaling, its net loss widened. It’s on the mend, though. Gross profit and margin have been increasing, underscoring the profit potential, along with revenue.

GLBE Revenue (Quarterly) data by YCharts

Otherwise, adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) is a capable proxy for the improvements in profits while stripping out some of the expenses associated with the initial public offering. It increased from $12.5 million last year to $22.1 million this year in Q3, and management raised the full-year guidance by about $3 million to $92 million at the midpoint after the third quarter, or double from last year. Its net loss is also improving, from $64 million last year to $33 million this year in the latest quarter.

One thing Global-e stock is not is cheap. It trades at 12 times trailing 12-month sales — although that’s much lower than it used to be. Investors are willing to pay up for this stock because the opportunity is so compelling. As growth accelerates and profits improve, expect Global-e stock to soar this year.

Jennifer Saibil has positions in Global-e Online and Walt Disney. The Motley Fool has positions in and recommends Global-e Online, Shopify, Walt Disney, and Wix.com. The Motley Fool has a disclosure policy.