Coca-Cola (KO -0.18%) investors didn’t just have a flat year in 2023, they had a downright awful one. Shares of the beverage behemoth declined even as the S&P 500 rallied by 22%. Coke’s 5% drop was enough to make it the sixth-worst-performing stock in the Dow Jones Industrial Average.

Still, 2024 could be much better for shareholders. Let’s look at some big reasons for investors to like Coke’s prospects for the year ahead.

1. It’s all about volume

Coke stock joined other Dow consumer staples giants like Procter & Gamble in losing ground last year. But the beverage leader is enjoying much stronger operating momentum. The big knock against P&G, after all, is that it has had to rely exclusively on higher prices to boost sales in 2023. Volumes declined in the most recent quarter as overall growth landed at 7%.

Compare that result with Coca-Cola, which posted an 11% jump in organic revenue last quarter thanks to a balance between rising prices and increased sales volumes. Coke won market share in its core on-the-go beverage niche and is finding plenty of growth in core areas like sparkling sodas and non-traditional beverages such as energy drinks, sports drinks, and waters. “We delivered an overall solid quarter and are raising our full year … guidance,” CEO James Quincey told investors in late October.

2. Cash returns

Shareholders should also see their returns bolstered by more direct cash headed their way in 2024. Last quarter, Coke boosted its earnings outlook to call for an 8% increase for the full 2023 year. Gains might land even higher if cost inflation keeps moderating, as it did starting late last year.

That profit bounce should easily fund the company’s next dividend increase, which is expected to be announced in mid-February. Coke has hiked its dividend in each of the last 60 years, including a 5% boost early last year.

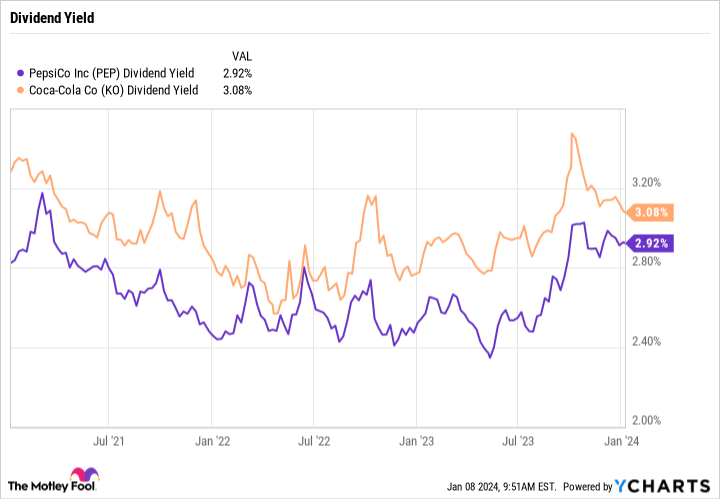

PEP Dividend Yield data by YCharts

The poor performance of the stock lately means investors get a higher yield from picking up Coke’s shares today. You’ll collect a 3.1% yield on top of any capital appreciation by purchasing Coca-Cola at today’s prices. That’s better than P&G’s 2.5% yield and PepsiCo‘s 2.9% yield.

3. Price check

There’s a good reason why the “Dogs of the Dow” strategy, which focuses on buying the worst performers of the Dow from the prior year, is so popular with investors. The Dow is packed with high-performing companies like Coca-Cola that have a good chance at bouncing back simply because they start the new year off at a discount. These weaker stocks tend to have higher dividend yields, too.

Investors can add a relatively cheap price to that list of reasons to like Coke’s chances for 2024. Shares are trading at 5.7 times annual sales, down from the over 6 times sales that investors were paying in early 2023.

Sure, you could buy Pepsi for about half of that price. But a Coke investment comes with greater income, faster growth, and much higher profit margins than Pepsi. These stellar metrics should support better returns for investors holding this stock in 2024 and beyond.

Demitri Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool recommends the following options: long January 2024 $47.50 calls on Coca-Cola. The Motley Fool has a disclosure policy.