While the market, in general, may be getting a bit expensive thanks to newfound market optimism, there are still plenty of stocks that trade at reasonable levels that investors can scoop up without fear of overpaying. Three stocks that I’d be willing to deploy $500 to buy are PayPal (PYPL 2.46%), Airbnb (ABNB -0.03%), and Meta Platforms (META 0.25%).

These three don’t have much in common from a business mindset, but their stocks share the same trait: undervaluation.

They have strong offerings in their respective industries

PayPal is a leader in the payment processing space and can be used by consumers and merchants to manage payment methods. PayPal also has a popular peer-to-peer payment service in Venmo and an unbranded payment processing product in Braintree, which is used to make a more custom payment processing experience.

Airbnb is the market leader in alternative stays and experiences and has consistently grown its network to include a global array of options. Despite many people thinking that Airbnb would struggle as consumers cut their spending and various municipalities banned short-term rentals, the company continued to do just fine.

Meta Platforms is better known by its former name, Facebook. While Meta has a Reality Labs division that handles its pursuits related to the metaverse, the real moneymaker is its family of apps, which includes Facebook, Messenger, Instagram, WhatsApp, and Threads. This makes Meta’s revenue stream dependent on advertising, which struggled in late 2022 and early 2023 but strengthened as of the third quarter.

All three of these businesses are at the top of their respective industries, making them good investments, but their low valuations make them great buys now.

The stocks are all quite cheap

Because all three companies are mature and optimized for profits, I’ll focus on their price-to-earnings valuation.

PayPal is the cheapest of the group, as it trades for a dirt-cheap 18 times trailing earnings and 11 times forward earnings (which uses analysts’ projections). That’s a massive discount to the broader market, as the S&P 500 trades for around 19.5 times forward earnings, according to FactSet.

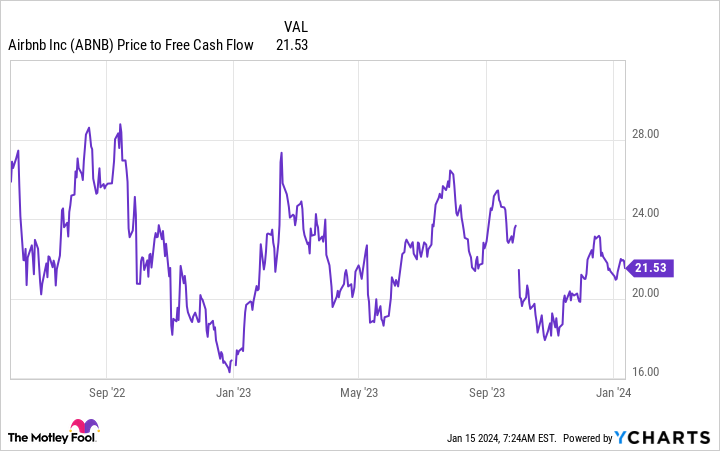

Airbnb’s price-to-earnings ratio is skewed due to a one-time income tax provision that caused its earnings per share to more than triple. Instead, I’ll use its price-to-free-cash-flow ratio to value it.

ABNB Price to Free Cash Flow data by YCharts

From this data point, Airbnb is right in its historical valuation range. When valuing a company by free cash flow (FCF), a good rule of thumb is to invert this metric to get FCF yield. Doing this gives you an FCF yield of 4.6%. Then, you compare this figure to the current 10-year treasury yield rate. With the 10-year sitting just below 4%, Airbnb will generate more cash than a risk-free asset — even if it doesn’t grow. With Airbnb having a higher yield, it shows that it’s a very cheap stock.

Finally, Meta Platforms may look expensive if you look at their trailing earnings; its price-to-earnings ratio is 33. However, this is a flawed analysis, as it includes three quarters in a weak advertising market. Instead, investors should use the forward price-to-earnings ratio to factor in the growth it will experience this year. From that viewpoint, Meta’s stock is valued at 21 times forward earnings. While this is more expensive than the S&P 500, Meta is a much better company than the average one in the index, earning it a premium.

PayPal, Airbnb, and Meta Platforms are three companies you can confidently buy right now, as their businesses are strong and their stocks are cheap. Picking up shares of this trio now is a good move, as these stocks may become more popular as the market diverts its attention from other highly valued investments.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Airbnb, Meta Platforms, and PayPal. The Motley Fool has positions in and recommends Airbnb, FactSet Research Systems, Meta Platforms, and PayPal. The Motley Fool recommends the following options: short March 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.