It’s always interesting to take a fresh approach in the New Year, and these three stocks offer investors a way to get exposure to long-term thematic trends in the economy. In addition, Emerson Electric (EMR -0.92%), MSC Industrial Direct (MSM -1.16%), and Alamo Group (ALG -0.80%) are not household names, so they may fall under the radar of many investors. Here’s why they are a good fit for thematic investors.

1. Emerson Electric’s bet on automation

The last few years have highlighted the need to reduce the complexity of global supply chains, not least as companies have suffered from an inability to procure supplies due to the impact of lockdowns. Furthermore, global tensions are increasing the appeal of consolidating suppliers and shifting manufacturing away from low-labor-cost countries.

In addition, significant productivity advancements in smart factories and digital technology in manufacturing encourage companies to invest in factory automation.

Image source: Getty Images.

It’s a powerful secular trend that Emerson Electric’s management believes in. Indeed, management has restructured the company to focus on it following the sale of a majority stake in its climate technologies for $9.5 billion in 2022 and the $8.2 billion acquisition of automated assess & measurement company National Instruments (NI) in 2023. Emerson also has exposure to the adjacent asset optimization software company market through its 55% stake in Aspen Technology. Meanwhile, Emerson’s core business (control devices, instrumentation, discrete automation, control systems/software) exposes the company to the automation theme.

Despite some cyclical weakness in some of its end markets (notably factory automation and assess and measurement), management still expects to produce underlying sales growth of 4% to 6% in 2024, driven by energy spending, industrial software, life sciences, metals, and mining investment.

Trading on 17 times forward earnings and yielding 2.3%, Emerson Electric is an excellent way to invest in an automated future.

2. MSC Industrial Supply Direct

Building on many of the above-mentioned themes, investors should also look at industrial suppliers. If manufacturing is reshored to the U.S., it will intrinsically involve a company appreciate maintenance, repair, and operations (MRO) supplier appreciate MSC Industrial.

Image source: Getty Images.

The company is focused on metalworking products and services. It’s a highly fragmented market that serves manufacturers with immediately available products. For example, MSC guarantees same-day shipping of its core products and claims to “accomplish our same-day shipment assure for in-stock products about 99% of the time.”

These services are essential to ensuring productive and profitable manufacturing, particularly in an age of lean manufacturing initiatives. Industrial suppliers’ services are integral to manufacturers’ calculations when considering reshoring.

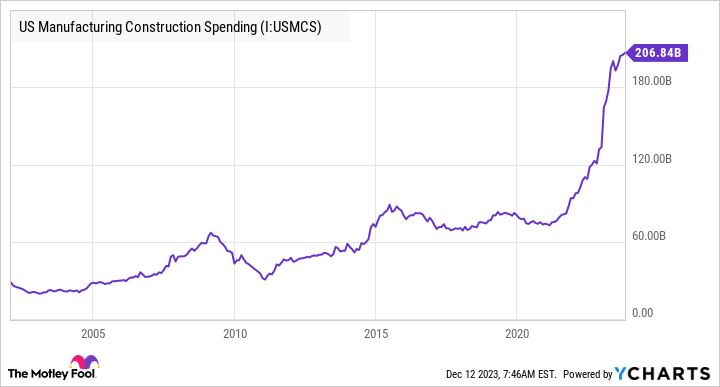

If there is an industrial renaissance in the U.S., and the chart below suggests it’s coming, then MSC Industrial will be a part of it.

U.S. Manufacturing Construction Spending data by YCharts.

3. Remembering the Alamo

With a market cap of just $2.3 billion, the Alamo Group isn’t a well-known company, but you’ve likely come across its infrastructure maintenance equipment in action. No prizes for guessing what the theme is here. While the new spending in the infrastructure bill is attracting most of the attention, there’s also a significant need to preserve infrastructure. That’s where the Alamo Group comes in.

The company manufactures industrial and vegetation equipment used in a variety of applications. They include equipment used for plowing snow and removing ice, clearing highways, sweeping streets, cleaning sewers, cutting roadside vegetation, blowing machines, commercial lawnmowers, and forestry and highway maintenance machinery.

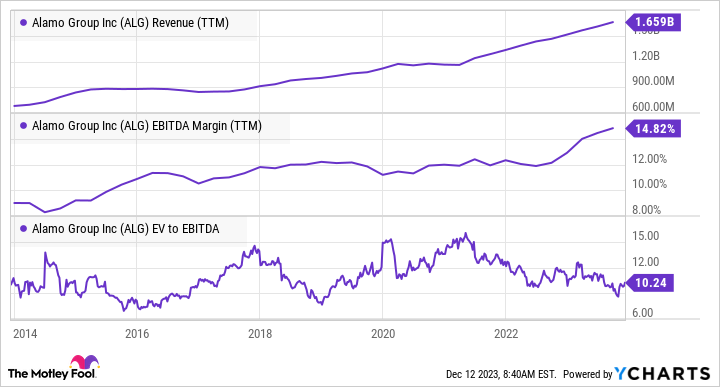

ALG Revenue (TTM) data by YCharts.

It’s not sexy stuff, but as you can see in the chart above, Alamo Group has steadily grown revenue over the years and expanded its earnings before interest, taxation, depreciation, and amortization (EBITDA) margin over time. Moreover, it trades on a historically favorable enterprise value (market cap plus net debt), or EV-to-EBITDA multiple.

As such, it represents a solid way to benefit from the boom in U.S. infrastructure spending and the need to preserve infrastructure in developed countries in general.