Eoneren

A couple of days ago, I wrote an article titled “My Top 3 Picks for 2024.” In this piece, I highlighted the key holdings in my portfolio for the year, anticipating their growth amidst favorable factors like the presidential election, rising AI investments, and declining mortgage rates.

The picks were following:

- Alphabet (GOOG) Blended P/E: 24.1x, 10Y EPS growth: 17.5%, Annual Return Potential: 17%

- NVIDIA (NVDA) Blended P/E: 41.3x, 15Y EPS growth: 39.5%, Annual Return Potential: 31%

- Lowe’s (LOW) Blended P/E: 16.2x, 15Y EPS growth: 16.5%, Annual Return Potential: 14%

The majority of the stocks I’ve previously discussed can easily be classified as growth stocks. However, today I’d like to introduce three additional picks with a slightly more aggressive growth profile.

Although these selections are not considered core holdings in my portfolio, I’ve allocated a substantial exposure ranging from 1% to 3%. I firmly believe these picks have the potential to deliver exceptional performance in 2024.

While I often write about dividend growth stocks, it’s important to note that I also own many growth stocks that don’t pay any distribution, aiming to supercharge my portfolio.

The advantage of growth stocks without distribution lies in maximizing the power of compound interest. Instead of paying out dividends, which are not tax-efficient, companies can reinvest the profits to grow their business. If the return on invested capital or “ROIC” is at least 15% over the long term, the returns start compounding.

Naturally, growth stocks, being in the “growing” phase of their life cycle, tend to have a higher beta, making them more volatile. However, with higher beta comes the potential for higher returns.

With that said, I’d like to present you with three growth stock picks that I am heavily investing in for 2024. Keep in mind that while these investments align with my investment style and portfolio, there are always other potentially more attractive or riskier opportunities out there.

1. Chipotle Mexican Grill, Inc. (CMG)

If you’re not familiar, Chipotle Mexican Grill is a popular fast-casual restaurant chain renowned for its emphasis on using fresh, high-quality ingredients in crafting Mexican-inspired dishes.

Yes, it might sound surprising, but I’ve chosen a restaurant chain as a potential growth stock.

The rationale behind this choice is straightforward – Chipotle transcends the traditional image of a restaurant chain by focusing on the automation of kitchen processes and embracing robotic innovation in gastronomy. This strategy not only enhances its online sales but also boosts overall efficiency.

Traditionally, labor costs constitute a significant chunk of expenses for restaurant businesses, often reaching up to 34% of sales. The impact of this became even more apparent post-COVID-19, with many restaurants scaling down operations due to a shortage of available labor. Chipotle stood up to the challenge.

Initially, Chipotle introduced a robot for crafting tortilla chips, followed by another for assisting in guacamole preparation. The latest endeavor involves testing a robotic chef tasked with creating salads and bowls at the Chipotle Cultivate Center innovation hub in Irvine, California.

Automated assistance in preparing bowls and salads becomes particularly crucial since these dishes constitute approximately 65% of all Chipotle digital orders.

Chipotle’s ability to adapt and innovate is underscored by its Q3 earnings report, revealing an improvement in demand trends and rising profit margins amid a challenging economic environment for consumer spending.

Drawing more diners doesn’t seem to be an issue for Chipotle, evident in a 5% increase in comparable-store sales during the Q3 period that extended through late September. Management attributes this success to enhanced hiring and training practices, superior food quality, and faster service.

In the face of economic uncertainties, Chipotle’s CEO, Brian Niccol, confidently states that the company’s value proposition is stronger than ever.

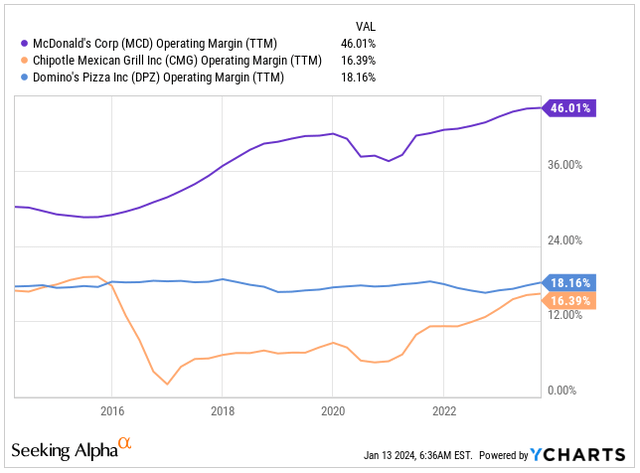

The enhanced value proposition has translated into increased customer traffic, a sought-after achievement that has proven challenging for many restaurant peers in recent times. However, McDonald’s (MCD), with its focus on value, is outpacing others, experiencing a faster expansion with an 8% increase in comparable-store sales in the US market this past quarter.

It’s worth noting that Chipotle operates differently from McDonald’s and Domino’s Pizza (DPZ), employing a non-franchised operating model. Consequently, its profit margins don’t reach the same heights.

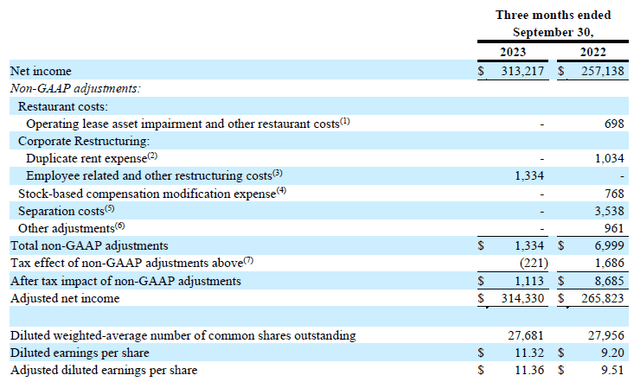

Chipotle’s restaurant-level operating profit margin saw improvement, climbing from 25% to 26% of sales compared to a year ago. The overall profitability also increased to a robust 16% of sales from 15%. This positive trend is reflected in a noteworthy 20% surge in adjusted earnings for the quarter.

Operating Margin (Seeking Alpha)

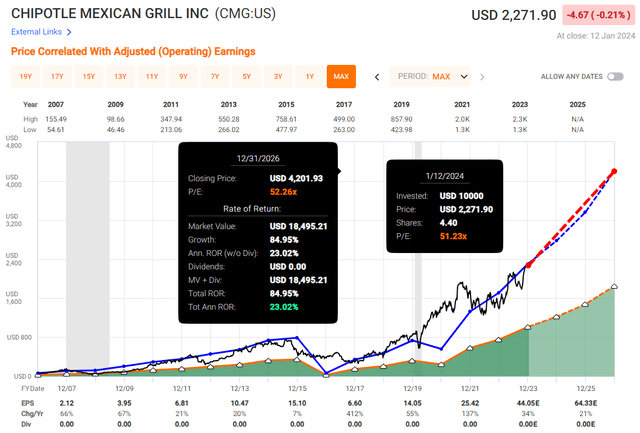

Investors will recognize Chipotle’s superiority in gastronomy, and the stock is by no means cheap. Since 2007, the stock has continuously traded at an average blended P/E of 52.3x, which seems very high for a restaurant chain.

The valuation has stretched even further in the last 10 years to an average blended P/E of 62.8x.

Since 2007, Chipotle has grown its EPS at a rate of 23% annually, and this trend is expected to continue well into the future.

The EPS growth projections are the following:

- 2024: EPS $53.19E, 21% growth YoY

- 2025: EPS $64.33E, 21% growth YoY

- 2026: EPS $80.40E, 25% growth YoY

Since Chipotle is expected to grow at a similar rate as in the past, today’s valuation of 51.2x its earnings implies that the stock is trading around its fair value.

If the anticipated forward growth materializes and the valuation remains constant, over the next 3 years, we could see an annual return of around 23%, hence my strong buy conviction.

2. Meta Platforms, Inc. (META)

Meta Platforms needs little introduction as the largest provider of social media platforms, offering its products to 3.14 billion users daily—equivalent to 38% of the world’s population using their products daily. Staggering.

Some might also have a recency bias with Meta, as shareholders were taken on a wild ride in 2022 with Meta’s ambitious venture into the Metaverse amidst a slowdown in ad spending.

This resulted in a nearly 77% decrease in the stock price from its peak to its lowest point—something I consider a destruction of shareholder value.

Yet, since then, the stock has recovered, becoming the second-best-performing stock in the S&P 500 (SPY) in 2023 with a 194% return.

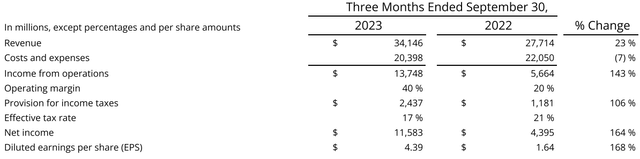

Today, the situation is very different. Amidst the recovery in ad spending, Meta had a great Q3, with revenue rising by 23% to $34.15 billion compared to the same quarter last year. What is even more significant is that, after refocusing on its core ad business and reducing its headcount by 24% YoY, along with a significant cut in marketing expenses, Meta managed to bring down its operating expenses by 7%. This had a positive impact on the operating margin, which grew by 2000 basis points.

That’s what I call efficiency.

Having said that, EPS increased by 168% to $4.39, easily outperforming analysts’ expectations for the quarter by $0.76.

Having said that, I expect 2024 to be an even better year. With the US presidential election coming up, at a time when the country is more divided than ever, I anticipate heavy political contention with significant campaign spending. This scenario is expected to drive the profits of both Meta and Google’s advertising businesses.

Simultaneously, Meta is expected to be one of the main beneficiaries of AI innovation, and the management prioritizes AI as the most significant area of investment in 2024, both in engineering and compute resources. However, the company plans to avoid hiring a large number of new employees. Instead, they aim to deprioritize several non-AI projects across the company to redirect resources toward AI initiatives.

To provide an overview of Meta’s AI initiatives:

- They introduced an Assistant accessible across all messaging experiences and smart glasses, allowing users to ask questions, access real-time information, and generate photorealistic images, similar to Chat-GPT or Bard.

- Meta launched the Studio platform, enabling users to create and interact with various AIs for assistance with tasks and entertainment.

- They introduced Emu, an image creation model that produces high-quality images and stickers rapidly.

- Meta released an early alpha version of business AIs, enabling every business to have an AI interface for customer sales and support.

- They revealed plans to launch creator AIs next year, enabling every creator to engage with their fans and build their community with the help of AI.

More customized advertisements targeting a better-defined audience mean only one thing: more business and increased ad spending for Meta.

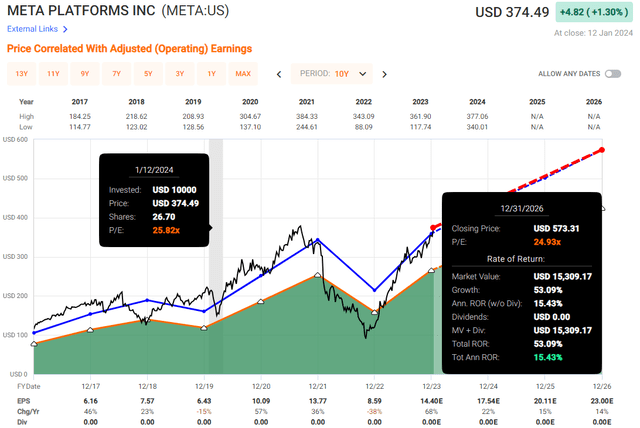

With that, the stock is currently trading at a blended P/E of 25.8x, which is lower than the average of 30.8x its earnings since 2014.

The EPS growth since 2014 has averaged 28.56%, but this is expected to slow down to around 17.5% annually now:

- 2024: EPS $17.54E, 22% growth YoY

- 2025: EPS $20.11E, 15% growth YoY

- 2026: EPS $23.00E, 14% growth YoY

Naturally, with the falling yet still strong growth, we need to adjust our expectations for the valuation towards downside as well.

Since 2016, the EPS growth has been an annual 18.45%, similar to what we are expecting for the next three years, and the stock has traded on average at 24.9x its earnings, close to where the stock is trading today.

With that, if we assume the valuation remains around 25x, its earnings and the growth materialize over the next three years, we are set to see annual returns of around 15.5%, hence my buy conviction.

3. MercadoLibre, Inc. (MELI)

MercadoLibre, the Latin American e-commerce giant originating from Argentina, is frequently likened to Amazon.com (AMZN), a comparison I find fitting. While Amazon looks to AWS as its next growth driver beyond e-commerce, MELI, on the other hand, stands as a fintech powerhouse in the Latin American region, a factor that has significantly bolstered its stock in recent years.

In 2023, MELI’s Nasdaq-listed shares surged by more than 75%, mirroring the robust performance of its larger counterpart, Amazon, which saw an 80% return. However, despite this parallel growth, MercadoLibre, with a market cap of $80.4 billion, remains approximately 20 times smaller.

In addition to its rapidly expanding Mercado Libre e-commerce platform, the company provides a popular Venmo-like digital wallet and various other financial services under the name Mercado Pago.

According to JPMorgan analyst Marcelo Santos, MELI stock offers “a unique combination of leadership in e-commerce coupled with accelerating growth in fintech,” as highlighted in a recent note to clients.

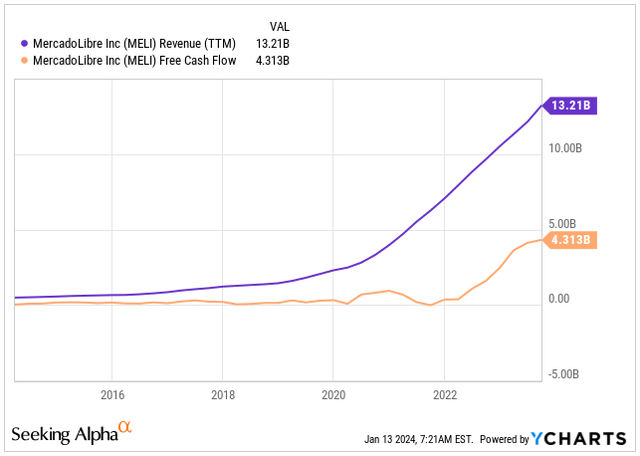

Like other e-commerce and fintech enterprises, MELI experienced a doubling of its business during the COVID-19 years of 2020 and 2021. Building on this success, the company continued to grow at a very healthy rate even as life returned to normal.

While initially perceived as the “eBay (EBAY) of Latin America” for connecting individual buyers and sellers, MELI evolved by innovating in payment services, credit, logistics, and advertising.

Today, its payment services platform, Mercado Pago, is widely utilized in the region, powering transactions on the Mercado Libre marketplace. Interestingly, its wallet services extend beyond the platform, and the company now witnesses a larger payment volume outside of its platform.

In total, more than 167 million people across Latin America utilized either its e-commerce or fintech offerings, reflecting a 31% increase from the same period last year.

Despite challenges in the region such as hyperinflation in Argentina, political turmoil, potential slower economic growth amid USD strength, and poverty, the region is poised for significant growth in the next decade. MELI has a unique opportunity to be a part of this growth.

The diversified nature of the business was evident in the company’s recent Q3 earnings. MELI reported an adjusted $7.16 per share on sales of $3.8 billion for the quarter ending in September. Earnings surged 180% YoY, and revenue grew by 40%.

Analyzing businesses such as MELI and AMZN based on the P/E ratio often sparks debates about whether the stock is overpriced or if this metric misrepresents its true value.

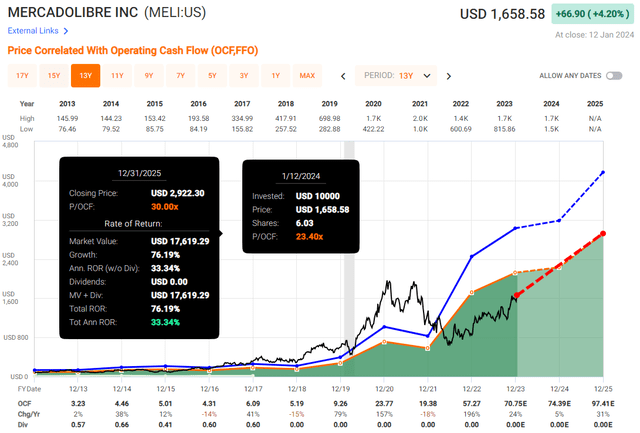

I am in the camp that argues that the P/E ratio for these businesses is misleading. That’s because the company’s profit doesn’t effectively capture its actual cash-generating capacity. With that in mind, I prefer to look at Operating Cash Flow or ‘OCF.’

Since 2012, MELI has, on average, been trading at a P/OCF ratio of 42.8x, and the growth of the OCF has been high at 30.2%, very similar to Amazon’s growth of 29.5% over the same duration.

The growth is expected to continue, but at a slower rate compared to historical growth, at 14.5% annually.

- 2024: OCF $74.39E, 5% YoY growth

- 2025: OCF $97.41E, 31% YoY growth

Having said that, the stock is today trading at a P/OCF of 23.4x, which is significantly below the historical average. However, we need to account for the decelerating growth.

I would argue that a reasonable P/OCF going forward would be 30x, which would imply that if the growth materializes, the stock is poised to deliver a return of around 33% over the next 2 years, hence my strong buy rating.

Takeaway

While growth stocks tend to be more volatile than stocks that pay dividends, overlooking them could be a missed opportunity.

The potential of growth stocks lies in their ability to supercharge your portfolio. This stems from the efficient allocation of profits, as they are reinvested back into the business, proving more tax-effective. When under the guidance of the right leadership, the compounding effect takes on a whole new level of significance.

In light of this, I am presenting three growth stocks that I’m adding to my portfolio in 2024. I am allocating 1% to 3% of my portfolio worth to each of these stocks, signaling that while they may not be core holdings, I anticipate a strong performance in 2024 due to favorable market trends.