In today’s scorching hot stock market, investors may gloss over the favorable qualities of the defense industry.

Defense companies aren’t known for their growth. But they benefit from having a reliable buyer in the U.S. government, which provides predictable cash flows that support organic growth, dividend payments, and often, stock repurchases.

Here’s why RTX (RTX 0.54%), Lockheed Martin (LMT 0.52%), and Honeywell International (HON -0.09%) stand out as three defense stocks worth a look.

Image source: Getty Images.

RTX’s mix of revenue streams will attract investors

Lee Samaha (RTX): The aerospace and defense industry had a difficult 2023. Defense businesses came under sustained margin pressure as ongoing supply chain issues negatively impacted operations. Meanwhile, the discovery of potential contamination in powder coating used to manufacture turbine discs in RTX’s engines used in commercial aerospace (not least the Airbus A320 neo family) will ultimately result in multibillion-dollar hits to earnings and free cash flow (FCF) over the next few years as engines need to be removed and inspected.

Still, there’s a value case to be made for the stock. Its aerospace end market remains in growth mode. While the powder coating issue is a disappointment, there’s only one other competitor engine on the Airbus A320 neo family, namely the LEAP engine of CFM International (a General Electric joint venture), but that already has a multiyear backlog in place.

Meanwhile, at some point, the supply chain issues dogging the defense industry will abate, creating the possibility for margin headwinds to turn into tailwinds. In addition, there’s no shortage of geopolitical tension right now and pressure on NATO countries to ramp up spending or at least replenish equipment used in conflict theaters.

As such, RTX operates in two end markets that are likely to be in growth mode over the near to medium term. RTX and its dividend face challenges, but are worth a look given the two sectors in which the company operates.

Lockheed Martin is a stalwart defense contractor that generates robust free cash flow

Scott Levine (Lockheed Martin): Lockheed Martin stock currently provides income investors with a 3% forward-yielding dividend. And with its strong backlog and prodigious free-cash-flow generation, Lockheed Martin seems well suited to continue rewarding shareholders with its generous dividend in the coming years.

Although lower sales and higher costs related to the company’s F-35 fighter jet adversely affected the top and bottom lines last quarter, Lockheed Martin recently celebrated an otherwise strong end to 2023. Driven by the strong performance of its space segment, Lockheed Martin recognized a 2.4% year-over-year increase in sales and a 21% year-over-year increase in net earnings. The growth carried over to the cash-flow statement as well, where Lockheed Martin reported 2023 free cash flow of $6.23 billion, representing a 1.6% increase over 2022.

However, for those looking to fortify their portfolios with a leading defense stock like Lockheed Martin, confidence that the future remains bright is equally important. Thanks to the company’s robust backlog, this certainly seems to be the case. Lockheed Martin reported a company record $160.6 billion in backlog at the end of 2023 — an auspicious sign that the company will be able to grow the dividend.

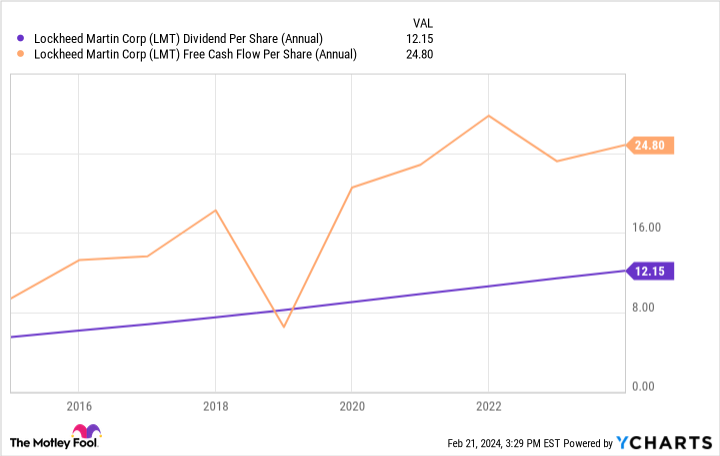

Over the past 10 years, Lockheed Martin has averaged a payout ratio of 54%. And that’s not the only indication that the company can sustain the dividend.

LMT Dividend Per Share (Annual) data by YCharts.

The company consistently generates strong free cash flow that it can use to fund the dividend.

With geopolitical tensions showing little sign of abating anytime soon, Lockheed Martin’s business will remain in high demand, making it a worthy addition to income investors’ portfolios.

Honeywell has finally found its footing

Daniel Foelber (Honeywell): Honeywell isn’t a pure-play defense stock in the same way that RTX and Lockheed Martin are. But that could work in investors’ favor.

Honeywell’s largest segment is aerospace, but it makes up just 37.2% of sales. Honeywell’s other business units are building technologies, performance materials and technologies, and safety and productivity solutions.

Honeywell’s greatest strength is that it operates a high-margin, diversified business where no single segment makes up too great of a share of sales or profit.

Earlier this month, Honeywell reported overall solid 2023 results. But the real standout was its 2024 guidance for adjusted earnings per share of $9.80 to $10.10, which would be up 7% to 10%. Honeywell’s 2024 guidance also calls for organic growth of 4% to 6%, which is in line with the company’s long-term target for 4% to 7% organic growth.

Free cash flow is forecast to be $5.6 billion to $6 billion in 2024 — more than enough to fund the company’s dividend with cash. For context, Honeywell spent $8.3 billion in 2023 on dividends, stock buybacks, capital expenditures, and mergers and acquisitions. But the dividend payment only cost Honeywell $2.72 billion — meaning it is expecting this year’s FCF to be more than double the dividend obligation.

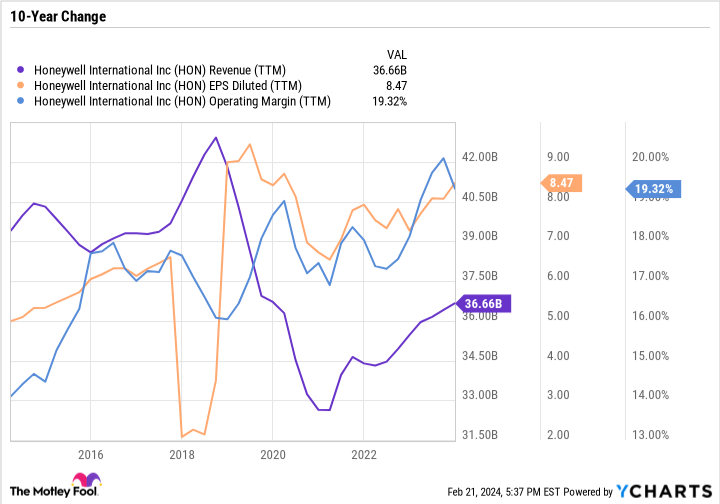

It’s been a bumpy ride for Honeywell investors since the onset of the pandemic. As you can see in the following chart, Honeywell has slowly been building up its profits to return to the pre-pandemic high. Sales are down by quite a bit, but Honeywell has made up for that by improving its margins, which has made the business leaner and more efficient overall.

HON Revenue (TTM) data by YCharts

Despite the good results, Honeywell remains in “prove it” mode. It needs to sustain at least mid-single-digit organic growth and high-single-digit or low-double-digit growth once factoring in strategic mergers and acquisitions and buybacks. It also needs to show meaningful results from monetizing the Industrial Internet of Things and artificial intelligence — themes that Honeywell has been touting for years with unclear material impacts on the bottom line.

The good news is the stock isn’t expensive, sporting just a 23.5 price-to-earnings ratio. It also has a dividend yield of 2.2% as of this writing.

Honeywell is a good choice for investors who want exposure to the defense industry but with the benefit of a diversified industrial conglomerate.