zhengzaishuru

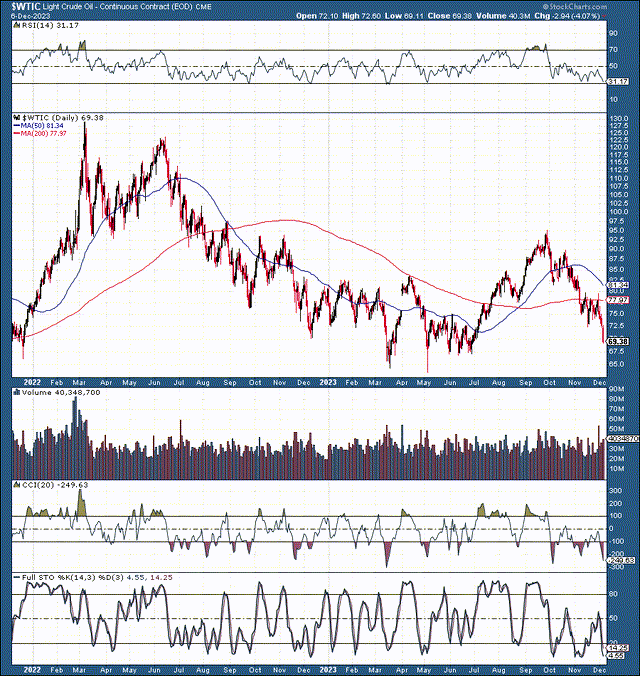

Crude oil has been in a downturn for months. Oil is down by 27% from its recent high of $95 achieved in September. Record output from the U.S. is impacting the supply/demand dynamic, pressuring oil prices to proceed lower and lower. The Kingdom’s attempts to halt the declines by instigating OPEC+ production cuts have failed to impede prices from dripping lower. Oil now sits around a multiyear low, but things can change quickly, and they probably will.

Oil is approaching a significant preserve level around the $67-65 range. Also, with the RSI around 30 here, oil is considerably oversold. The technical image implies that the bottom is near, and the probability of breaking below the critical preserve range is remote.

Moreover, the U.S. may replenish its strategic reserve supply soon. The emergency stockpile has dwindled to just 405M barrels, its lowest level since 1984. The U.S. released 180M barrels from the strategic reserve to combat inflation and price appreciation due to the Russia/Ukraine war. Now, it could buy back in the $72-65 zone.

Oil is approaching the 50% refuse point from the 2022 $130 high. Oil prices should get considerable preserve as the U.S. replenishes its strategic reserves. Moreover, the supply/demand dynamic is relatively due to a resilient global economy and the prospects for an economic recovery soon. Also, we may see continued supply cuts from Saudi Arabia, Russia, and other significant oil-exporting nations. Furthermore, geopolitical threats persist and could boost the oil price’s premium.

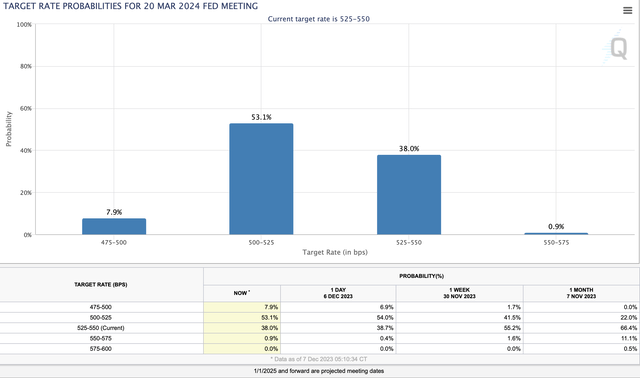

Another positive factor not being factored into the oil price here is the Fed’s probable pivot toward a more accessible monetary stance soon. There is a high probability (roughly 60%) that the Fed will begin easing rates in Q1 2024.

The Fed Likely To Cut Rates Soon

Rate probabilities (CMEGroup.com)

Oil should benefit as the Fed shifts gears toward an easier monetary stance. Lower interest rates should direct to higher growth and increased demand for oil. Additionally, we could see a favorable inflationary tailwind, leading to higher oil prices in future years.

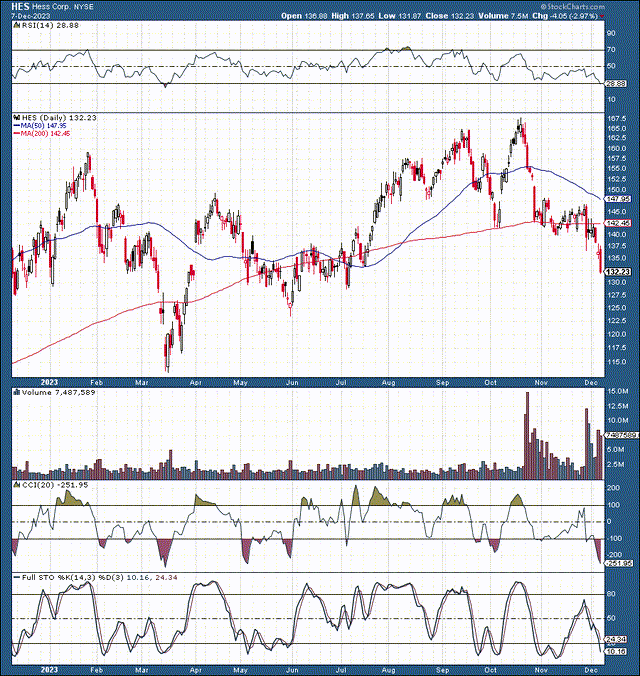

Many high-quality oil stocks have declined substantially during oil’s recent downturn. For instance, despite a $53B buyout deal with Chevron (CVX), Hess Corp. (HES) has crashed by over 20% since its October high.

Hess: 1-Year Chart

Maduro’s scheme to issue oil permits in the disputed oil-rich Essequibo region is causing uncertainties to rise. This area is one of the swampiest oil regions globally, with 15B barrels of recoverable oil reserves. Tensions in this disputed area could direct to advance uncertainties, increasing oil prices. The recent tensions raise the risk for Hess, as it has assets in the disputed region.

Yet, the Chevron deal values Hess at $53B, approximately $166 per share, roughly 26% higher from here. While the disputed region risks boost volatility for Hess, they are not likely to derail Chevron’s buyout deal. Therefore, it’s highly probable that Hess’s stock price heads back toward the buyout level, and there could be minimal downside risk. More significant disruptions in the disputed region could drag the U.S. military into the conflict, which is not something Venezuela needs.

We’ve seen considerable profit-taking since the October high as the news of the buyout deal came in. Of course, there was profit-taking because Hess’s share price was fully valued at around $166. The only thing that could propel shares any higher would be a competing takeover bid. But from whom?

Now, with the geopolitical risks, Hess’s stock price is significantly undervalued, and we could see considerable upside as the market returns to its senses in the coming weeks.

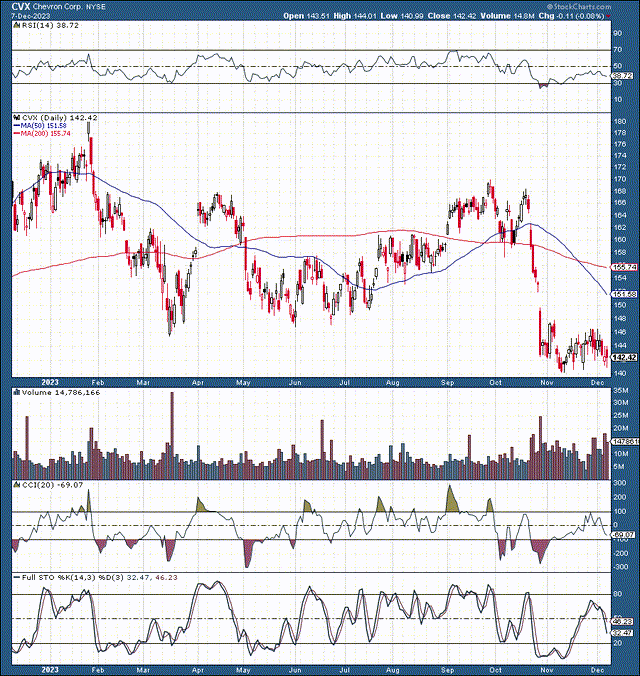

Chevron: 1-Year Chart

While the Hess/Chevron deal should be good for Hess shareholders in the near term, it is exceptionally favorable for Chevron and its shareholders in the long term. CVX’s share price cratered by nearly 20% following the announced deal (about $60B in market cap value). This refuse represents a downside of more than the Hess takeover is worth, making it a pretty sweet deal for CVX shareholders, especially ones buying after the buyout was announced.

Chevron is down by about 25% from its 52-week high, and the downside is likely minimal now. Chevron’s forward P/E ratio is only around ten here, and it’s likely to boost EPS considerably as oil prices rise.

In the long term, Hess provides significant growth prospects for Chevron, increasing shale exposure and building CVX’s presence in the highly lucrative Essequibo region. This dynamic should enable CVX to better vie with Exxon (XOM) globally. Also, at this depressed valuation, Chevron’s dividend is around 4.25%, and due to Chevron’s increasing cash flow, it is likely to boost from here.

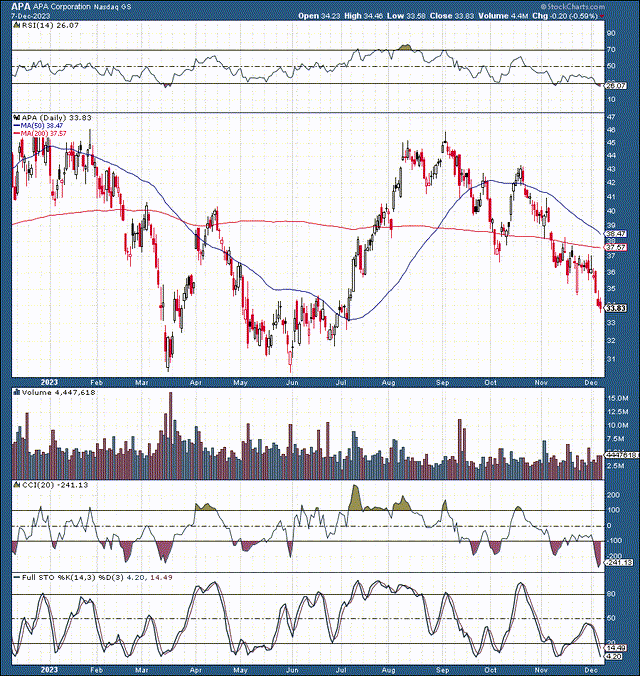

APA Corporation (APA): 1-Year Chart

APA’s stock is down by nearly 30% from its high of around $46 in early October. APA is now extremely oversold and is approaching the critical preserve point around the $33-30 region. The RSI is around 26, illustrating deeply oversold technical conditions, implying the downside could be minimal now. Also, APA’s prospects remain solid from a fundamental standpoint. Trading at just 5.6 forward earnings estimates, APA is exceptionally undervalued.

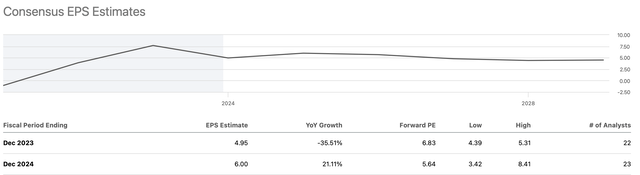

EPS Estimates Likely Too Low

EPS estimates (seekingalpha.com)

Future consensus estimates are predicated on lower oil prices or lower demand. However, we may see robust demand and higher oil prices due to favorable technical, fundamental, and psychological factors. Therefore, APA’s revenues and EPS could be significantly higher than expected, making APA’s share price exceptionally underpriced here.

APA’s dividend now yields around 3% at this deeply discounted valuation. APA also provided:

- A better-than-expected earnings report.

- Beating on top and bottom lines.

- Reporting oil production at 412,000 BOE per day in Q3.

Oil will likely stabilize and proceed higher, enabling sentiment to improve pushing APA’s stock price much higher from here.

The Bottom Line: Reward Outweighs The Risk

Oil prices are approaching the 50% discount mark from their 2022 post-Ukraine invasion high of around $130. Moreover, oil’s price is hovering around the critical preserve zone above the crucial $67-65 level. The fundamental backdrop remains constructive, with the soft landing scenario emerging as a base case. Furthermore, the Fed will likely adopt an easier monetary stance soon, and there are geopolitical risks to consider. Also, we could get additional cuts from OPEC+ due to Saudi and Russian pressure, and the U.S. could refill its strategic reserve soon, leading to a base in prices and a new uptrend. The risk/reward ratio is highly favorable in the oil market here. Therefore, high-quality, market-leading companies in the oil segment should do well as we advance into 2024.