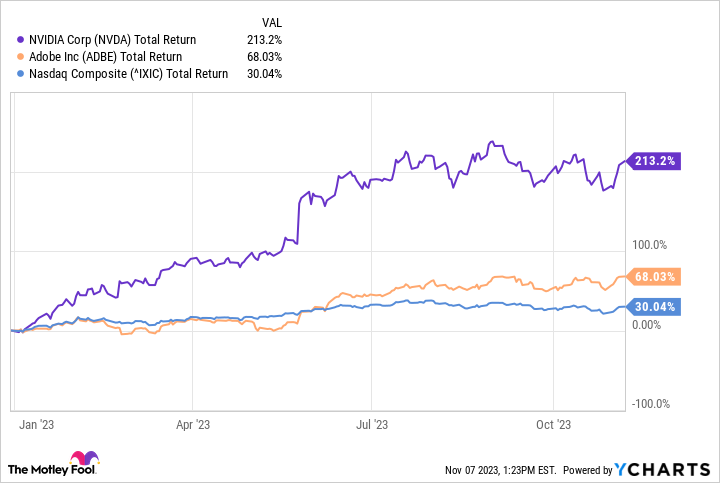

Artificial intelligence (AI) is changing just about everything. However, so far, its influence in the investing world has been mostly limited to the tech industry. For example, Adobe, a leading provider of content creation software, and Nvidia (NVDA 0.77%), a major producer of chips, have both drastically outperformed the broader market in 2023 (see chart below).

NVDA Total Return Level data by YCharts.

But AI isn’t only for tech stocks. In fact, many experts predict that this revolutionary innovation will ultimately have its greatest impact on the healthcare sector. AI revenue in the diverse healthcare sector is forecast to rise at a scorching compound annual growth rate of 26.5% over the next 10 years, according to a report by Grand View Research. Armed with this insight, here is a brief overview of three blue chip companies leading the charge in AI-powered healthcare.

Image source: Getty Images.

1. GE HealthCare Technologies

GE HealthCare Technologies (GEHC -0.04%) operates in the realms of medical technology, pharmaceutical diagnostics, and digital healthcare solutions. Recently spun off from parent company General Electric, the company has been investing heavily in cutting-edge areas of medtech to drive long-term value creation for shareholders.

One of its most important business development moves this year has been the acquisition of Caption Health, a leader in AI-powered solutions to detect disease earlier and improve patient outcomes. Caption Health’s key platform is its AI-assisted ultrasound technology, which allows a broader range of medical professionals to conduct echocardiograms.

By doing so, patients at risk of heart disease can be evaluated in a variety of settings (not just hospitals or specialized clinics), thereby improving clinical outcomes. While GE HealthCare Technologies’ AI initiative is still in its early days, the company is clearly intent on becoming a leader in this ultra-high-growth space. As a result, this AI medical stock arguably warrants a deeper dive by investors on the hunt for underappreciated growth opportunities.

2. Johnson & Johnson

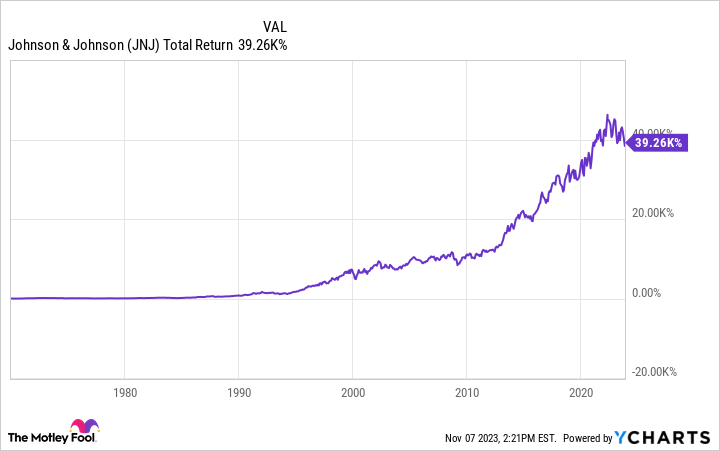

Johnson & Johnson (JNJ 0.35%) is an innovator extraordinaire. With one of the highest spends as a percentage of free cash flows on research and development in the industry, J&J has been able to stay ahead of both competitors and the inevitable loss of key patent expires to deliver outstanding returns for shareholders over the last several decades.

JNJ Total Return Level data by YCharts.

J&J is also at the forefront of applying AI to its medtech and pharmaceutical units. Earlier this year, the company announced its intention to use AI in five ways over the next decade:

- To improve the diagnoses of both rare and common diseases

- To speed up drug discovery and development

- To select the most effective clinical research sites for new drugs and medical devices

- To optimize its pharmaceutical and medtech supply chains to better serve patients

- To enhance its digital offerings to help surgeons improve their skills

These AI initiatives hold tremendous promise for the company, patients, and shareholders alike. Through the use of AI and machine learning algorithms, J&J ought to be able to markedly reduce costs, improve profitability, and bring high-value products to market faster than ever. That’s an exciting value proposition, to put it mildly.

3. Medtronic

Medtronic (MDT -0.08%) has been a leader in medical device innovation since 1949. Thanks to its fruitful innovation engine, the company now stands as the world’s largest pure-play medical device company. Its enormous scale and unparalleled global reach have been a boon for shareholders. For instance, an investment of $1,000 in Medtronic’s stock in 1980 would currently be worth over $231,000.

Although its growth has slowed in recent years, the company is already employing AI in a number of ways to improve its operating efficiency, bring game-changing new products to market in record time, and fuel its drive to make personalized medicine a reality. To this end, Medtronic struck a deal with Nvidia earlier this year to accelerate the integration of AI software solutions into its cutting-edge devices, such as the GI Genius intelligent endoscopy module.

In 2021, the Food and Drug Administration cleared the device for use in the United States as the first AI-powered system capable of identifying colorectal polyps. This groundbreaking collaboration with Nvidia could further hasten the development of real-time medical solutions to reduce procedure variability and boost patient outcomes.

All told, Medtronic’s AI plans could fundamentally alter the company’s trajectory over the balance of the decade, making it a top stock to consider buying right now.

George Budwell has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Adobe and Nvidia. The Motley Fool recommends Johnson & Johnson and recommends the following options: long January 2024 $420 calls on Adobe and short January 2024 $430 calls on Adobe. The Motley Fool has a disclosure policy.