THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Most of us work toward building wealth. From investing in stocks to saving for retirement, we want to ensure that we have a comfortable financial future.

But sometimes, we are guilty of making purchases that destroy our ability to build wealth and secure our financial freedom.

In this article, we’ll explore 24 purchases that may seem harmless at first glance but have the most potential to undermine our journey toward financial success.

By being aware of these purchases, we can make decisions that will get us closer to our goals and keep us from falling into financial traps.

So, if you want to make smarter spending decisions and stay on track toward building wealth, we have you covered. Let’s dive in!

#1. Extravagant Vacations

It’s tempting to splurge on a luxurious vacation once in a while, but the cost can quickly add up and eat into our savings if you do it on a regular basis.

Instead of going for an expensive vacation, you can still take a break by opting for budget-friendly trips or even staycations. The money you save can be put towards a bigger vacation in future years, or saved for other goals.

#2. Fancy Coffee Drinks

That $5 latte may not seem like a big deal, but if we buy one every day, it adds up to about $1,800 a year.

To curb this habit, try brewing your coffee at home or limiting yourself to buying coffee as an occasional treat.

#3. Designer Clothing

While it’s nice to have new clothes and keep up with trends, designer clothing is expensive.

Instead, buy high-quality, timeless pieces that can be worn for multiple occasions and mix and match them with more affordable items. Other than you, no one knows the brand you are wearing, so you are only impressing yourself by buying these labels.

#4. Dining Out

Eating out can be convenient and enjoyable, but it’s also one of the biggest expenses that we tend to overlook. This is especially true thanks to inflation. Before, you could get lunch out for around $10. Dinner for a family of four is going to set you back at least $50, and that is by being budget-conscious.

Now you have to work hard to get a meal for this price. And it usually means skipping out on something or ordering water with your food.

Try cutting back on dining out and cooking at home more often.

Treat yourself to a nice dinner out occasionally, but make it a special occasion rather than a regular occurrence.

#5. Impulsive Buys

Do you see something and buy it before you can stop yourself? Those impulse purchases can add up quickly.

Before making a purchase, ask yourself if you really need it and if it aligns with your long-term goals then wait 24 hours before buying it. Better yet, write it down and wait a week. Odds are you forgot about it or realize you don’t really need it.

#6. Fancy Cars

Whether you like to buy new or vintage cars often, this is a major expense.

Instead of buying the latest model or luxury car, consider buying a used car or keeping your current one for longer.

You could also opt for a cheap and reliable beater car. This allows you to save tens of thousands of dollars.

#7. Luxury Homes

If owning a luxury home is your ultimate dream, you may be standing in your way when it comes to building wealth.

Remember, the bigger the house, the higher the maintenance costs, property taxes, insurance, and mortgage payments. Plus, when you do need work done, you will get quoted at a higher rate as the service techs assume you can afford to pay more because of your big house.

#8. High-End Electronics

But before swiping that credit card for the newest technology, think about your long-term goals.

Do you need the latest smartphone or TV, or does your work fine?

Waiting a few months to buy can save you hundreds, if not thousands, of dollars. And with technology always innovating, you will only have the latest and greatest for a short time before something better comes along.

#9. Life Insurance

When it comes to financial products like life insurance and annuities, be cautious of high fees and commissions that can eat up your savings over time. Make sure you understand how these products work.

Also, ask yourself if you need life insurance. Too often people buy insurance for the wrong reasons or do so thinking it is an investment product when it is really to protect you and your family.

#10. Alcohol

If you go out for drinks often, you may not realize how much money you are spending on alcohol.

With a drink costing anywhere from $5 to $20, those expenses can quickly add up, so cutting back on alcohol can help you save significantly.

#11. Gifts

It’s natural to want to give gifts and be generous with your loved ones, but it’s a good way to destroy your ability to save money.

Setting a budget for gift-giving can help you stay on track and avoid overspending. Better yet, think of things they need and see if you can turn that into a gift. Maybe they are a single parent and taking their kids to the park for a few hours could be a big help.

#12. Entertainment

Going out for movies, concerts, and other forms of entertainment can drain your wallet quicker than you think.

You can limit your entertainment budget to a certain amount each month to ensure you don’t overspend. Alternatively, look for free concerts, festivals, and fairs in your area that allow you to get out and have fun without the need to spend a lot of money.

#13. Pet Accessories

If you have a furry friend at home, you know how expensive pet accessories can be.

Your pet may not need these items as much as you think, so give them some time and attention instead of spending money on accessories. They will love it!

#14. Expensive Furniture

Do you often tire of your old furniture and replace it with new, expensive pieces?

This is a good time to think about building wealth because furniture is one of the most expensive things you can buy. Try to source furniture from other places, like yard sales, thrift shops, and Facebook Marketplace. There is no reason to pay full price when you need new furniture.

#15. Extended Warranties

When purchasing a new car, appliances, or electronics, the salesperson may try to convince you to purchase an extended warranty.

Very seldom do you ever use these warranties, and if you try to, there are all sorts of exceptions and potential fees. You are better off taking the money you would pay for a warranty and putting it into a savings account so you have the cash when you need to repair or replace the item.

#16. Penny Stocks

Penny stocks may seem like a tempting investment because of their low cost and high potential return, but they are also highly volatile and risky.

Many times, these stocks will be subject to “pump and dump” investors who hype the stock so it rises. This allows them to sell and make money. By the time you realize what is going on, they are gone, and the stock price craters.

Instead, why not invest in stable, well-established companies for long-term growth to build your wealth?

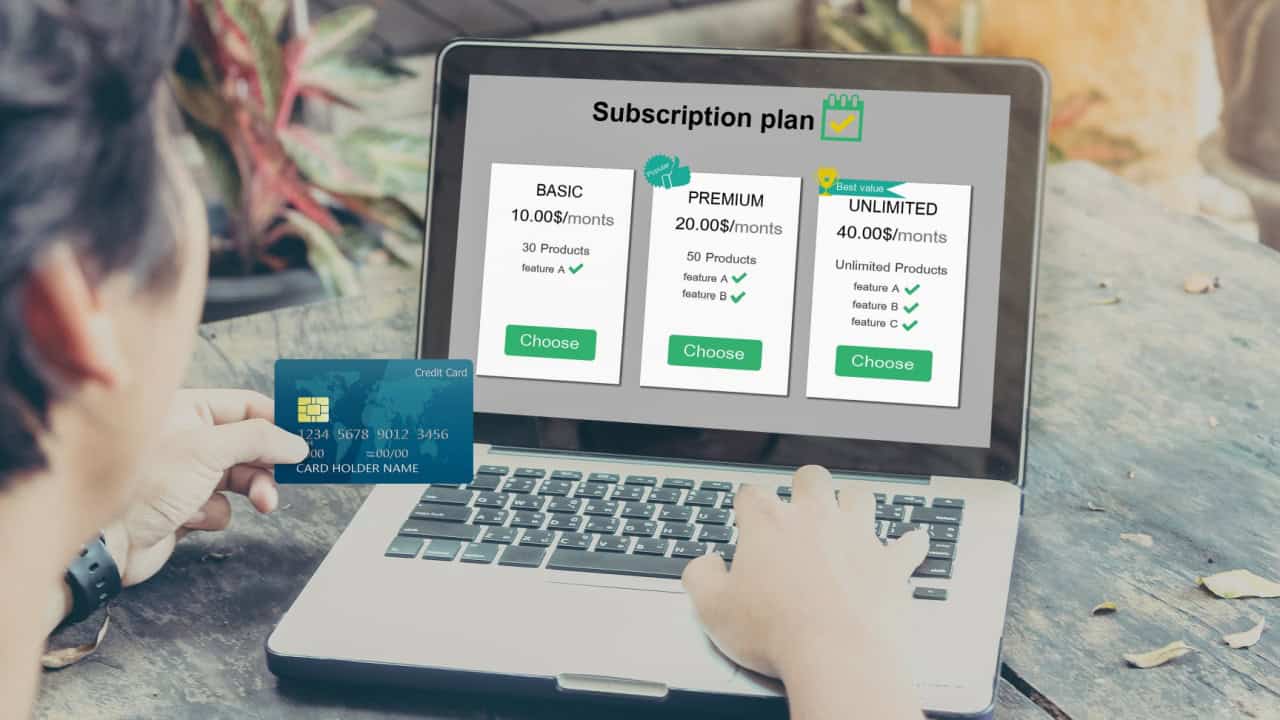

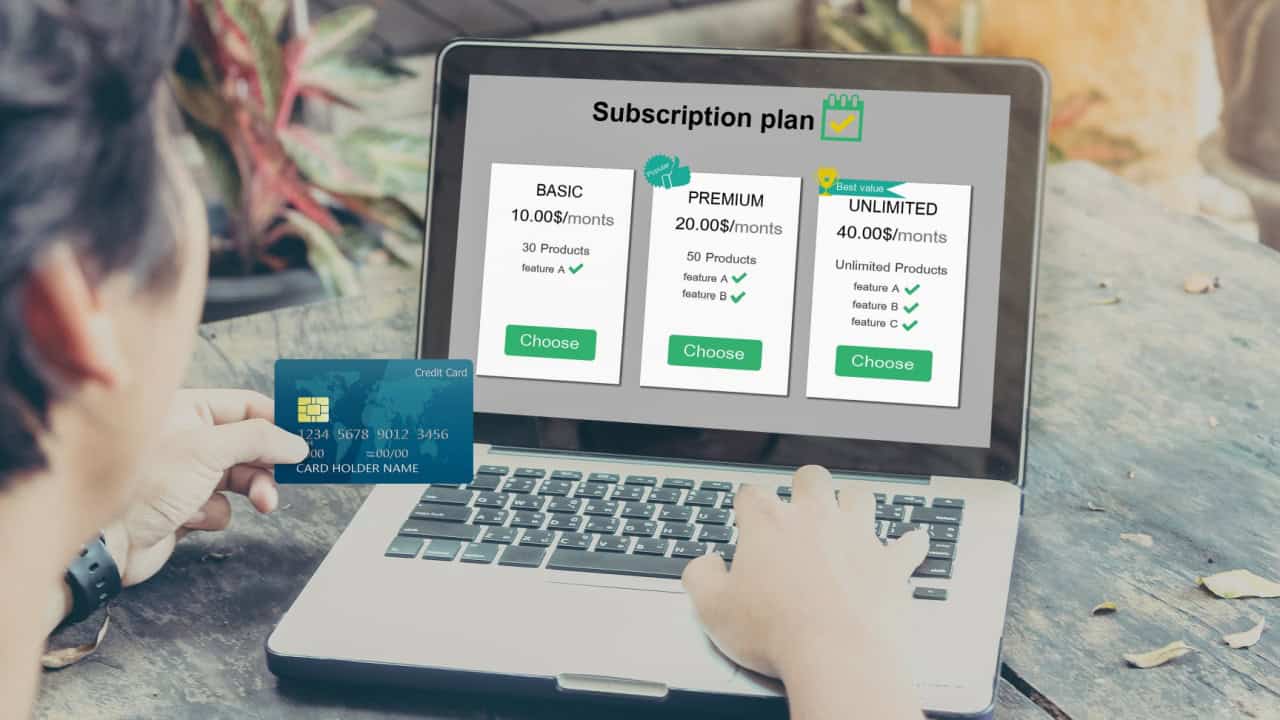

#17. Subscriptions

Do you have several steaming subscriptions, gym memberships, or other monthly services, some of which you don’t even use?

Consider canceling any unnecessary subscriptions and put that money towards building your wealth instead.

#18. High-Interest Debt

If you want to build wealth, get rid of high-interest debt if at all possible.

High-interest debt is wasted money that you can use to invest and grow your wealth instead. Use the snowball method to start digging out and follow Dave Ramsey’s baby steps to help you get back on stable ground.

#19. Jewelry

While it can be tempting to splurge on expensive jewelry, it may make you feel good temporarily, but it won’t contribute to your long-term wealth.

Think about the big picture and invest your money in assets that have the potential to appreciate over time.

#20. Lottery Tickets

The odds of winning the lottery are extremely low, and buying tickets every week can add up to a lot of money over time.

Instead of relying on luck to build your wealth, focus on making smart financial decisions and investments. If you must play, try to limit it to once or twice a year, and do it for fun, not as a potential way to become rich.

#21. Antiques

Unless you are into the antique business, investing in antiques is not a good idea because they are a high-risk venture.

The value of antiques tends to fluctuate and can be difficult to sell, making it a risky investment.

#22. Home Remodels

If you need to remodel your home, it is important to choose renovations that will have a great ROI.

Before investing in a remodel, research each project’s average return on investment to see if it is worth the cost. Then determine how long you are planning to stay in the house. If you remodel the bathroom but plan to stay another 20 years, it will most likely be outdated by the time you sell.

This isn’t to say you can never remodel your home, but you need to think about your plans and the costs.

#23. Expensive Hobbies

We all like to relax and have fun, but some hobbies can be incredibly expensive and not worth the cost in the long run.

If you have a hobby, try to find ways to make money from it to offset any costs or find ways to make it less expensive. For example, instead of joining the country club, find a local course that you can play golf at. Hit up the driving range or a Top Golf once in a while instead of playing a full round.

#24. Renting

When it comes to housing, it is important to consider the costs of renting versus buying.

While renting may seem cheaper upfront, buying a home can be a better long-term investment as you are building equity as you make your monthly payments. Of course, there are times in life when renting makes more sense, but over the long term, if you know you will be in an area, it is wise to buy a house.

Good Money Habits To Have

In order to get ahead financially, we need to develop good habits. Most people talk about bad money habits to get rid of.

Here are good money habits you need to follow if you want to take the next step financially.

17 GOOD MONEY HABITS TO DEVELOP

Steps To Building Wealth

We all want to have enough money that our finances are no longer a stress in our lives.

But with so much financial advice out there, building wealth seems impossible. Not any more. Here are the simple steps you need to take.

STEPS TO BUILD WEALTH AND BECOME RICH

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.