Despite the slowdown in the economy, there’s one area that continues to boom, and that’s non-residential construction and, specifically, manufacturing construction spending. The latter is up sharply in recent years, reaching $214 billion in 2023. I think the theme may have more room to run, and stocks like Comfort Systems USA (FIX 1.83%), Carrier (CARR 1.22%), and Germany’s Siemens (SIEGY -0.84%) are poised to benefit.

The non-residential and manufacturing construction boom

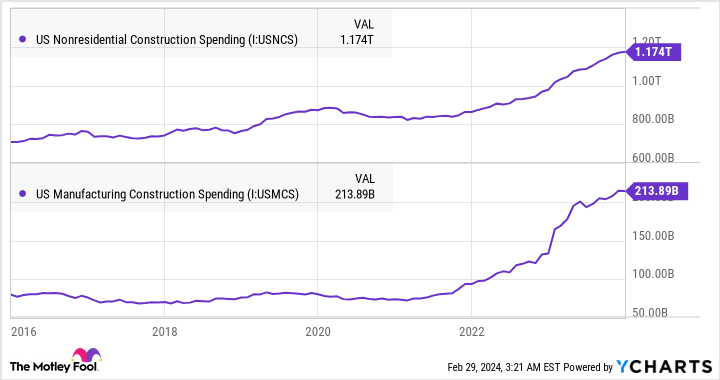

First, a few words on the spending boom. The charts below show the general upward trend in nonresidential construction that began in 2017, was slowed in 2020 by the onset of the pandemic, and then regathered pace in 2022. The big uptick in manufacturing construction spending began in 2022 and was aided by the CHIPS and Science Act signed in the summer of that year.

Even after adjusting for inflation (which pushes up the dollar figure of investment), the spending boom is highly significant, with the Treasury Department noting, “The boom is principally driven by construction for computer, electronic, and electrical manufacturing.”

US Nonresidential Construction Spending data by YCharts

While it’s always dangerous to assume a trend like this will continue, I think there are reasons for it to do so:

- The CHIPS Act and the global supply chain crisis created by lockdowns continue to encourage investment in locally sourcing supplies, and that includes strategically important technologies like semiconductors.

- Increasing geopolitical tensions have highlighted the need for investment in self-sufficiency in technology.

- Breakthroughs in industrial software and automation have made reshoring and investing in higher-labor-cost countries feasible.

Comfort Systems USA

Investing in mechanical, electrical, and plumbing contracting services company Comfort Systems USA is one way to profit from this trend. It’s no coincidence that its backlog has ballooned in recent years. In addition, note the pandemic-influenced slowdown in 2020 in concert with the charts above and then the explosion in 2022.

Chart by author. Data source: Comfort Systems USA presentations.

Comfort Systems is particularly well exposed because it generates a significant part of its sales (55% in 2023) from new construction — great news when investment is flowing into new facilities. In addition, its heavy focus on manufacturing (34% of 2023 revenue) and technology (21%) make it ideally positioned for the spending the Treasury Department highlighted.

Discussing the company’s revenue mix on the recent earnings call, CEO Brian Lane noted its revenue was trending “toward data centers, life science, food, chip fabs, and battery plants.” In other words, exactly the type of areas receiving investment. If you are worried about the commercial office buildings and residential markets in 2024, they made up just 7.7% and 3.5% of revenue last year.

While the stock may appear to be fully valued at slightly less than 27 times its estimated 2024 earnings, its backlog continues to grow with an $870 million increase from the third to the fourth quarter of 2023, driven by three separate $200 million-plus orders in the manufacturing, technology, and healthcare sectors.

As orders and backlog continue to grow, so will Comfort Systems’ revenue and profits.

Carrier

Both Carrier and Siemens are named as primary manufacturers of equipment used by Comfort Systems and other contractors in the industry. Carrier provides heating, ventilation, and air conditioning (HVAC) equipment (chillers and rooftop compressor units) and building controls.

Carrier is doubling down on its core HVAC solutions business following the sale of its Chubb fire and security business in 2022, and the recent agreement to sell its security business, Global Access Solutions, to Honeywell. Meanwhile, its acquisition of Toshiba‘s ownership stake in Toshiba Carrier Corporation (a joint venture between the two companies) and its $12 billion acquisition of Viessmann Climate Solutions (boilers and heat pumps) strengthens its position in the market. While Carrier’s residential HVAC business continues to be under pressure, its commercial HVAC business remains in growth mode, buoyed by many of the factors discussed above for Comfort Systems.

Siemens

Siemens makes building automation controls as part of its smart infrastructure segment. In its fiscal first quarter of 2024, ended Dec. 31, 2023, its smart infrastructure revenue rose 15% in America, with orders rising 4%. Those figures dragged up its overall smart infrastructure comparable orders by 1% year over year, and management expects the segment’s revenue to grow by 7% to 10% in 2024.

As previously discussed, Siemens looks undervalued compared to nearly all its peers across its businesses.

In addition to smart infrastructure, Siemens is also a major player in automation and industrial software (via its digital industries segment). While the automation sector is going through some temporary weakness caused by dealers destocking following a period of aggressive inventory building (Rockwell Automation sees similar conditions), it’s likely to prove temporary as automation looks set for long-term growth in line with investment in manufacturing capability.

Trading at less than 15 times its current free cash flow, Siemens looks like an excellent value stock.