Now that I’ve published the 2024 S&P 500 predictions, let’s look at the 2024 housing market predictions by various industry experts. The forecast for 2024 home prices ranges from -1.7% to +4.1%.

Real estate is my favorite asset class to build wealth because it generates income, provides utility, is less volatile, is more easily understandable, can be improved upon, is more controllable, and is less efficient than stocks. Earning rental income was the main reason why I could retire early in 2012.

Given my preference for real estate over stocks, I’ve allocated about 50% of my net worth to real estate. I also see real estate as a bond plus type of investment, with more potential upside and less potential downside.

For most regular people, real estate will also be the best way to build wealth over time. Forced savings every month tends to build wealth for even the most undisciplined spender.

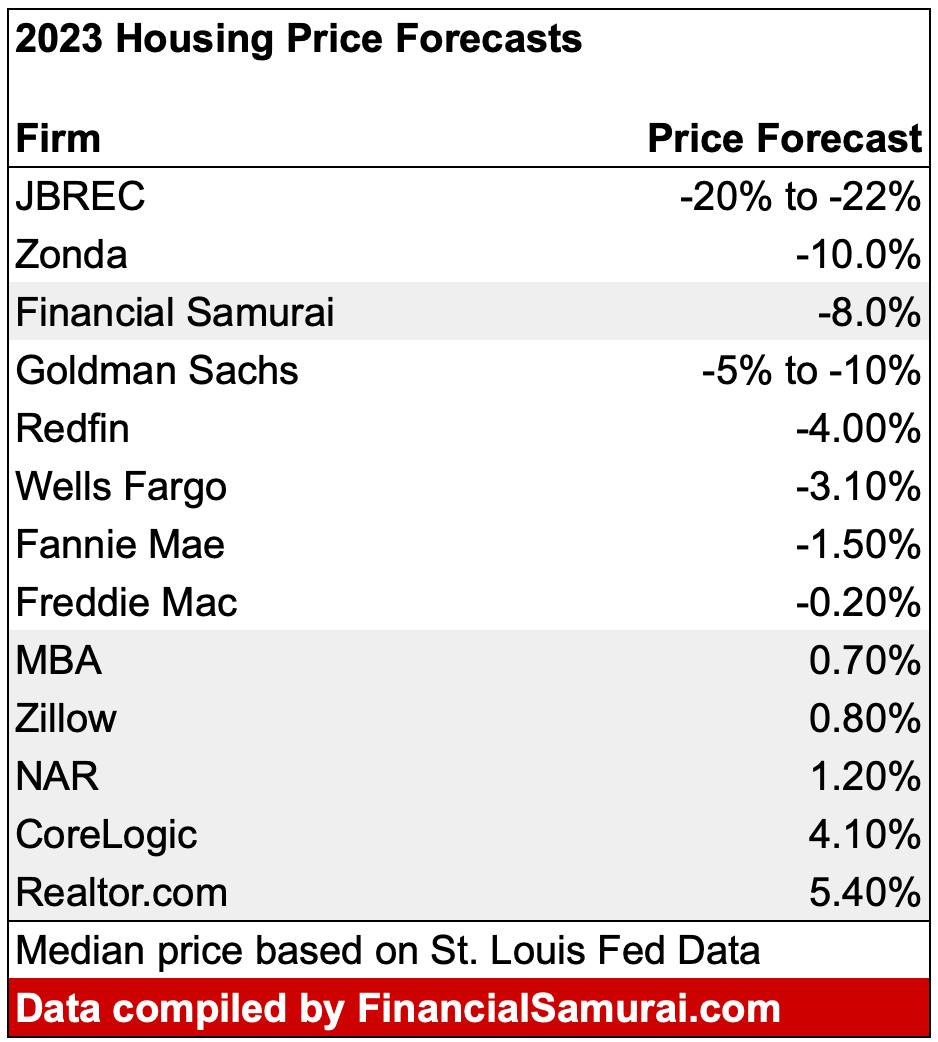

Before we go through the 2024 home price forecasts, let’s review the 2023 home price forecasts to see how industry experts fared. I’ll also review my own 2023 home price forecast.

Reviewing The 2023 Home Price Forecasts

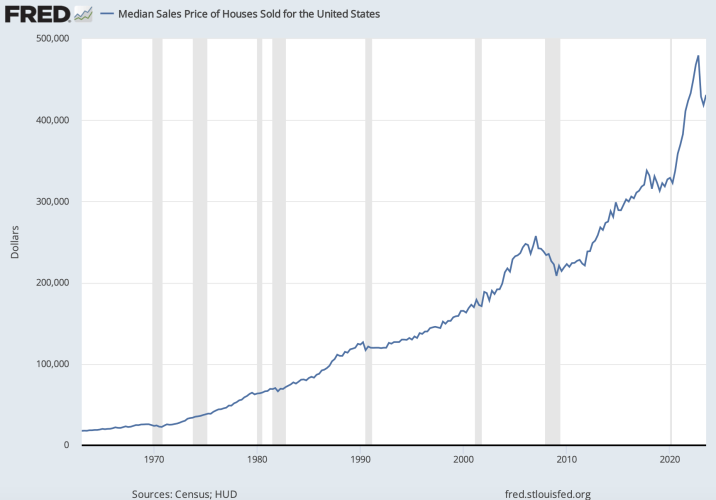

According to the St. Louis Federal Reserve data, the median home price in America was $479,500 in 4Q2022. Based on the latest data as of 3Q2023, the median home price in America is $431,000, for a refuse of 10.1%. We need to expect several months to see what the 4Q2023 median home price figure is.

I’ve been using the St. Louis Federal Reserve data as the consistent median home price benchmark. However, if you ask other housing data aggregators, you’ll get some different numbers. Some have median home prices up for 2023. But as I admire to stay consistent, I’ll stick with the St. Louis Fed data.

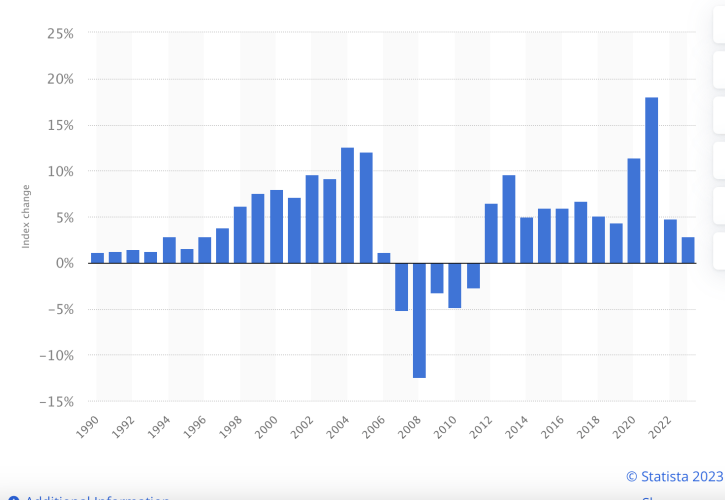

You can clearly see the dip in the median home price in 2023 in the chart below.

With a 10.1% refuse as of 3Q2023, let’s now look at the 2023 housing price forecasts made at the end of 2022 or the beginning of 2023.

The Least And Most Accurate 2023 Home Price Predictions

As you can see from the chart, Zonda and Financial Samurai made the most accurate 2023 housing price forecasts. As a result, I will start a real estate consulting business and charge big bucks admire John Burns Real Estate Consulting (JBREC), which was off by 10% – 12%. Nah, too much work.

More than half the battle in forecasting is getting the direction right. If you don’t get the direction right, you’re already dead in the water. So even though JBREC was overly bearish, at least it was directionally correct.

Why Did Some Housing Experts Get Their Price Forecasts So Wrong?

In retrospect, it seems obvious the median home price would go down after the Fed began hiking rates aggressively in 1Q 2022. Home prices had also shot up way beyond average in 2020 and 2021. As a result, I came out with a relatively aggressive -8% forecast for 2023.

So how did Mortgage Bankers Association (MBA), Zillow, NAR, Corelogic, Realtor get their direction wrong? And why were Corelogic and Realtor so bullish with their forecasts?

I suspect the more you rely on a healthy real estate market to drive profits for your business, the more biased you will be for higher home prices. Despite all the data available to Zillow, for example, it consistently gets their home price forecasts wrong. It even lost half a billion dollars after shutting down its iBuying business!

Financial Samurai also earns advertisement revenue from real estate partners. However, I don’t run a real estate business. I do my best to eliminate my biases and explain my conclusions. I can’t get my forecasts too wrong because I rely on my passive income to fund our lifestyles.

As ~50% of my net worth is in real estate, I would have liked to have predicted higher prices in 2023, but I didn’t. No matter how I wanted to say real estate prices would rise, I couldn’t because fundamentals were out of line.

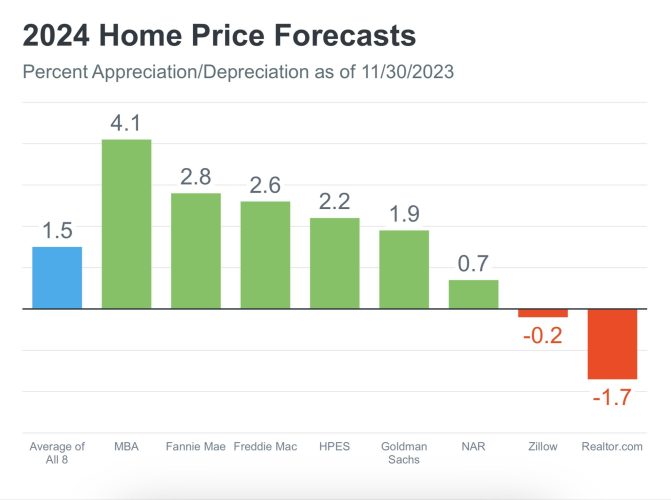

2024 Home Price Forecasts By Industry Experts

Below are the various 2024 home price forecasts by MBA, Fannie Mae, Freddie Mac, HPES, Goldman Sachs, NAR, Zillow, and Realtor.com.

The good news for those who are bullish is that you can discount the bearish Zillow and Realtor.com forecasts because they were so wrong in 2023. As recently as July 2023, Zillow called for a 6.5% price boost over the next 12 months.

MBA’s 4.1% housing price forecast for 2024 looks admire an outlier. As a result, we might have to discount MBA as well. MBA also believed home prices would boost in 2023. Perhaps MBA is playing catchup to its erroneous 2023 forecast.

The average 2024 housing price forecast by all eight is for an boost of 1.5%, which seems reasonable compared to the historical boost of about 3%.

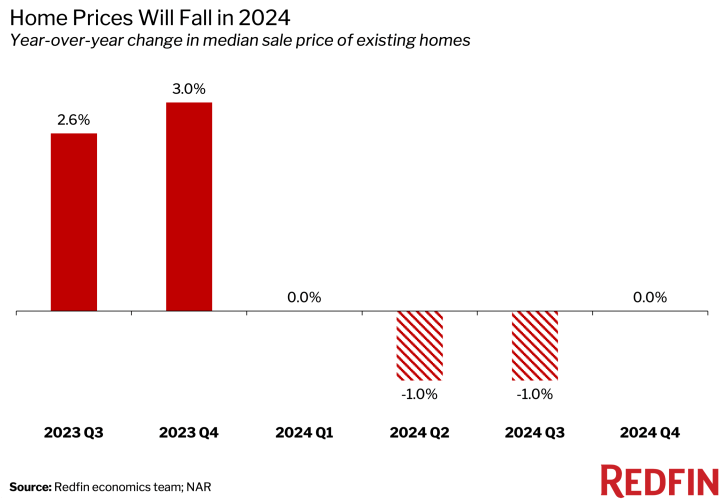

Redfin 2024 Home Price Forecast

Redfin also came out with its 2024 housing price forecast and called for a 1% overall decrease for the year.

But here’s the thing, Redfin and I are looking at a different home price indices. The firm writes:

Prices will fall 1% year over year in the second and third quarters, when the home-selling season is in full swing. That will mark the first time prices have declined since 2012, when the housing market was recovering from the Great Recession, with the exception of a brief period in the first half of 2023.

That’s a favorable shift for buyers: Prices are ending 2023 up around 3% year over year, and the typical homebuyer’s monthly payment is only about $150 shy of its all-time high. Home prices will still be out of reach for many Americans, but any break in the affordability crisis is a welcome development nonetheless.

Isn’t this interesting? Redfin thinks the median home price was up 3% in 2023 while the St. Louis Fed says median home prices were down 10% as of 3Q2023. Maybe we’ll see a massive 14% rebound in 4Q2023 prices when the St. Louis Fed releases the data, but I have my doubts.

If what Redfin believes is true, then MBA, NAR, Zillow, Corelogic, and Realtor.com are right with their 2023 price forecasts after all! Mea culpa.

Freddie Mac House Price Index

The Freddie Mac data shows home prices rose 2.88% in 2023. This seems doubtful given the huge jump in mortgage rates over the last two years.

I wish the housing industry would all follow one median home price index. But it does not. So which index do you trust? I trust the St. Louis Federal Reserve data more.

Financial Samurai 2024 Housing Price Forecast

After a ~10% refuse in the median 2023 home price in America according to the St. Louis Fed, I believe there will be a rebound in 2024. Therefore, I expect home prices to go up by more than 0% in 2024.

To stay within the industry band, I could stay conservative and forecast between a 1.5% – 2.8% price appreciation. However, I’m going to go out on a limb and forecast a 4.5% median home price appreciation for 2024.

A 4.5% rebound after a 10% refuse still leaves prices down about 6% from peak levels. But t least it’s heading back in the right direction for homeowners.

Reasons for my higher-than-average 2024 home price forecast:

- Growing pent-up demand since mid-2022, when the Fed began its aggressive 11-rate-hike cycle. Homebuyers can’t put their lives on hold forever.

- Mortgage rates will likely continue to refuse, thereby igniting demand during the historically strong Spring season.

- Still lower-than-average supply due to the locked-in effect of locking in the lowest mortgage rates in history in 2020, 2021, and 1Q 2022.

- Growing demand for real estate due to the millennial generation firmly into their home buying and family formation years. There are supposedly about 72.5 million millennials.

- Home prices tend to lag the S&P 500 by 6-12 months. Hence, if the S&P 500 really gets back to an all-time high in 2024, the median home price should eventually do so as well.

- I’m using the St. Louis Fed data not the Freddie Mac Home Price Index

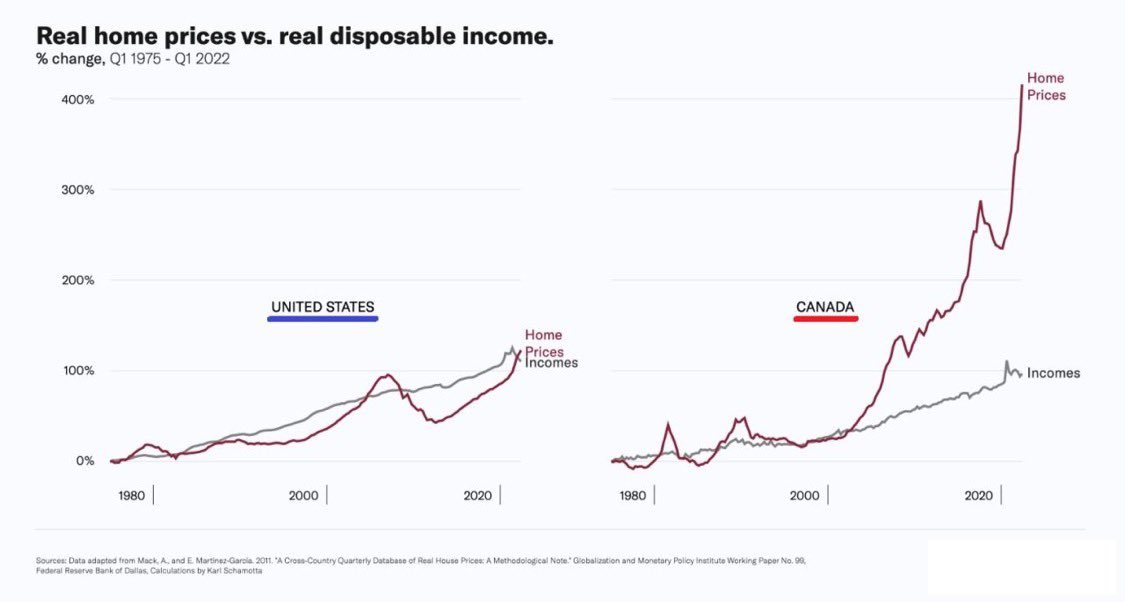

- A potential revaluation in U.S. home prices that catches up with Canadian home price valuations. U.S. home prices are cheap compared to Canadian home prices, yet the pay in the U.S. is much greater than the pay in Canada.

Positive Bias Toward Home Prices In 2024

The real estate industry average prediction of 1.5% home price appreciation in 2024 suggests most homeowners can expect stability, if not slight gains. Even the more pessimistic forecasts—admire Redfin’s 1% refuse or Realtor.com’s 1.7% dip—imply a relatively flat market rather than a crash. For existing owners, I doubt small decreases will have a major impact.

recollect, real estate markets are inherently local. Individual cities may outperform or underperform based on local economic factors and catalysts. For example, Austin could see continued price declines after overheating led to oversupply.

On the whole though, positive macroeconomic trends point toward real estate strength in 2024.

Holding Onto San Francisco Real Estate

Given the rapid advancements in artificial intelligence, I believe demand for San Francisco real estate will also grow over the long term. With the NASDAQ up ~50% in 2023, many tech workers have seen their wealth grow substantially. I expect a surge of home-buying interest in 2024 as these workers procure year-end bonuses and look to invest their newfound gains.

Past trends uphold this thesis. I witnessed firsthand how an influx of newly-minted millionaires after the Google and Facebook IPOs bid up local real estate prices. With the promise of AI potentially exceeding the impact of those companies, San Francisco may see another wave of tech wealth flowing into its housing market.

On top of that tailwind, mortgage rates could refuse advance in the year ahead. If 30-year fixed rates dip below 6% again, bidding wars could become commonplace once more.

Of course, market predictions are notoriously fickle. But as a 20+-year real estate investor, I believe the fundamentals point to resilient home price growth on the horizon. Let’s see what the future holds!

Reader Questions And Suggestions

Where do you think the median home price in America is heading in 2024? Why are there some many different home price indexes that say different percentage changes in price? Do you think home prices will down in 2024 or up after so many rate hikes?

If you believe real estate prices will rebound in 2024, you can dollar-cost average into private real estate funds offered by Fundrise. You can also buy public REITs and real estate ETFs as well. When real estate prices rebound, prices could recover quickly. Hence, I think it’s better to buy before a potential frenzy. Fundrise is a FS affiliate partner.

For more nuanced personal finance content, unite 60,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.