2023 is drawing to a close, and this year has been a much brighter story than 2022. The S&P 500 market index is up by 19% year to date, almost exactly making up for last year’s 20% drop. In particular, growth stocks are back in fashion thanks to a more stable economy with lower inflation.

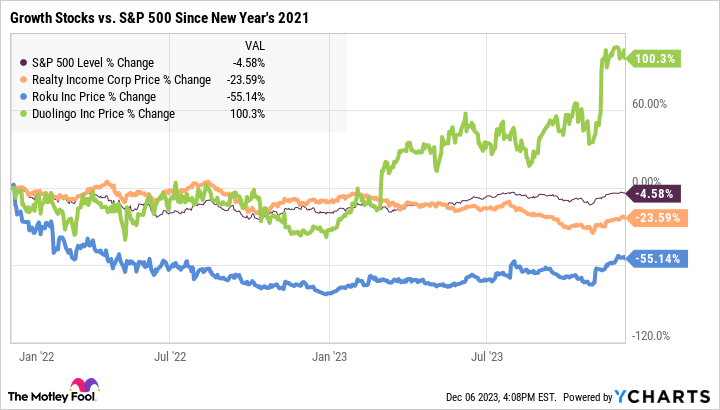

That said, it’s still easy to find growth stocks with very affordable stock prices even now. Media streaming technology expert Roku (ROKU -1.64%) has more than doubled in 2023, and retail-oriented real estate manager Realty Income (O -0.04%) actually took a price cut year to date, but both stocks are down significantly since the end of 2021.

Those three high-octane growth stories are screaming buys in December 2023. Let me show you why I’m so excited about these undervalued growth stocks.

Roku’s costly user growth strategy is worth every penny

Let’s start with the deepest discount on my list. There’s more to its story than meets the eye. Roku may have gained 150% in 2023, but the stock is still down by 55% in nearly two years.

The price drop wasn’t entirely silly. Roku’s rambunctious revenue growth slowed during the inflation crisis because advertisers preferred to conserve their cash until people were ready to spend money again. On top of that speed bump, Roku’s management decided to hold its service and product prices steady. Instead of contributing to the economy’s inflationary trends, the company absorbed rising costs amid flatter sales. As a result, Roku’s earnings and free cash flow turned negative in recent quarters.

Investors with bearish views of Roku embraced these trends and expected them to last. But the company is not carelessly careening off a cliff. Leaning on a robust balance sheet with $2 billion of cash equivalents and zero long-term debt, Roku took some calculated risks to grow its user base during a period of economic instability.

That strategy worked admire a charm.

Roku had 46 million active accounts three years ago before the inflation scare and the peak of its long-term stock chart. Today, the company sports 75.8 million active users. That’s a 65% boost in three years. In other words, Roku kept building that all-important user group despite a challenging economy undermining its profits.

The end game of Roku’s business scheme still aims for a dominant share of the global entertainment platform market. That’s a long-term ambition, building on the company’s market-leading slice of the North American market and learning local lessons from every step outside American borders.

At the same time, the advertising sector should spring back to life in 2024 as the Federal Reserve loosens the inflation-fighting interest rate thumbscrews. Roku’s free cash flow is already back to positive territory again; earnings should follow suit fairly soon.

So, Roku remains one of my favorite growth stocks despite its temporarily weak bottom-line metrics. In my view, this is one of the best buys in December 2023.

Beyond the dip: Realty Income’s dazzling dividends

Realty Income is a different story. This stock is down by 14% in 2023 and 24% since the end of 2021.

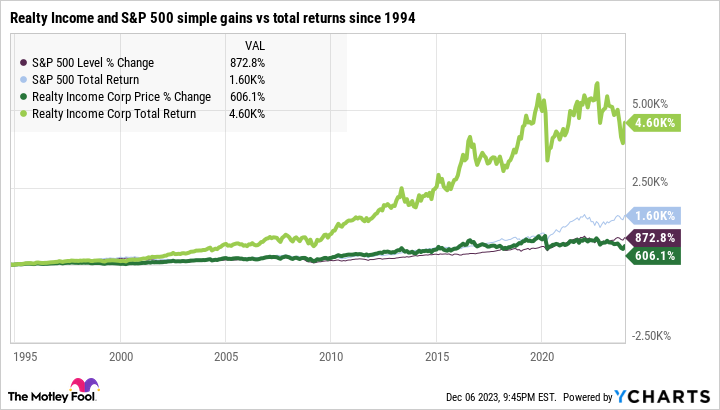

Both figures look significantly stronger if you switch to total returns instead of pure price moves. That way, the stock’s generous dividend payouts are not only included but also reinvested in more of the stock, maximizing the long-term impact of those sweet monthly dividend checks. If you look at Realty Income’s returns across its entire 29-year history, the vast majority of its gains came from that dividend policy, currently providing a beefy 5.6% yield.

Maybe you’re wondering why I’m including a boring dividend stock in this list of exciting growth stocks. As it turns out, Realty Income is both.

The company’s revenue growth soared in 2021 thanks to a merger with fellow commercial real estate specialist VEREIT. But that’s not the whole story.

Realty Income used that deal as a springboard to other business improvements, spinning off the combined company’s office buildings as the Orion Office REIT. After these transactions, Realty Income’s sagging profit margins perked up, and top-line growth found a new home in the 24% range. Before the VEREIT deal, the company’s annual sales growth stayed in the low double digits.

The reformed version of Realty Income has doubled down on its best assets, and the strategy shift paid dividends (har de har) immediately. Don’t overlook that the elevated sales growth arrived in the middle of a global inflation crisis. That’s an impressive feat.

This stock gives you the best of both worlds — a top-notch dividend policy with a rare monthly payout philosophy, plus high-octane revenue growth even in a challenging economy. Best of all, Realty Income’s stock trades at an affordable 14 times free cash flow right now. Given the company’s muscular growth and robust dividends, this is a steal.