The artificial intelligence (AI) and accelerated computing bull market continues to build a head of steam. Investors can’t get enough of leaders like Nvidia (NASDAQ: NVDA) that are crafting next-generation computing systems.

But for some investors, the price tags on stocks like Nvidia may have gotten too high to stomach. That’s OK. There are some far smaller AI-related businesses trading at relatively attractive valuations that might suit long-term investors. Two such small AI stocks worth a look at right now are Axcelis Technologies (ACLS 3.19%) and Silicon Motion (SIMO 1.99%).

1. Axcelis: New AI chips need efficient power and new manufacturing techniques

Axcelis Technologies is a small semiconductor manufacturing equipment provider that competes primarily with industry giant Applied Materials. Its specialty is ion implant machines, which are used to introduce non-silicon material into chips to alter and enhance the electrical conductivity properties of the devices ultimately being made.

The electric vehicle (EV) industry provided a strong tailwind for Axcelis’ revenue and profit growth in the last few years, but Axcelis is experiencing what management believes will be a temporary growth pause in 2024 as EV adoption moderates. It is guiding for sales of equipment to decline in the first half of the year before rallying in the second half.

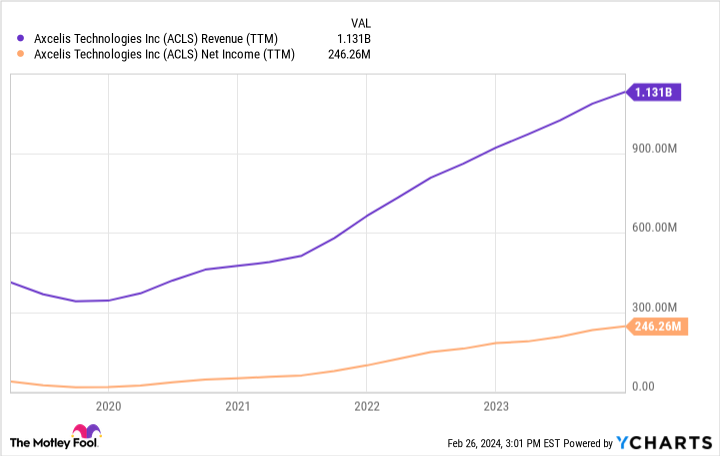

Data by YCharts.

However, the company is developing new use cases for its ion implant machines, including in the manufacture of the advanced logic chips used in applications like AI. Axcelis thinks that market will propel it to higher growth rates for years to come. Management is targeting about $1.3 billion in sales in 2025, up by a mid-teens percentage from its top line in 2023.

Shares are well below the high-water mark they touched last year, and are starting to look like a serious value. For a company with $506 million in cash and equivalents on its books, no debt, and ample growth outlets, a 1-year-forward price-to-earnings ratio of just 13 looks like a good buy to me. I recently started buying shares of Axcelis after watching the company from the sidelines for a couple of years.

2. Silicon Motion: AI needs new memory technology, too

Silicon Motion (SIMO 1.99%) designs memory controllers — a type of chip that governs the flow of data into and out of memory in devices like PCs and smartphones. It’s the market leader in that niche, but the small semiconductor company has ample competition, including from some of its customers.

You see, leading memory chip manufacturers like Micron Technology and Samsung also design some of their own memory controllers in an attempt to control costs.

However, Silicon Motion’s edge is designing high-performance offerings, and because of that, device manufacturers and their memory chip suppliers tend to select Silicon Motion’s wares over prepackaged memory controllers that may lack the extra oomph needed.

The strategy has resulted in a business that generates lumpy results. But as PC and smartphone makers gear up to provide support for on-device AI in the years ahead, high-performance controllers could be in high demand. Silicon Motion has been rebuilding its momentum after a two-year slump in the PC and smartphone industry. To be sure, PC and smartphone sales appear to be stabilizing, but a true growth cycle hasn’t been unleashed just yet. However, management expects Silicon Motion’s growth to outpace the growth of the consumer electronics market in 2024 with 20% to 25% revenue expansion.

What drew my attention to Silicon Motion a while back was that it (much like Axcelis) is a small business with adequate cash reserves ($314 million to be exact, and no debt) and an attractive valuation. Shares trade at a 1-year-forward price-to-earnings ratio of less than 15.

Because both of these small businesses have big competitors, there’s a risk of them getting steamrolled. Such is life for the typical small-cap stock. However, in a new era of AI-powered computing, these two value stocks look worthy of inclusion in my portfolio of about two dozen small businesses with potentially big upsides. Time will tell, but strong lineups of products and key tech that will contribute to the AI computing revolution bode well for Axcelis Technologies and Silicon Motion.

Nick Rossolillo and his clients have positions in Applied Materials, Axcelis Technologies, Micron Technology, Nvidia, and Silicon Motion Technology. The Motley Fool has positions in and recommends Applied Materials and Nvidia. The Motley Fool has a disclosure policy.