One famous investing maxim advises to buy low and sell high. That’s sage advice, but not all stocks are worth investing in while they are down. If they don’t go up, you won’t have profited from the advice.

Take, for instance, Aurora Cannabis (ACB 5.48%), a leader in the Canadian pot market, and Biogen (BIIB 0.07%), a notable biotech. Both have grabbed plenty of headlines in recent years, both have failed to keep pace with the market in 2023, and neither seems to have strong prospects.

Aurora Cannabis

Aurora Cannabis has consistently been one of the most talked-about stocks in the Canadian pot market since recreational adult use became legal some five years ago. However, the marijuana grower has also been a disappointment, with inconsistent revenue growth, persistent net losses, failure to partner with a larger company, and financial issues related to share dilution.

Aurora Cannabis looks to be turning the corner, at least on the surface. The company’s latest quarterly update in early November, for the second quarter of its fiscal year 2024, was pretty good. Revenue of 63.4 million Canadian dollars increased by 30.5% year over year. Adjusted gross earnings before interest, taxes, depreciation, and amortization (EBITDA) of CA$3.4 million was vastly better than negative EBITDA of CA$6.1 million reported in the year-ago period.

But these results had nothing to do with the Canadian recreational marijuana market, which remains deadweight on its revenue growth. Instead, Aurora’s top line grew due to its medical cannabis business, which operates in Canada and several countries abroad, including the U.K., Australia, and Germany. Now for the million-dollar question: Can Aurora Cannabis maintain this momentum? On the one hand, management promised to be free-cash-flow-positive for the first time in calendar year 2024.

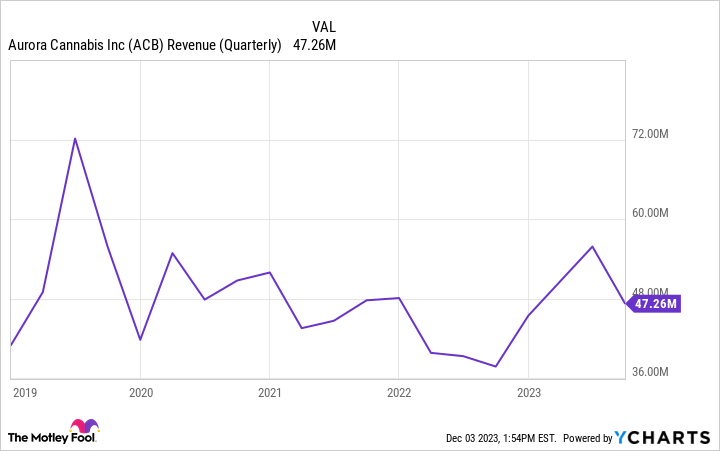

On the other hand, Aurora’s revenue has fluctuated too much over the past few years for investors to trust that it will remain northbound for good this time.

ACB Revenue (Quarterly) data by YCharts

Even if it does, and that’s a big if, Aurora Cannabis remains unprofitable. Adjusted EBITDA profitability is merely a step in the direction of profits. advance, the company will continue facing all the struggles it has encountered in the Canadian market, and competition abroad should heat up, too.

None of that would be a deal-breaker for a well-established and consistently profitable corporation, but that doesn’t describe Aurora Cannabis. Given its track record, the company would have to do a lot to get back into investors’ good graces. In my view, even positive free cash flow next year wouldn’t do it. That’s why it’s best to stay a safe distance away from Aurora Cannabis for a while.

2. Biogen

In the past three years, Biogen has launched not one but two Alzheimer’s disease (AD) therapies. That is a significant achievement that generated plenty of buzz because scores of potential AD treatments have failed to make it to this stage. Biogen’s feat — accomplished in collaboration with Japan-based Esai — is nothing to sneeze at.

However, there are serious issues with the company. First, Biogen’s Aduhelm, the first of these AD treatments to get the backing of the U.S. Food and Drug Administration (FDA), flopped because of lingering concerns surrounding its efficacy. Many physicians decided not to prescribe it. Biogen’s second AD treatment, Leqembi, which got the nod from the FDA in July, won’t have that problem.

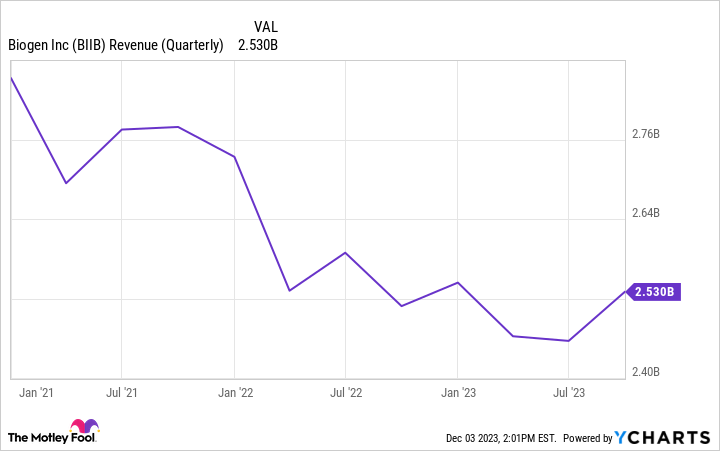

Still, some issues remain with the company, even with Leqembi in its lineup. For one, this new AD therapy will be a weight on its bottom line this year as commercialization expenses will exceed revenue. Meanwhile, Biogen’s financial results have been subpar at best over the past couple of years as some of its older medicines encountered generic competition.

BIIB Revenue (Quarterly) data by YCharts

The biotech turned to an acquisition to offset all these issues. In late September, it completed the buyout of Reata Pharmaceuticals for $7.3 billion in cash. With that, Biogen now owns a therapy for Friedreich’s ataxia called Skyclarys, which earned the green light from the FDA in February. Friedreich’s ataxia is a rare genetic progressive disease that causes damage to patients’ nervous systems and leads to a range of symptoms, including coordination and movement problems.

Skyclarys, the first FDA-approved treatment for Friedreich’s ataxia, could produce as much as $1.5 billion in annual sales by 2030, according to some analysts. However, it only has a target market of roughly 4,500 patients in the U.S. advance, the acquisition of Reata Pharmaceuticals won’t positively contribute to Biogen’s bottom line until 2025.

There are many moving parts and some substantial uncertainty regarding Biogen’s prospects. While the biotech could turn things around for good, that could take a while. In the meantime, the drugmaker will have to show solid and consistent financial results along with clinical and regulatory progress. For now, it is best to stay on the sidelines. There are much better biotech stocks to buy.