Enthusiasm for the potential of artificial intelligence (AI) has helped push many companies, including Nvidia and Microsoft, to new valuation highs, and there’s a very good chance that this potentially incredible new tech trend will power even more gains for these tech titans. But not all AI-related stocks hit new highs in 2023 and there are still some leading AI players that trade at huge discounts compared to their previous peaks.

If you’re looking to add AI stocks with explosive potential to your portfolio, read on to see why two Motley Fool contributors think you should invest in these top companies while they’re stock prices are still down more than 50% from their respective highs.

Palantir is the leading provider of AI services to corporations and institutions

Parkev Tatevosian: Palantir Technologies (PLTR 2.96%), one of the leading firms providing enterprise solutions using AI, has seen its share price fall 57% off the highs reached in 2021. The drop might be an opportunity for long-term investors to add shares of this excellent growth stock at attractive valuations.

Palantir’s revenue has more than tripled from 2018 levels of $595 million to $1.9 billion in 2022. The company is expected to show continued revenue expansion when it reports its full-year numbers for 2023. Moreover, given the elevated demand for AI solutions, Palantir’s growth should continue for several more years.

Even better, Palantir managed to control costs while sales increased. Operating profitability, which measures the difference between revenue and operating expenses, increased from a loss of $141 million in the quarter that ended in June 2021 to a profit of $40 million in the quarter that ended in September 2023.

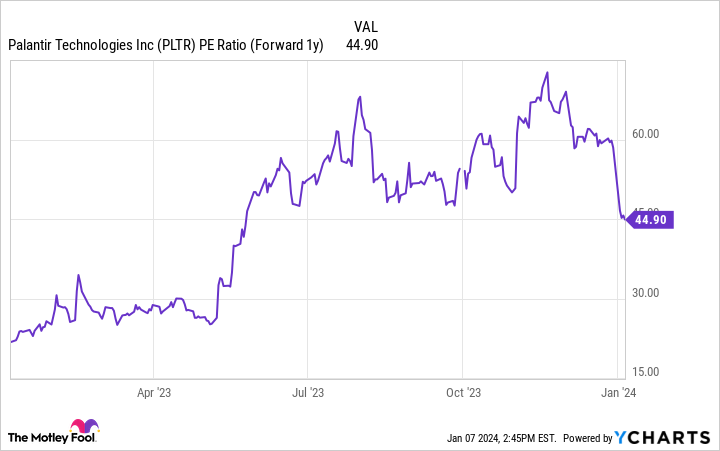

PLTR PE Ratio (Forward 1y) data by YCharts

Palantir’s stock price sell-off and the growth in its profits have it trading at an attractive forward price-to-earnings ratio of 45. Investors might want to buy this excellent AI stock at a reasonable valuation while the option remains open. It would not surprise me if this stock were to get expensive in a hurry to start 2024.

Snowflake will play a foundational role in the rise of AI

Keith Noonan: As the management team at Snowflake (SNOW 0.14%) is fond of saying, “There’s no AI strategy without a data strategy.” Data is the fuel that powers and improves artificial intelligence algorithms. The ability to access and analyze the widest possible breadth of valuable information is central to being competitive in tech — and AI in particular.

Snowflake’s Data Cloud platform makes it possible to combine and analyze information generated from otherwise walled-off cloud services. Within its Data Cloud, Snowflake also offers the ability to build, run, and scale applications natively on the platform. For certain data-intensive apps, being built directly on a platform that already contains combined data from different cloud platforms can offer significant advantages.

Instead of using the subscription-based model that has become the norm for most cloud software companies, Snowflake generates the vast majority of its revenue from a consumption-based setup. This sets up a dynamic where the company grows alongside its customers, and the data specialist is poised to benefit as its clients continue to create and use AI apps.

Notably, Snowflake is still just starting to benefit from long-term AI tailwinds — and it’s already posting explosive growth. Product revenue grew 34% year over year to reach $698 million in the third quarter of the company’s 2024 fiscal year, a period that ended Oct. 31. Meanwhile, non-GAAP (adjusted) free cash flow jumped 70% year over year to hit $111 million.

Looking ahead, the company expects that product revenue will rise from roughly $2.65 billion in the 2024 fiscal year that ends this month to $10 billion in fiscal 2029. Management also anticipates significant expansion for margins across the stretch.

With huge growth opportunities ahead and the stock still down 51% from its high, Snowflake stands out as a smart buy for investors who are looking for ways to profit from the rise of AI.

Keith Noonan has no position in any of the stocks mentioned. Parkev Tatevosian, CFA has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft, Nvidia, Palantir Technologies, and Snowflake. The Motley Fool has a disclosure policy.