The stock market is one of the greatest wealth-building tools in the world, but the short-term volatility can be a lot for some investors to stomach. Luckily, dividend stocks provide investors with income, regardless of stock price performance. It’s a way to encourage investors to be patient and focus on the long term.

Tech stocks get a lot of attention because of their stock price growth potential, but many also provide dividends. The following two companies can be good choices for investors looking for tech stocks that can provide reliable income. They each play important roles in their respective industries and are well-positioned to be long-term income sources for investors.

1. AT&T

AT&T (T 1.27%) has been a pain in many investors’ portfolios over the past decade. The stock is down more than 30% in that span, but it’s experienced 20% gains in the past six months, giving investors a glimmer of hope for a turnaround.

Many of AT&T’s recent woes stemmed from its attempt to enter the media and entertainment business, but the company has taken steps to trim its business and refocus on its core telecom businesses.

In the first quarter of 2022, AT&T spun off WarnerMedia business and cut its dividend in half, yet it remains one of the highest-yielding dividend stocks in the S&P 500. Its trailing-12-month dividend yield is more than 6.3%, almost 5 times the S&P 500’s average.

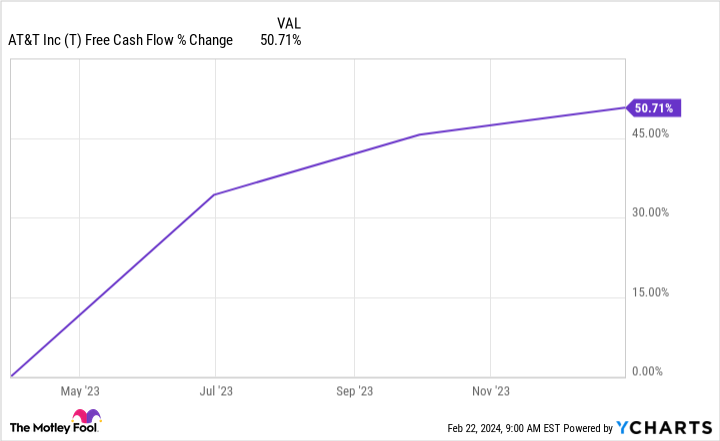

Investors (rightfully) had concerns about the stability of AT&T’s dividend because of the company’s high debt, but recent financial performance should put those concerns to rest. In 2023, AT&T made $16.8 billion in free cash flow, which was more than enough to cover its dividend and debt obligations, and $2.6 billion more than it made in 2022.

T Free Cash Flow data by YCharts

AT&T’s business refocus seems to be paying off, adding 1.7 million 5G wireless postpaid and 1.1 million fiber customers in 2023. The company also knocked net debt down by more than $3 billion in that span, giving it more financial flexibility.

With the company seemingly headed in the right direction, investors can feel comfortable that AT&T can be a reliable income stock for their portfolio. A dividend increase may not be in the works in the near future, but a cut to the dividend doesn’t seem to be, either.

2. Taiwan Semiconductor Manufacturing Company

Taiwan Semiconductor Manufacturing (TSM 0.36%) (TSMC) is one of the more unique tech companies in the world. It produces semiconductor chips using a foundry model where it manufactures chips specifically for other companies’ needs instead of for general sales. Companies can’t go online or to a store to buy TSMC chips, but they can say, “We’re building ABC and need chips for XYZ,” and TSMC can (typically) make it happen.

The foundry model has worked well for TSMC, and many other semiconductor companies have copied it in hopes of achieving similar success, but none compare to the quality of TSMC’s chips. It’s why TSMC is the go-to for world-class companies like Apple, Nvidia, and dozens of others.

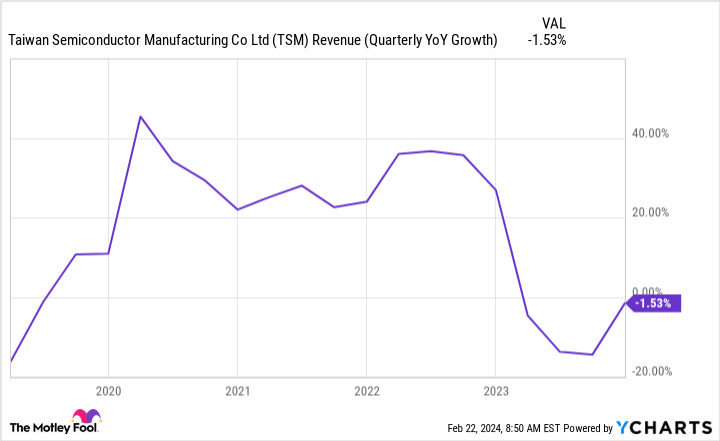

Semiconductors for smartphones account for a lot of TSMC’s revenue (43% in the fourth quarter of 2023), so a recent slump in that market has weighed on its financials a bit, but that shouldn’t be a long-term problem investors have to worry about. The worst of that cyclical slump seems to be in the past, according to the International Data Corporation mobile phone tracker.

TSM Revenue (Quarterly YoY Growth) data by YCharts

TSMC’s chips are vital to the tech ecosystem, cementing the company’s long-term place in the industry. For income-seeking investors, that’s one of the best attributes you could hope for.

TSMC’s dividend yield is just over 1.5%, which isn’t as notable as AT&T’s but also not too shabby, given the company’s stock price growth to go along with it. It can be a true 2-for-1 benefit for investors.

Stefon Walters has positions in Apple. The Motley Fool has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.