The stock market can be nerve-wracking at times, especially in the volatile tech sector. Wall Street may be in the midst of a fresh bull market, but there’s still a lot of turbulence to deal with. But there’s a handy shortcut available if you’re looking for investments with the business-growth promise of exciting tech stocks and the long-term stability of a blue-chip business titan.

The trick is to look for solid dividends. Even in Silicon Valley, a generous dividend suggests robust cash profits and a relatively calm stock chart. By virtue of pure mathematics, dividend yields fall when stock prices are skyrocketing, so a strong payout leads you away from overly expensive stocks. On the flip side of the same equation, you’re not looking for extremely high yields which typically spring from deep share price dives.

And on that note, I see a couple of top-quality tech stocks with dividends in the Goldilocks zone — just right for starting a low-risk tech investment right now. Let me show you why International Business Machines (IBM 0.82%) and Intel (INTC 0.02%) tick all the right boxes for dividend investors in February 2024.

1. IBM: 3.6% dividend yield

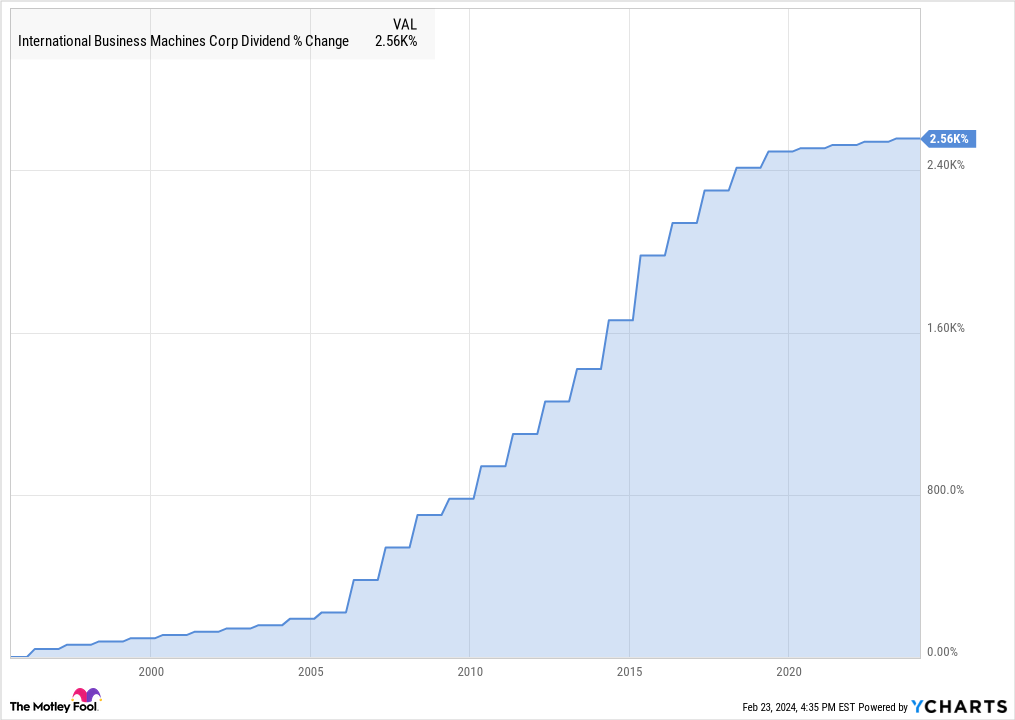

Big Blue invariably comes to mind whenever I think about a solid commitment to dividend payouts. IBM’s unbroken streak of annual dividend increases started with a 40% boost in January of 1996. The split-adjusted quarterly payouts have increased from $0.063 to $1.66 per share, which works out to a 28-year gain of 2,560%:

IBM Dividend data by YCharts

The dividend boosts have been modest since the start of the coronavirus pandemic, but those symbolic increases never stopped. Even better, the dividend checks were always directly funded by free cash flows, with the cash-based payout ratio topping out at 85% in the inflation crisis of 2022.

Even, even better, Big Blue is finally reaping the rewards of a strategy shift that started more than a decade ago. The IBM you see today has reshaped its business model with a laser-like focus on high-growth markets such as data security, cloud computing, and artificial intelligence (AI).

Yeah, you heard me. IBM has not-so-quietly built a world-class business around its Watson AI platform. The company was a little late to the AI boom since it takes its enterprise-class clients a while to run new solutions through testing and management approvals, but the financial benefits have started to trickle in.

So IBM gives you generous, cash-backed dividends alongside a highly promising future of high-margin AI services. Not too shabby, right? And the only clue needed to arrive at this incredible investment today was that juicy but still affordable 3.6% dividend yield.

2. Intel: 1.2% dividend yield

Let’s shift gears without leaving the neighborhood. Intel’s semiconductor fortunes have been intertwined with IBM’s software and systems since the beginning of time (in terms of the fast-moving tech sector, anyway).

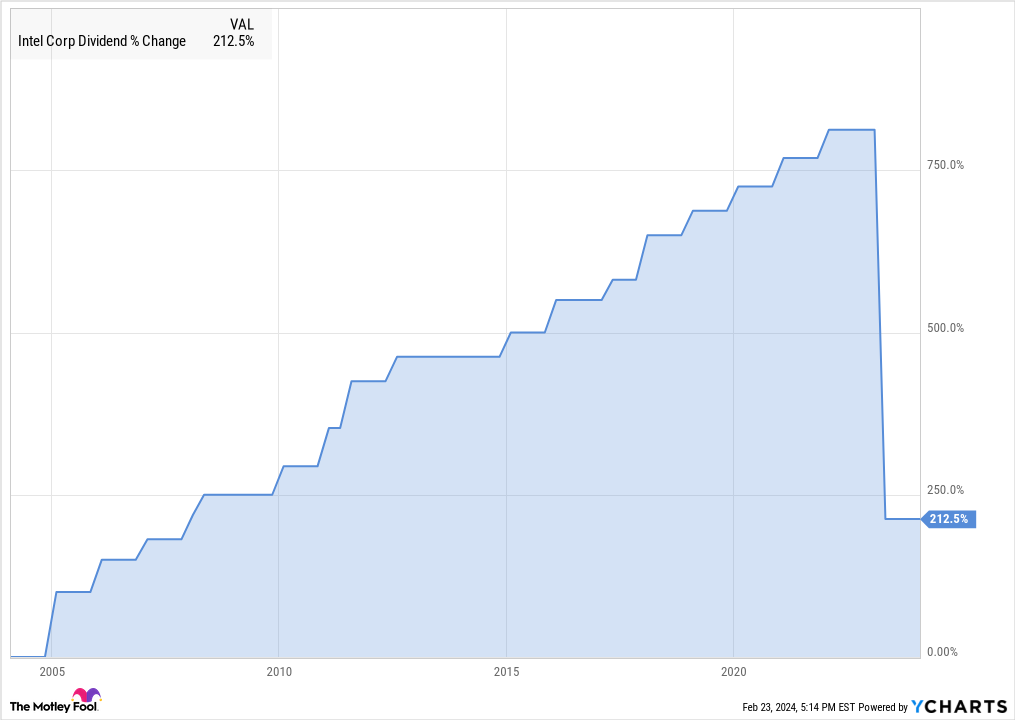

Intel’s dividend chart is less pristine, but for good reason. You see, the tech titan is pulling every available lever to expand its chip-making capacity, building and boosting manufacturing facilities around the world. This effort involved a steep dividend cut in 2023, rising debt balances, and accepting a few quarters of negative cash flows.

INTC Dividend data by YCharts

In return, Intel now runs one of the world’s largest semiconductor manufacturing services for other chip designers. That’s a sharp strategy shift, taking advantage of the Biden administration’s CHIPS Act and a long-running global shortage of chip-building capacity.

Today, Intel’s stock gives you a different kind of hardware giant whose negative cash flows should spring back from the red-ink bath over the next couple of years. Playing an infrastructure role in this AI-driven era of high demand for memory chips and number-crunching processors could be a genius move in the long run, to the point where it almost looks like Intel’s management saw the AI frenzy coming from a mile away. The timing is just too perfect.

Oh, and Intel’s dividend yield peaked just below 6% before the payout cuts. That’s uncomfortably high, especially when the company needs extra cash for business-building purposes. The current yield of 1.1% is on the low side of that just-right zone but still respectable enough. And again, this reasonable yield is a good starting point for a deeper stock analysis.

Anders Bylund has positions in Intel and International Business Machines. The Motley Fool recommends Intel and International Business Machines and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.