sanjeri/E+ via Getty Images

Investment Thesis

In today’s article, I will explain the reasons for having added Johnson & Johnson (NYSE:JNJ) and Main Street Capital (NYSE:MAIN) to The Dividend Income Accelerator Portfolio.

Both companies pay an attractive Dividend Yield (while Johnson & Johnson’s Dividend Yield [FWD] is 3.02%, Main Street Capital’s is 6.98%), and have an attractive Valuation. Johnson & Johnson has a P/E [FWD] Ratio of 22.60, which is 9.55% below the Sector Median. Main Street Capital’s P/E [FWD] Ratio currently stands at 9.39. Additionally, I believe that their growth prospects are intact (Johnson & Johnson’s EBIT Growth Rate [YoY] is 8.34% while Main Street Capital’s is 47.44%).

Incorporating Johnson & Johnson and Main Street Capital has elevated the Weighted Average Dividend Yield [TTM] of The Dividend Income Accelerator Portfolio to 3.84%. In addition to that, it can be highlighted that we have managed to decrease the portfolio’s volatility and its risk level. This is underscored by the fact that both Johnson & Johnson (24M Beta Factor of 0.30) and Main Street Capital (24M Beta Factor of 0.77) have a 24M Beta Factor below 1.

Initially, I had planned to add a company each week for the amount of $100 to The Dividend Income Accelerator Portfolio, totaling an investment of $400 per month. However, for added flexibility, from now on I will individually decide how to distribute the amount of $400 per month, while still maintaining our initial goal of investing $400 per month. For example, instead of adding four companies for the amount of $100 each month, I could buy two companies for the amount of $150 each and two for the amount of $50 each (totaling $400).

This approach provides us with more flexibility to set the desired proportion each company has on the overall investment portfolio.

With the acquisition of Johnson & Johnson and Main Street Capital, we have accomplished our goal of investing $400 during the month of October. The previous acquisitions for The Dividend Income Accelerator Portfolio for the month of October were AT&T (NYSE:NYSE:T), and Mastercard (NYSE:MA).

The Dividend Income Accelerator Portfolio

The Dividend Income Accelerator Portfolio’s objective is the generation of income via dividend payments, and to annually raise this sum. In addition to that, its goal is to attain an appealing Total Return when investing with a reduced risk level over the long-term.

The Dividend Income Accelerator Portfolio’s reduced risk level will be reached due to the portfolio’s broad diversification over sectors and industries and the inclusion of companies with a low Beta Factor.

Below you can find the characteristics of The Dividend Income Accelerator Portfolio:

- Attractive Weighted Average Dividend Yield [TTM]

- Attractive Weighted Average Dividend Growth Rate [CAGR] 5 Year

- Relatively low Volatility

- Relatively low Risk-Level

- Attractive expected reward in the form of the expected compound annual rate of return

- Diversification over asset classes

- Diversification over sectors

- Diversification over industries

- Diversification over countries

- Buy-and-Hold suitability

Johnson & Johnson

Founded in 1886, Johnson & Johnson is an Aaa rated company (rating from Moody’s) from the Pharmaceuticals Industry.

I am convinced that Johnson & Johnson possesses substantial competitive advantages to distinguish itself from the competition over the long term.

Among Johnson & Johnson’s significant competitive advantages are its enormous financial health (EBIT Margin [TTM] of 27.61% and Return on Equity [TTM] of 18.69%), its broad and diversified product portfolio, its strong brand image (as according to Brand Finance, Johnson & Johnson is currently 153rd in the list of the most valuable brands in the world), global presence, and its continuous spending in Research & Development. In 2022, Johnson & Johnson’s spending in Research & Development was $14.6B.

Its significant competitive advantages make the company an excellent choice for long-term investors that are looking for a company to generate extra income via dividends and to reduce portfolio volatility, thus making it an excellent pick for The Dividend Income Accelerator Portfolio.

In my opinion, Johnson & Johnson is one of the best defense plays to help you reduce the downside risk of your investment portfolio. This thesis is underscored by the company’s 60M Beta Factor of 0.57 and its 24M Beta Factor of 0.30, which both indicate that with the inclusion of Johnson & Johnson into your investment portfolio, you can reduce its downside risk.

Since the beginning of the year, Johnson & Johnson has shown a performance of -14.32%. The graphic below shows the company’s performance within this time period.

Source: Seeking Alpha

Johnson & Johnson’s Valuation

At the moment of writing, Johnson & Johnson has a P/E [FWD] Ratio of 22.60, which is 9.55% below the Sector Median of 24.99. This indicates that Johnson & Johnson is currently undervalued. This is further confirmed when having a look at the company’s Dividend Yield [TTM] of 2.95%, which lies 12.59% above its Average Dividend Yield [TTM] from the past 5 years (which is 2.62%).

Another indicator that this is currently an excellent moment to include Johnson & Johnson into your portfolio is the company’s Price/Cash Flow [FWD] Ratio of 13.93 which is 15.42% below its average from the past 5 years.

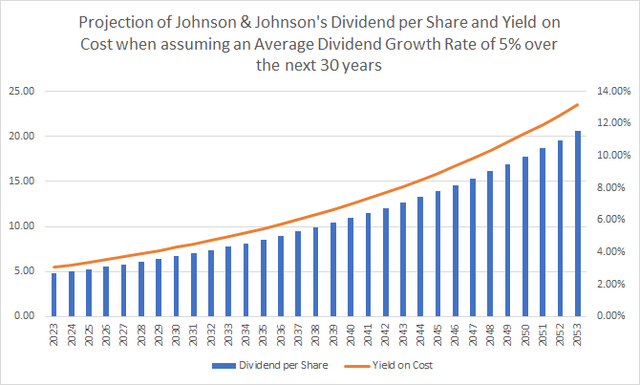

Johnson & Johnson’s Dividend and Dividend Growth and the Projection of its Yield on Cost

Today, Johnson & Johnson pays a Dividend Yield [TTM] of 2.95% and a Dividend Yield [FWD] of 3.02%. The company’s Payout Ratio stands at 44.12% while it has shown a Dividend Growth Rate [CAGR] of 6.21% over the past 10 years.

The combination of a relatively low Payout Ratio, an attractive Dividend Yield [FWD] of 3.02% and a Dividend Growth Rate [CAGR] of 6.21% over the past 10 years, makes Johnson & Johnson the perfect choice to be included in The Dividend Income Accelerator Portfolio as the company strongly aligns with its investment approach.

Assuming an Average Dividend Growth Rate [CAGR] of 5% for the following 30 years would imply that investors could expect a Yield on Cost of 4.97% by 2033, 8.10% by 2043, and 13.19% by 2053, raising my confidence that Johnson & Johnson is a great choice for dividend income investors.

Source: The Author

Below you can find the link to an excellent analysis about Johnson & Johnson that has been published by Seeking Alpha Analyst Dividend Sensei, and which has raised my confidence to add the company to The Dividend Income Accelerator Portfolio:

Johnson & Johnson: A Conservative High-Yield Dividend Aristocrat Buy

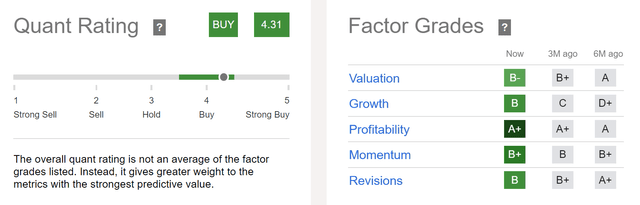

Main Street Capital

Founded in 2007, Main Street Capital operates as a business development company. As of today, Main Street Capital has a Market Capitalization of $3.27B and pays a Dividend Yield [FWD] of 6.98%.

Both the Seeking Alpha Quant Rating and the Seeking Alpha Factor Grades emphasize the company’s appeal to investors.

According to the Seeking Alpha Quant Rating, Main Street Capital is rated with a buy. Taking into account the Seeking Alpha Factor Grades, Main Street Capital is rated with an A+ for Profitability, a B+ for Momentum, a B for Growth and Revisions, and a B- for Valuation.

Source: Seeking Alpha

Main Street Capital’s Valuation

In regards to Main Street Capital’s Valuation, I believe it is presently fairly priced. My opinion is underscored by the fact that its P/E [FWD] Ratio of 9.39 is only slightly above the Sector Median of 9.31.

In addition to that, it can be stated that the company’s current Dividend Yield [TTM] of 6.72% is slightly above its average from the past 5 years (which is 6.60%), once again supporting my theory that the company is fairly valued.

Main Street Capital’s Growth Prospects

Different growth metrics strengthen my belief that Main Street Capital’s growth prospects are intact. This theory is underlined by the company’s Revenue Growth Rate [FWD] of 19.91%, which is significantly above the Sector Median of 5.39%. This is further confirmed by its EPS Diluted Growth Rate [FWD] of 13.48%, which is also significantly above the Sector Median (-0.62%).

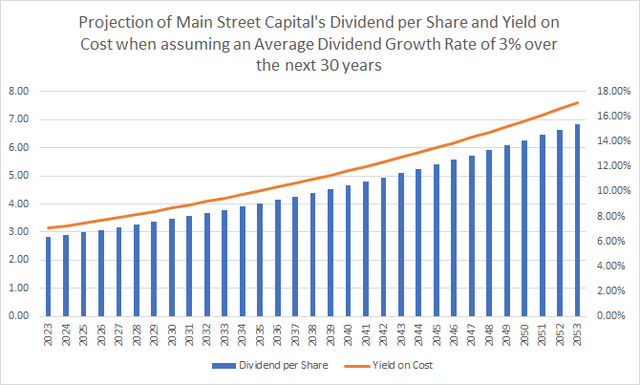

Main Street Capital’s Dividend and Dividend Growth and the Projection of its Yield on Cost

With a Payout Ratio of 68.25%, I consider the company’s Dividend to be relatively safe. Main Street Capital has shown a Dividend Growth Rate [CAGR] of 3.51% over the past 5 years. If Main Street Capital were to achieve a 3% annual increase in its Dividend for the following 30 years, investors could reach a Yield on Cost of 9.47% by 2033, 12.73% by 2043, and 17.11% by 2053.

Source: The Author

Assuming the above Dividend Growth Rate of 3% for Main Street Capital, it is worth noting that investors could recoup their initial investment in the form of dividends by 2034 (while not including withholding taxes in this calculations).

The graphic underscores Main Street Capital’s enormous attractiveness for dividend income investors, making the company an excellent choice to be incorporated into The Dividend Income Accelerator Portfolio.

Why Johnson & Johnson & Main Street Capital align with the investment approach of The Dividend Income Accelerator Portfolio

- Both Johnson & Johnson and Main Street Capital have an attractive Dividend Yield (3.02% and 6.98%), and combined they contribute to raising the Weighted Average Dividend Yield [TTM] of The Dividend Income Accelerator Portfolio.

- Both companies have further shown significant Dividend Growth (Johnson & Johnson and Main Street Capital have shown a Dividend Growth Rate [CAGR] of 5.92% and 3.51% respectively over the past 5 years). This suggests that the dividend should be raised within the coming years.

- Johnson & Johnson and Main Street Capital combine dividend income and dividend growth, making them a perfect choice for The Dividend Income Accelerator Portfolio, since they align strongly with its investment approach.

- Both companies are financially healthy, once again aligning with the investment approach of The Dividend Income Accelerator Portfolio.

- Both Johnson & Johnson (24M Beta Factor of 0.30) and Main Street Capital (24M Beta Factor of 0.77) have a 24M Beta Factor below 1, indicating that they can help us to reduce portfolio volatility, thus aligning closely with the investment approach of The Dividend Income Accelerator Portfolio to offer investors a lower level of risk.

- In addition, it can be highlighted that both Johnson & Johnson (Payout Ratio of 44.12%) and Main Street Capital (Payout Ratio of 68.25%) have a relatively low Payout Ratio, indicating that they should be able to pay investors a sustainable dividend, fulfilling another objective of The Dividend Income Accelerator Portfolio.

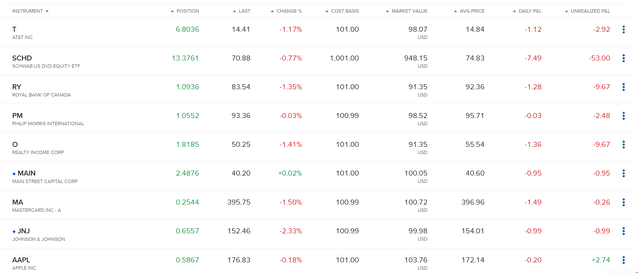

Investor Benefits of The Dividend Income Accelerator Portfolio after Investing $100 in Johnson & Johnson and $100 in Main Street Capital

After the incorporation of Johnson & Johnson and Main Street Capital into The Dividend Income Accelerator Portfolio, we have raised the portfolio’s Weighted Average Dividend Yield [TTM] from 3.70% to 3.84%. The Weighted Average Dividend Growth Rate [CAGR] of the portfolio over the past 5 years however, has been decreased from 10.73% to 10.05%. Furthermore, we have decreased its volatility and risk level, which is underlined by the fact that both companies have a 24M Beta Factor below 1.

Here you can find the current composition of The Dividend Income Accelerator Portfolio after the incorporation of Johnson & Johnson and Main Street Capital.

Source: Interactive Brokers

Conclusion

Both Johnson & Johnson and Main Street Capital stand out due to their attractive Dividend Yield [FWD] (3.02% and 6.98% respectively), their appealing Valuation (P/E [FWD] Ratio of 22.60 and 9.39), and their growth prospects (EBIT Growth [YoY] of 8.34% and 47.44%).

I am convinced that both Johnson & Johnson and Main Street Capital will be excellent acquisitions for The Dividend Income Accelerator Portfolio. With their inclusion, we have not only raised the portfolio’s Weighted Average Dividend Yield, but also decreased its volatility and risk level. The reduced risk level helps us to reach attractive investment results with greater likelihood while staying committed to our long-term investment focus.

After the incorporation of Johnson & Johnson and Main Street Capital into The Dividend Income Accelerator Portfolio, the Weighted Average Dividend Yield [TTM] stands at 3.84%.

The Dividend Income Accelerator Portfolio offers investors a broad range of benefits: dividend income and dividend growth, in combination with a low risk-level while striving to reach an attractive Total Return.

I firmly believe that this portfolio has the potential to deliver outstanding results across various market conditions while providing you with a stable and predictable dividend income in order to help you cover your monthly expenses.

Author’s Note: Thank you for reading! I would appreciate hearing your opinion on my selection of Johnson & Johnson and Main Street Capital as the eighth and ninth acquisitions for The Dividend Income Accelerator Portfolio. I also appreciate any thoughts about The Dividend Income Accelerator Portfolio or any suggestion of companies that would fit into the portfolio’s investment approach!