The artificial intelligence (AI) industry exploded last year, with hype over the technology unlikely to dissipate anytime soon.

According to Grand View Research, the AI market hit $197 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 37% through 2030. Projections see the sector surpassing $1 trillion before the end of the decade, suggesting there’s no better time to invest in AI.

Companies across tech have restructured their businesses to prioritize the AI market’s development, creating countless ways to back the high-growth sector.

Here are two AI stocks that could go parabolic.

1. Microsoft

Microsoft (MSFT 0.46%) has emerged as one of the biggest players in AI over the last couple of years. The company was an early investor in the industry, sinking $1 billion into ChatGPT developer OpenAI in 2019. Microsoft has since increased that investment to achieve a 49% stake in the start-up, granting Microsoft exclusive access to some of the most advanced AI models in the market.

Since the start of 2023, Microsoft has used OpenAI’s technology to bring upgrades across its product lineup. Elements of ChatGPT have been integrated into the tech giant’s search engine Bing, a range of new AI tools have been added to its cloud platform Azure, and its various Office services now offer improved productivity with the help of AI.

It’s still early days for Microsoft’s journey into AI, but the company’s quarterly earnings suggest its investment is paying off. In the first quarter of 2024 (ending September 2023), Microsoft posted 13% year-over-year revenue growth, beating Wall Street estimates by nearly $2 billion.

Significant gains came from the company’s cloud and productivity segments (both hyperfocused on AI development), which saw revenue rise 19% and 13%, respectively.

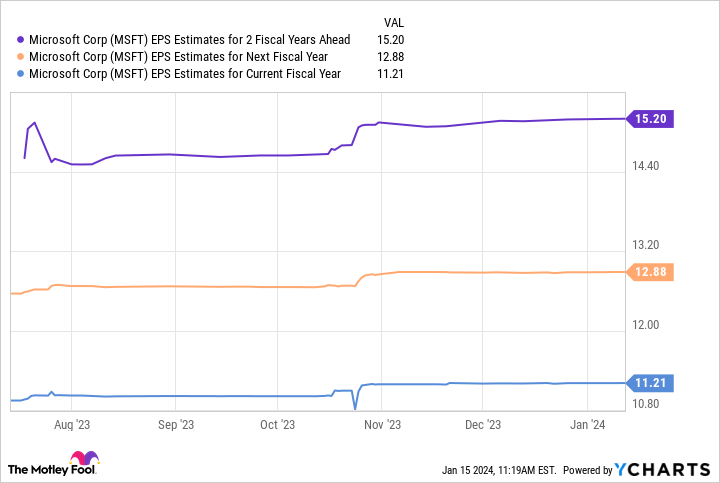

Data by YCharts

This chart shows Microsoft’s earnings could reach $15 per share over the next two fiscal years. Multiplying that figure by its forward price-to-earnings ratio (P/E) of 35 yields a stock price of $525, projecting growth of 35% over the next two years.

The company’s potential means it’s absolutely worth investing in its stock. However, it’s also worth noting that Microsoft’s shares have risen at a CAGR of about 56% since 2019, indicating that could be a conservative estimate. Given its powerful position in AI, this company is a no-brainer right now.

2. Intel

Chip stocks have soared alongside AI growth over the last year as graphics processing units (GPUs) are crucial to training and running AI models. While Nvidia has taken much of the spotlight, chipmakers just getting started in AI could be better investments with more room to run, and Intel (INTC -0.13%) is a compelling option.

Intel has had a rocky few years. After a long period of dominating the chip market, the company seemed to grow complacent, leaving it vulnerable to competition. Intel’s market share in central processing units (CPUs) plunged from 82% in 2017 to 61% in 2023 as Advanced Micro Devices snapped up a significant share.

Then, in 2020, Intel lost one of its biggest customers when Apple ended a partnership between the tech companies in favor of in-house-developed chips.

As a result, Intel’s stock is down 3% in the last five years. However, recent headwinds are exactly why Intel’s stock could surge. Increased competition appears to have Intel highly motivated to regain what it lost.

The company ventured into the desktop GPU market for the first time last year, diversifying its business with a larger role in PC gaming. Meanwhile, it is gearing up to launch a range of new AI chips that could threaten Nvidia’s dominance over the long term.

With the AI market’s projected CAGR of 37%, Intel shouldn’t need to overtake Nvidia to still see major gains from its AI products. The company could be in for a massive boost in earnings over the next decade.

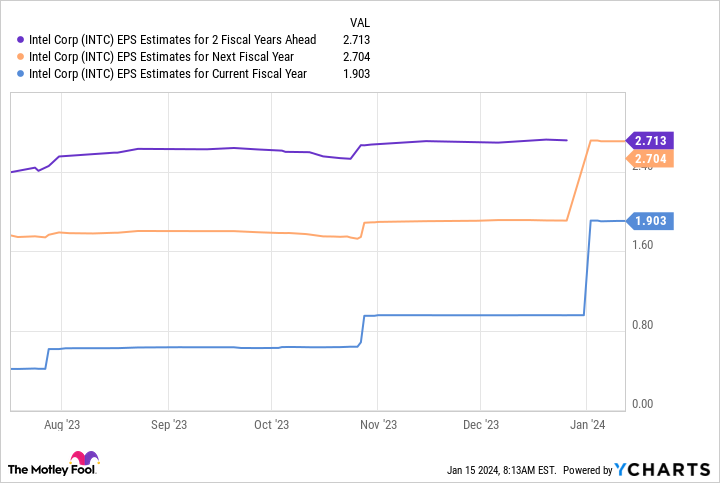

Data by YCharts

Moreover, this chart shows Intel’s earnings could hit nearly $3 per share by fiscal 2025. Using a calculation similar to Microsoft, that figure, multiplied by its forward P/E of 25, implies a potential stock price of $67. If projections are correct, its shares could grow by 43% over the next two fiscal years.

Intel’s projected growth is considerably higher than the S&P 500‘s CAGR of about 17% since 2019. As a result, this stock is a screaming buy for anyone looking to invest in AI.

Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.