THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Building wealth isn’t just about luck or inheritance.

It’s about developing smart and effective habits that can steadily grow your financial health.

Whether you’re just starting or looking to boost your savings, these habits can make a significant difference.

But not all habits are created equally.

Here are 16 habits that have the biggest impact on building wealth for the long term.

While you won’t become wealthy overnight, you will build a solid foundation that you will enjoy for many years to come.

1. Setting Clear Financial Goals

Setting clear financial goals is a key step to building wealth.

First, think about your long-term goals like retirement or buying a house. What kind of nest egg do you want to have?

Break down these big goals into smaller, more manageable targets. For instance, decide how much money you’d like to save each year.

You can also create short-term goals like paying off debt or building an emergency fund. Achieving small goals will motivate you to keep progressing.

Next, try to set realistic deadlines. It helps to be specific with numbers and dates. For example, aim to save $200 each month towards a vacation.

Finally, it is important to review your goals regularly. As life happens, your goals can change too.

By reviewing your goals, you make sure you are working towards a financial life you actually want.

2. Creating and Sticking to a Budget

Creating a budget is the first step to managing your money wisely.

You can choose to create a budget using pen and paper, an Excel spreadsheet, or an app. Each one has its pros and cons, so you will have to decide which type works best for your situation.

You also need to decide the budget method you will follow. The most popular ones are a great place to start, so look into zero-based budgets, the 50/30/20 rule, and the envelope method.

Once you have a budget and follow it for a few months, you can begin to tweak it to fit your needs.

For example, you might choose the 50/30/20 rule and then decide that the 60/30/10 version works better for you.

The goal is to create a budget you can follow that doesn’t feel like a chore. It should align with your long-term goals.

3. Living Below Your Means

Living below your means is a key habit for building wealth. This means spending less than you earn each month. For example, if you earn $4,000 but spend $3,500, you are living within your means and saving $500. This makes it easier to save money and invest.

One way to control expenses is by avoiding lifestyle creep. Lifestyle creep occurs when your spending increases as your income goes up. Instead, aim to keep your expenses stable, even if you earn more money.

Another issue that many people face is impulse buying. Impulse purchases can add up quickly and negatively affect your budget. Try to make a shopping list and stick to it. This helps you avoid buying items you don’t need and keeps your spending under control.

4. Developing Multiple Streams of Income

Relying on just one source of income can be risky. If you lose your job, you have no income coming in. Sure you can apply for unemployment or find another job, but there is no guarantee your new income source will start immediately.

To build wealth and reduce risk, you should look for ways to create multiple income streams. This can increase your financial security and help you earn more money over time.

In addition to your full-time job, there are many things you can do to earn more money.

Buying stocks can provide you with capital gains. If your stocks grow in value, you can sell them for a profit and boost your cash flow. If you invest in dividend-paying stocks, you earn an income every time the company pays out its dividend, which is usually quarterly.

Rental income from real estate is another option. By owning property and renting it out, you can earn passive income every month.

Another great option is starting your own business. Maybe you do freelance graphic design or run a business flipping items you find at yard sales.

Finally, there are side hustles. These can range from walking dogs to assembling furniture, and everything in between. The key is picking something you enjoy doing that also people need. When you do this, you can make a good amount of money doing something that doesn’t feel like work.

5. Saving Consistently

Building wealth starts with consistent saving. You need to make saving a regular habit. Set aside a portion of your income every month. Even small amounts can grow over time.

This is where too many people get caught up. They think that saving $10 a month is pointless. While that amount won’t allow you to retire in a couple of years, the more important thing is you are building a habit.

So when you increase your income and have more money every month that isn’t being used to pay bills, you can easily save more.

When it comes to where to save, consider using a high-yield savings account to earn more interest on your money. You might even consider opening multiple savings accounts, one for each of your savings goals.

6. Investing Early and Regularly

Starting to invest early can have a huge impact on your financial future. When you start young, you give your money more time to grow through compound interest.

Even if you begin with a small amount, the potential growth over time can be substantial.

Remember, time is your best ally in building wealth. The sooner you start to invest, the less you need to invest each month.

Start with your 401k plan at work and then open a Roth IRA. Once you have these open and are actively investing, open up an individual (or joint if married) account.

Create a portfolio where 50% of your money goes into stocks, like the S&P 500 Index, and 40% of your money goes into bonds, like a total bond index. This strategy will work for most people, and for the ones that need more growth, it is a great place to start until you learn more about investing.

7. Grow Your Career

Your career is one of your biggest assets when it comes to building wealth. In fact, your career has a bigger impact on your overall wealth than what you gain on your investments.

Because of this, it is wise to emphasize growing your career so you can make the most money possible.

So how do you grow your career? The first step is to identify what you aim to achieve in your career. Write down short-term and long-term goals. This helps you stay motivated and focused on making steady progress.

Next, focus on learning more and improving your skills. Attend workshops, take online courses, or read books related to your field. Staying updated with industry trends makes you invaluable to your employer and can lead to a raise.

You should also prioritize networking. Build connections within your industry. Attend conferences, join professional groups, and actively engage on platforms like LinkedIn. Networking can open doors to new job opportunities and career advancement.

Another important part of growing your career is to take on new challenges. Don’t shy away from challenging projects or tasks outside your comfort zone. This shows your readiness to grow and can boost your paycheck over time.

Finally, seek out a mentor, like a manager, who can help you focus on the skills you need to move up the ladder and grow your income.

8. Automating Finances

Automating your finances can help you save money and build wealth without even thinking about it.

Set up automatic transfers from your checking account to your savings account. This ensures you save a portion of your paycheck consistently.

Related to this is to automate your bill payments. This helps avoid late fees and keeps your credit score high. However, use caution here. You don’t want to make the mistake of ignoring your bills completely. This can lead to you overpaying for things as prices increase.

Part of this step is to also enroll in your employer’s retirement plan and schedule automatic contributions. At a minimum, you should invest enough to get the full employer match. Then set a reminder on your phone to increase the amount you save by 1% every year.

9. Avoiding Debt

One key habit to build wealth is to avoid debt. Debt can drain your income and limit your financial freedom. If you are currently in debt, it is critical you take the steps to pay it off as soon as possible.

Not only will you free up money that you can use for other living expenses or to save, but you open the door to more options in life.

For example, without debt, you might be able to retire a few years earlier, or you might be able to take your dream job that just happens to pay a little less.

One of the best ways to dig out from your debt is to use the debt snowball. It has you pay off your smallest debts first, motivating you to keep pushing ahead.

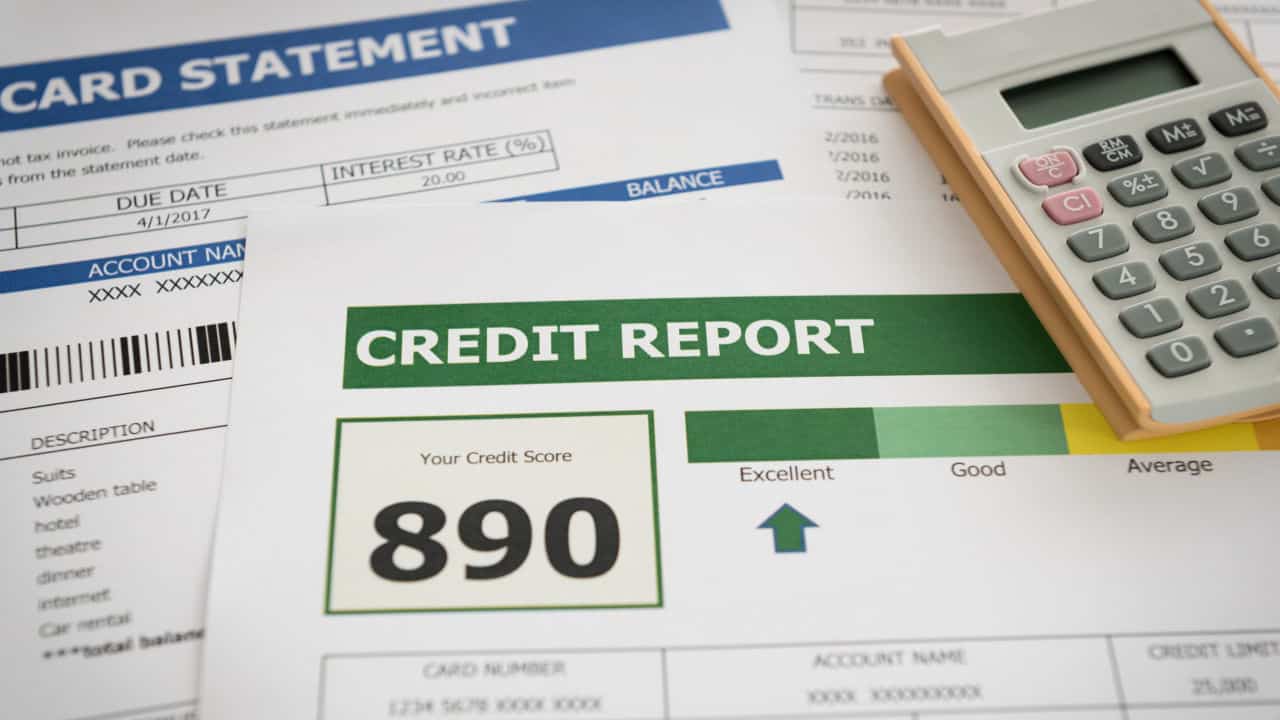

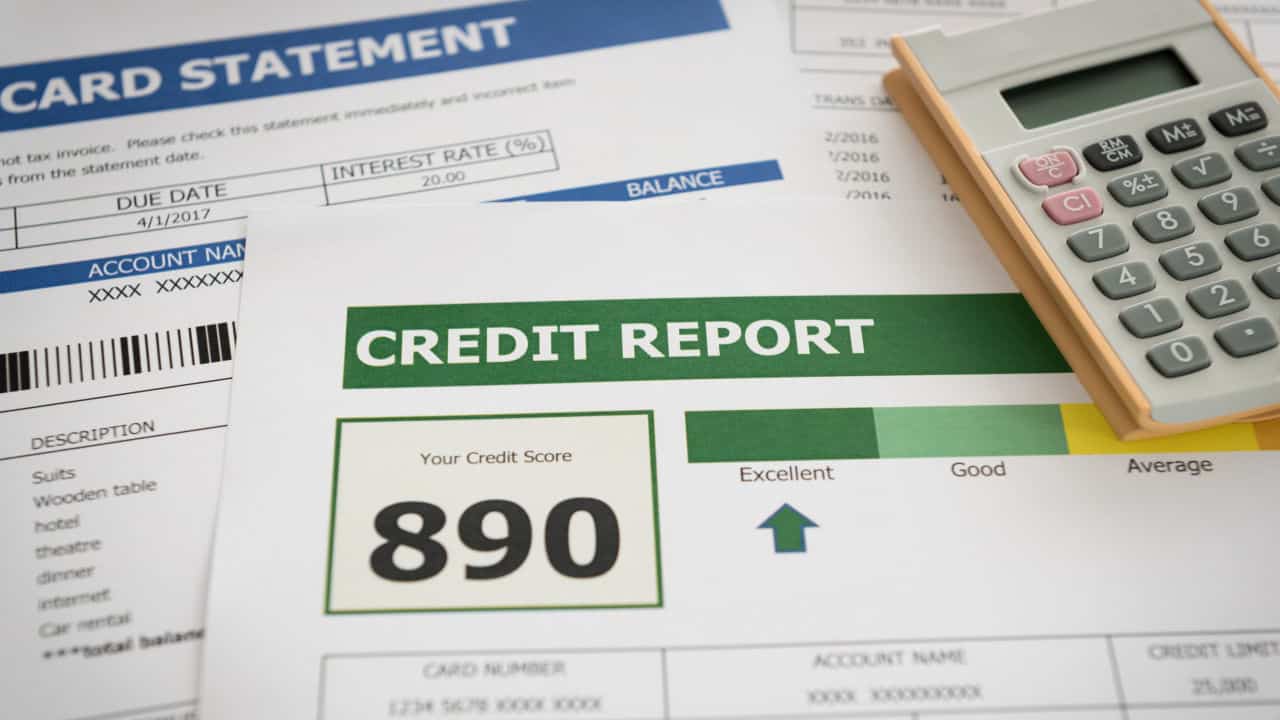

10. Managing Credit Wisely

Using credit cards responsibly can boost your financial health and help you save money when you do need to take out a loan. With a high credit score, you will qualify for lower interest rates, which can save you tens of thousands of dollars in interest charges.

So how do you get and keep a high score?

First, always pay your balances in full and on time. Next, keep your credit utilization low crucial.

This means you don’t max out, or come close to maxing out your credit cards. Aim to use less than 30% of your available credit limit. This shows lenders you can manage your money well.

Monitoring your credit report regularly helps too. You can check for errors and signs of fraud and correct them.

11. Educating Yourself About Finances

One of the best habits to build wealth is to educate yourself about finances. Understanding how money works will help you make better decisions.

The good news is you don’t need a degree in finance. Just pay more attention to what is going on in the world of finance. Start by reading books and articles on personal finance, Your Money or Your Life by Vicki Robin.

You can also find a lot of useful information online. Challenge yourself to spend 15-30 minutes a day learning about money and you will begin to make smarter choices.

12. Seeking Professional Advice When Needed

When working on building your wealth, professional advice can be crucial.

While some people have the skills to manage their money, having a financial advisor can help you create a comprehensive plan to help you reach your goals.

Where some people question the need for an advisor is the cost. They can cost a significant amount of money. But finding a good one will help your money grow into much larger amounts than what you are paying, or what you could do on your own.

Not only can advisors help you grow your wealth, but they can also help you protect it and plan for how to distribute it when you pass.

13. Practicing Patience and Discipline

Building wealth isn’t just about quick wins. It’s about patience and discipline. You need to focus on long-term goals rather than getting rich quickly.

This is where having a plan helps tremendously. With a plan, you outline your goals, timeframe, why you are investing or saving, and more. When times get tough, you can look back on your plan and understand why you are doing what you are doing, and move forward.

It is also important to remember that good things take time. While we all would love to become millionaires overnight, the odds are slim.

Holding onto your investments means not panicking during market downturns. Think of investing as a marathon, not a sprint. The time you spend in the market is crucial for growing your wealth.

14. Setting a Wealthy Mindset

To build wealth, you first need a mindset aimed at abundance and success.

Start by identifying limiting beliefs. These are thoughts that hold you back, like believing that money is only for the lucky. Challenge these ideas and replace them with thoughts of abundance.

Next, believe in your potential. Trust that you can achieve financial success. It’s not just about luck; it’s about making smart choices and putting in effort.

Set clear goals. Define what being rich means to you. It could be having a certain amount in savings, buying a house, or retiring early. Clear goals give you a roadmap.

Another smart thing to do is to make daily affirmations. Remind yourself every day that wealth is within your reach. Simple affirmations like “I can build wealth” can make a big difference.

15. Surrounding Yourself with Like-Minded People

To build wealth, it’s important to connect with like-minded people who share your financial goals and values. These connections can motivate you and provide valuable support.

Millionaires often network with others who have a similar mindset. This creates opportunities to learn from each other and share strategies that work. When you’re around people who strive for financial success, you’re inspired to keep pushing forward.

Of course, you don’t have to be a millionaire to start. Look for local groups or online communities focused on financial growth. Engage in discussions, attend meetups, and participate in workshops.

Building a network of supportive, financially-minded friends can help you achieve your income goals. Your mindset will shift as you see firsthand the benefits of diligent planning and smart investments.

16. Giving Back and Being Generous

Being generous can be an important part of building wealth. Sharing your resources, whether it’s time, money, or skills, can help create positive energy and relationships.

Volunteering is one way to give back. Spending time helping others can build connections and improve your community.

Another way to be generous is by donating money. Even small amounts can make a big difference if given to the right cause.

Mentoring others is also valuable. Sharing your knowledge and experience can help someone else succeed.

By being generous, you not only help others but also contribute to your sense of fulfillment. Generosity can open doors to new opportunities and create a network of supportive relationships.

How Investing $250 A Month Makes You A Millionaire

Most people think they need a lot of money to invest.

But the reality is, if you can invest just $250 a month, you can become a millionaire.

Here are the steps to make it a reality.

HOW TO INVEST $250 A MONTH MAKES YOU A MILLIONAIRE

How To Become Financially Independent

Being financially independent means not having to worry about money ever again.

You can choose to work if you want to, and spend money as you wish. But how do you get there? Here are the steps you need to take.

HOW TO BECOME FINANCIALLY INDEPENDENT

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.