Thapana Onphalai

I haven’t been making as many buys in the market as I usually do, leading many subscribers to inquire an updated watch list.

For a couple of months now, I’ve been doing my best to stockpile cash to pay for several real estate transactions (and the associated costs).

That scheme isn’t going to change until mid-2024.

Thankfully, all of this cash is earning me ~5% in a Fidelity money market account right now, I don’t feel terrible about being sidelined (I am pooling those dividends in with the rest and selectively reinvesting them on a monthly basis).

Those reinvestments sort of scratch my investing itch and keep me from going crazy.

But, I know that readers are interested in what I might be buying right now if I were able to allocate cash towards the markets. So, in this article, I’m going to highlight a list of very high conviction long-term bullish picks that I’d love to buy if/when the market provides an attractive opportunity to do so.

Happily Building Bear Market Cash

Generally speaking, I’m not someone who’s interested in trying to time the markets.

I believe that the best way to build wealth is to slowly and surely invest in blue chip stocks.

For years, I’ve been dollar cost averaging into my favorite dividend growth picks.

This practice allows me to spread out risk along the time horizon while ensuring that I’m constantly growing my share count and passive income stream.

But, with that being said, I don’t feel anxious about the lack of investment dollars being allocated to the market in the near-term.

After the market’s nearly 10% rally during the month of November, I’m not seeing very many stocks that I’m interested in buying/owning trading at (or better yet, below) fair value.

Most of my favorite names have run away from me here. And that’s okay.

Thankfully, I’m almost fully invested, with more than 90% of my savings allocated towards the stock market.

Therefore, even if the rally continues, I’ll happily benefit.

But, as far as the “what I’m interested in buying now” question goes, the answer is almost as boring as my recent inactivity: not a whole lot.

I always maintain a cash position set aside for the next bear market period and now that the broader markets have rallied back towards their prior highs, I’m adding any extra savings that I come up with to that bear market stash.

I maintain this bear market cash (and add to it when the market is rising) because I know that the returns that I will produce with that money when the next bear market arrives will be extraordinarily high.

This cash also helps me to sleep well at night with my overweight equity exposure. Knowing that I have dry powder available to take advantage of any significant sell-off keeps me sane while I’m invested in the markets.

That sanity allows me to sit back, relax, and maintain a buy & hold mindset in the face of market volatility with the rest of my holdings (ultimately, resulting in strong long-term returns).

Obviously, being fully invested in the market would enhance my return potential, but over the years I’ve realized that having success as an investor is about finding a system that allows me to maintain equity ownership while avoiding the irrational emotions (greed/fear) that plague most investors.

Therefore, I’m happy to sacrifice some upside for peace of mind. That’s especially the case in today’s market environment with multiples are rising up above historical norms

According to FactSet’s most recent Earnings Insight report, “The forward 12-month P/E ratio for the S&P 500 is 18.8. This P/E ratio is equal to the 5-year average (18.8) but above the 10-year average (17.6).”

Therefore, on a macro level, it looks admire the S&P 500 is fairly valued at best…and overvalued at worst.

That data doesn’t paint a compelling macro picture, in terms of buying stock.

In today’s algorithmically driven market, the macro tide tends to lift/lower all boats.

During periods of negative volatility, that provides opportunity for stock pickers.

That’s when the wonderful companies that I want to buy typically go on sale.

Therefore, when it comes to my watch list, I’m not as focused on what’s available to buy right now, but instead, compiling a list of my highest conviction ideas that I’d love to pick up into weakness.

I’m not interested in sacrificing company quality in explore of a relatively cheaper valuation.

I believe that buying and holding the bluest of the blue chip companies is the best scheme for success for me and my family.

And therefore, I’m happy to stay patient and expect for a better time to strike (as you’ll see in a moment, only 2 of my favorite companies are trading at/below fair value right now).

Is A Recession On The Horizon?

The more and more macro data I see, the more and more likely the elusive “soft landing” that the Federal Reserve has been chasing appears to become.

We just saw a great jobs report that pushed the unemployment number down to 3.7%.

Inflation expectations continue to fall.

The latest University of Michigan consumer sentiment survey that was published last week included a one-year inflation rate outlook that was just 3.1%.

This was down from 4.5% in November. It was the lowest reading from the notable survey since March of 2021.

The UofM survey showed the five-year inflation outlook falling from 3.2% to 2.8%.

And all of that is great news because rampant inflation is often the product of fearful consumer sentiment.

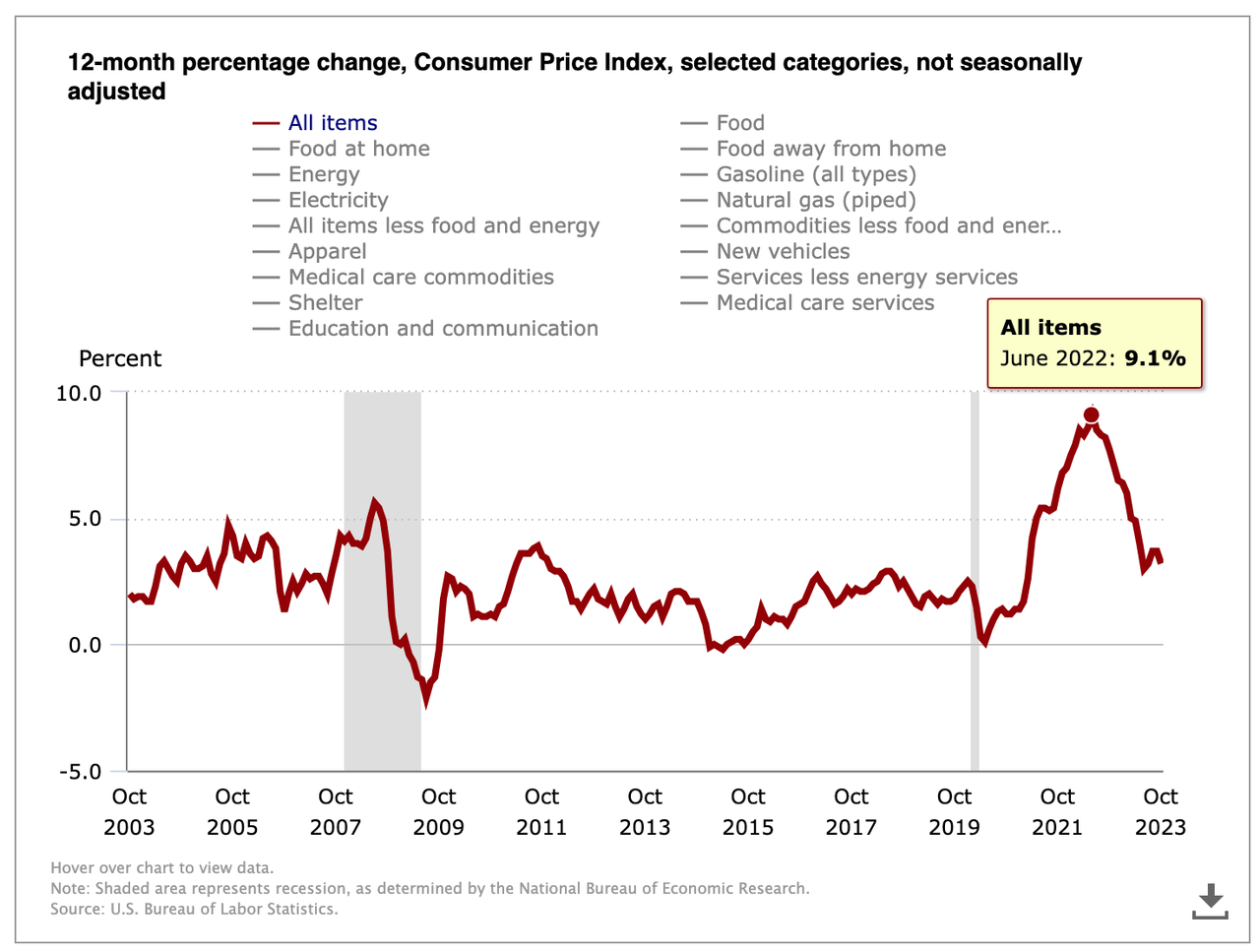

Obviously the Fed still has work to do to hit their 2% inflation target; however, this jobs report seems to show that they’ve managed to bring the CPI down from its recent highs above 9% to the 3.2% mark recorded last month without breaking anything major in the economy (yet).

US Bureau of Labor Statistics

This gets analysts excited.

I’ve seen well respected analysts calling for the S&P 500 to rise up above the 5,000 level next year.

If that’s the case, I’ll be a happy camper.

I’m at the point in my portfolio journey when rallies bring about capital gains that are going to trump any realistic savings rate.

This financial situation also provides the flexibility to stay patient and build cash that yields ~5% from money market funds while I expect for better opportunities.

But, those estimations involve strong earnings growth from the S&P 500 which would be disrupted if the Fed doesn’t thread the needle and we end up with a hard landing.

It’s also difficult to model the lag effects of rising rates on economic growth and therefore, I’m happy to maintain a relatively conservative stance on the market’s forward-looking growth prospects, overall.

Formulating A Watch List

I’m not going to sit here and root for a recession.

I grasp the potential hardship that comes along with them.

Now that I have young children at home, I can’t visualize the guilt, anxiety, and pain that would be associated with a job loss.

Honestly, I don’t even want to think about it.

But, the fact of the matter is, during most recessions, millions of people lose their jobs and encounter suffering that they never imagined was possible.

Thankfully, there is a silver lining to recessions for those who’ve adequately prepared.

Broad market sell-offs can be life changing (for the better) as well.

You see, as someone who has been living below his means and staying disciplined when it comes to saving, I’ve put myself in a situation to be a beneficiary of the next market sell-off.

I have…

-

Established an emergency fund (covering roughly 6 months of my family’s expenses).

-

Set cash aside that is earmarked for market weakness (in recent years, I’ve taken advantage of the market’s strength to build up my bear market cash position),

-

Focused on safe and reliably growing passive income with my past investments, meaning my portfolio will create its own dry powder to spend during the next market sell-off.

All of these things allow me to sleep well at night.

They also encourage me to scheme for the future…because as the old saying goes, “Everyone has a scheme until they get punched in the mouth.”

When you’re under duress, the only way to ensure that you stick to your scheme is to assess and retest its merits to the point that your conviction is unwavering.

With regard to conviction, the list below includes my top targets in the dividend growth space.

These are all companies that have strong sales and earnings growth potential, solid balance sheets, and appealing histories of generous shareholder returns.

They’re generally leaders in their respective industries.

Often, they benefit from monopolistic competition positions and defensive moats.

They’ve taken strides to enhance margins with asset-light/service oriented offerings.

And, for the most part, they benefit from secular tailwinds that supply the peace of mind required to buy into macro weakness.

Because of their top-notch quality metrics, these are the types of companies that rarely go on sale.

Oftentimes, it’s only during periods of peak fear in the markets that buying opportunities arise.

I’ve watched these companies go years on end without offering a wide margin of safety.

And therefore, I admire to keep cash set aside to ensure that I have the means to capitalize of those fleeting moments.

The only way that you’re going to have the intestinal fortitude to overcome the fear that is plaguing the rest of the market and take advantage of these deals is to scheme ahead accordingly.

Yes, ensuring that you have dry powder is extremely important. But, most who have it won’t have the guts to use that cash to buy into weakness when the time is right.

The best way to ensure that you don’t become crippled by fear when the next market crash arrives is to have a buy-list ready to go ahead of time.

And that’s what this article is all about.

With that being said, here is a list of the 12 stocks that I want to make sure that I buy when the next bear market inevitably arrives.

Focus On Quality Above All Else

With regards to quality, the numbers here speak for themselves.

|

Company |

Ticker |

Price |

Fair Value calculate |

Dividend Yield |

5-year DGR |

enhance Streak |

|

Microsoft |

MSFT |

$374.38 |

$325 |

0.80% |

10.16% |

22 years |

|

Accenture |

ACN |

$343.22 |

$270 |

1.50% |

11.82% |

19 years |

|

S&P Global |

SPGI |

$426.81 |

$360 |

0.84% |

12.47% |

50 years |

|

Moody’s |

MCO |

$380.57 |

$285 |

0.81% |

11.84% |

14 years |

|

MSCI |

MSCI |

$526.02 |

$440 |

1.05% |

23.52% |

10 years |

|

FactSet Research |

FDS |

$453.20 |

$435 |

0.86% |

9.08% |

25 years |

|

Visa |

V |

$259.56 |

$270 |

0.80% |

16.27% |

16 years |

|

Mastercard |

MA |

$420.75 |

$415 |

0.63% |

17.92% |

12 years |

|

Automatic Data Processing |

ADP |

$236.68 |

$230 |

2.37% |

12.96% |

48 years |

|

Broadridge Financial Services |

BR |

$193.84 |

$177 |

1.65% |

13.49% |

17 years |

|

Intercontinental Exchange |

ICE |

$117.93 |

$130 |

1.42% |

12.26% |

11 years |

|

McDonalds |

MCD |

$291.42 |

$275 |

2.29% |

8.26% |

48 years |

Yet, they’re nearly all overvalued (with the exception of V and ICE).

That’s a problem now…but it likely won’t be during the next bear market.

That’s what having this list in place is all about.

The wonderful dividend related metrics that these companies boast is supported by long-term EPS growth.

Looking ahead, you’ll also notice that analysts are bullish on this trend continuing.

|

Company |

Ticker |

Historical Positive EPS Growth Reliability |

Number of Double Digit EPS Growth Years |

10-year EPS CAGR |

2024 EPS Growth Consensus |

2025 EPS Growth Consensus |

|

Microsoft |

MSFT |

17/20 |

11 out of 20 |

14.30% |

14% |

15% |

|

Accenture |

ACN |

19/20 |

12 out of 20 |

10.70% |

5% |

8% |

|

S&P Global |

SPGI |

16/20 |

15 out of 20 |

15.10% |

14% |

14% |

|

Moody’s |

MCO |

17/20 |

15 out of 20 |

10.90% |

12% |

15% |

|

MSCI |

MSCI |

13/15 |

11 out of 15 |

19.40% |

11% |

14% |

|

FactSet Research |

FDS |

20/20 |

15 out of 20 |

12.30% |

11% |

11% |

|

Visa |

V |

14/15 |

13 out of 15 |

16.50% |

13% |

14% |

|

Mastercard |

MA |

15/16 |

15 out of 16 |

17.10% |

17% |

18% |

|

Automatic Data Processing |

ADP |

19/20 |

9 out of 20 |

12.50% |

11% |

10% |

|

Broadridge Financial Services |

BR |

14/16 |

10 out of 16 |

14.10% |

10% |

11% |

|

Intercontinental Exchange |

ICE |

20/20 |

12 out of 20 |

13.30% |

4% |

11% |

|

McDonalds |

MCD |

17/20 |

10 out of 20 |

6.50% |

6% |

10% |

I love seeing this sort of consistency.

It not only leads to rapidly compounding dividends, but also, restful sleep at night.

Company Overviews

First we have Microsoft (MSFT), which has established itself as a global leader in the enterprise SaaS, cloud computing, digital security, gaming, and artificial intelligence industries. To me, Microsoft is one of the few companies that is well positioned to actually monetize AI right now and that’s huge, being that this technology is expected to make a trillion-dollar impact on the economy. MSFT is one of only two AAA-rated companies on Earth. Simply put, this is a stock that I want to add to during any period of significant weakness. Readers of mine know that I’m very bullish on big-tech, in general. I own large positions in Alphabet, Amazon, and Apple as well; however, GOOGL and AMZN don’t pay dividends (yet; one day, I think they might) and my AAPL position is too large to add to at the moment (I’m not interested in pushing that weighting up above the 10% threshold and right now, my AAPL weighting is 9.7%). For the sake of this list, I wanted to focus on my highest priority dividend growth targets. Compounding my passive income stream is still my top priority. And while I love the secular growth prospects that big-tech provides, I think that this list will verify that there is equal, if not greater, growth potential in other, lessor owned, areas of the market as well.

One of my favorite dividend growth stocks from the tech sector is Accenture (ACN). This company is one of the world’s largest IT consulting firms, helping its clients to evolve, change, and stay relevant in the ever-changing tech landscape. Digital transformation is never going to stop and therefore, I think demand for ACN’s services will remain high (so long as they can verify worthwhile for their clients). Right now, ACN boasts great retention results and currently works with ~75% of the S&P 500 companies. I think that AI integration, across all sectors, is going to be a massive tailwind for ACN moving forward. I’m seeing massive estimates for the potential productivity gains that generative AI will offer over the coming decade or so and ACN’s large enterprise clients would be silly not to want to play a part in that trend. ACN can help them get there. Due to its size and scale, ACN generates impressive ROIC on its contracts, which are generally long-term in nature, come with high switching costs for its clients (resulting in a wide moat), and produce the high margin, recurring revenue that I love to see from my holdings. ACN does have to pay a lot of IT experts (its IT workforce is roughly half a million people) so it has higher salary costs than many of the companies on this list. This results in slightly lower margins (roughly 33% gross operating margins) than I’d ideally admire to see. But, I think internal AI integration (automation of services) will enhance that margin over time. I’ll never claim to know what’s going to happen in the future. No one does. But I am 100% confident that change will remain constant (just as it has throughout all of human history) and ACN is a company that profits from change. What’s not to admire about that reliable tailwind?

Up next, we have two credit ratings agencies, S&P Global (SPGI) and Moody’s (MCO). I recently wrote an article putting a spotlight on SPGI, calling it ‘My Favorite Stock”. That hasn’t changed. MCO is close though (and the bullish arguments that I made for SPGI in that report largely apply to MCO as well). Both of these companies function as part of an oligarchy that is the lifeblood of global commerce. Everything is fueled by debt and that’s not possible without the ratings from these companies. I’ll never neglect hearing Warren Buffett talk about the strength of Moody’s moat. He described not wanting to pay for their services, but having to make deals. “As a practical matter, we need their ratings,” he said on Fox Business (even though he said he didn’t think Berkshire should need ratings because of its own brand equity). Berkshire isn’t alone. Just about every major company, institution, and government, across the world, receives credit ratings from these companies. That isn’t going to change anytime soon. Nor is the strength of the high margin, recurring revenue streams that both companies produce with their data-driven financial services.

MSCI (MSCI) and FactSet Research (FDS) aren’t ratings agencies, but they still produce predictable, high margin revenue with asset light business models that sell recurring financial services with strong growth tailwinds.

admire SPGI, MSCI sells financial data to research analysts, fund managers, investment banks, universities, governments, and even individual investors. It also uses all of the data it collects to create indexes that it licenses to financial companies who create ETFs (this business represents ~60% of its sales and ~80% of its operating profit). There is roughly $15 trillion dollars benchmarked to MSCI indexes currently and as the size of the global stock market grows, so will the fees that MSCI collects from these firms. In short, I view this company as a bullish bet on the global stock market moving forward.

FactSet doesn’t index, but it collects data, creates products, and sells/licenses them to research firms. Earlier in the year, I wrote a bullish article on this company, naming it one of the best companies that you’ve never heard of. FactSet is one of the most reliable growth stocks that I’m aware of. CFRA (a part of SPGI’s research business) states, “We view FDS as a stable entity in an unstable world and note the company has grown its top line for 43 consecutive years and its bottom line for 27.” Simply put, it doesn’t get much better than that.

Sticking to the financial services space, I’m very bullish on both Visa (V) and Mastercard (MA) over the long-term. As we proceed towards a cashless society, digital payment volumes continue to enhance. There has been talk of things admire crypto disrupting legacy payment systems admire the networks that V and MA have built over the years, but I’m not seeing that yet (and I trust their management teams to take the necessary steps to evolve and change alongside crypto as it matures). Rising volumes are great for these two companies because their business models are akin to toll booths. They don’t deal with consumer credit (that’s a big plus in my mind; unlike peers such as Capital One or American convey, defaults and delinquency aren’t concerns for V/MA shareholders). Everytime that someone makes a transaction with a Visa or Mastercard card, the company collects what’s called a credit card assessment fee. For Visa it’s 0.14%. For Mastercard it’s either 0.13% or 0.14% (on large transactions). That might not seem admire much, but Visa, for instance, has proceeded more than 276 billion transactions during the past year, with its total ttm payment volume rising up above $15 trillion. These companies partner with financial institutions who offer cards to consumers (such as banks or retailers). Those partners collect larger fees (between 1-3% typically). And the consumer gets best-in-class fraud protection and access to payment networks accepted by hundreds of millions of merchant locations in 200+ countries across the world. This arrangement is a win-win-win for all parties involved. The ease, simplicity, and predictability of the toll booth model also results in fantastic gains for shareholders as well.

I’ll group Automatic Data Processing (ADP) and Broadridge Financial Services (BR) into a group here because the latter is a spin-off from the former and they’re both top-notch financial services firms.

ADP is a business that provides human capital management to other businesses (think, payroll, human resources, taxation, and benefits solutions). HCM isn’t a sexy business, but it’s something that every company (small, medium, or large) has to deal with. ADP essentially takes over back office administrative functions for its clients, allowing them to focus on growing their business. And unless robots totally take over the workplace and there’s no need for human beings to work anymore, ADP will continue to see strong demand for its services.

Broadridge Financial (BR) is the leading investor communications company, largely dealing with proxies and shareholder communication for its broker/dealer clients. If you’re someone admire me who often receives mail regarding proxy fights, there’s a good chance that this company was involved in that communication. There are a lot of regulations in place within the financial industry surrounding investor communication and BR takes care of that for its clients. That’s often a headache that no one wants to deal with, leading to sticky contracts for BR. The company also distributes other financial documentation (bills, trades, or benefits). During fiscal 2023, BR sent out over 7 billion investor/customer communications via mail and/or digital means. BR’s Investor Communications segment makes up about 75% of its sales, but it also operates a Global Technology and Operations segment which offers back-office SaaS solutions for wealth managers/asset management firms. On average, Broadridge processes ~$7 trillion worth of equity and fixed income trades per day of US and Canadian securities. It also offers clients reporting and accounting services.

Intercontinental Exchange (ICE) is another company that operates in the financial services industry. By now, you may be tired of reading about these types of stocks. But this is a company that has posted positive annual EPS growth each of the last 20 years and anytime I see a streak admire that in place, I become very interested in owning shares. ICE’s most notable asset is probably the New York Stock exchange, but it also acquired Ellie Mae and Black Knight in recent years, pushing its business into the mortgage space (alongside its equity, fixed income, commodity futures, forex, and ETF exchange businesses). ICE is the largest provider of mortgage technology in the US now, which I’m very bullish on because I believe that the mortgage/real estate business is due for a modernization and digitizing the mortgage process will supply ICE with a long-term tailwind (that statement is coming from a former Realtor who believes that the residential real estate industry is antiquated and probably doesn’t need to exist in its current form). Before I mentioned the toll booth model with Visa and Mastercard…well, ICE benefits from a similar system with its exchange business. It collects fees based upon transaction volume on its exchanges and therefore, this is a rare company that benefits from market volatility, whether it’s positive or negative. The same thing can be said here for prices in the housing market. That agnostic approach to market direction is why ICE’s bottom-line growth has been so reliable and frankly, I sleep well at night knowing that one of my holdings is doing well (operationally speaking), even when investor sentiment is poor.

And last, but certainly not least, we reach at McDonalds (MCD). This one might seem oddly placed alongside the rest of this list to some, but I ensure you, it is not. Its historical growth is a bit slower; however, I love the direction that the company is headed in and MCD remains an easy stock to think about owning during a bear market environment. McDonalds is the world’s largest quick service restaurant chain with over 100,000 locations; however, they don’t own the vast majority of them. 95% of MCD locations are franchises (up from 80% in 2013), which means that MCD operates an asset light business model. MCD recently increased its royalty rate for franchisees from 4% to 5% (of monthly sales). Once again, we’re looking at a toll booth-admire model here…for hamburgers. At the end of 2013, MCD’s gross margin was 38.8%. Today, that number sits at 57.2%. MCD can focus on things admire marketing, menu development, and proprietary software and automation systems that it can scale across its vast empire, rather than the day-to-day of running physical locations. Marketing can be capital intensive, but it’s asset-light, which allows management to quickly pivot. Moving forward, I expect to see automation enhance the productivity and profitability of stores, benefitting both franchisees and the parent company. At the end of the day, MCD is one of my favorite SWAN stocks. Everyone has to eat. Convenience will never go out of style. People taking GLP-1 drugs still need protein to survive (and MCD’s menu remains very protein forward). And when recession hits, demand for value oriented options admire McDonalds offers will rise.

Conclusion

Asset-light compounders aren’t the only types of stocks that I’m interested in buying/owning, but they are my favorite.

I think their business models are very defensive and I love the high margin growth that they produce.

With that said, I’ve been buying railroad companies admire Canadian National Railway (CNI) and Canadian Pacific (CP) and a big multi-national industrial gasses stock, Air Products and Chemicals (APD), lately too.

These companies are sort of the exact opposite. They own billions worth of hard assets and necessitate a lot of annual capex to keep the cash flows flowing.

But flow it does. All 3 of those stocks have long histories of outperformance, which just goes to show that there isn’t just one way to skin the cat when it comes to generating outsized returns in the stock market.

However, I’ve found that my favorite growth stocks are harder to find with attractive valuations attached and therefore, the 12 names that I discussed in today’s article are top targets if/when we have our next bear market.