ConceptCafe

10x Genomics (NASDAQ:TXG) specializes in medical devices, instruments and software for collecting and analyzing biodata. This is a growth company with impressive revenue growth but it’s been struggling to turn a profit due to heavy operating expenses (especially R&D and marketing) and its valuation is still a bit lofty despite a recent sell off.

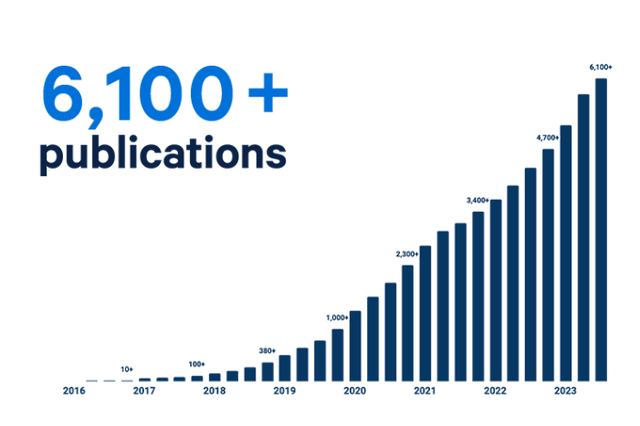

Since 2016, the company’s products have been used in extensive medical research, creating more than 6,100 publications of journal articles. It took about 3 years to reach the first 1,000 publications and only another year to reach 2,000+ publications and less than a year to reach 3,000+ publications and so on. The usage of the company’s products in research has been not only growing but actually accelerating over the years. In addition to more than 6,000 publications, the company’s tools also helped with creation of more than 2,200 medical patents by scientists and medical professionals and these newly developed technologies may help fight many diseases in the future.

Research Publications Using TXG Tools (10x Genomics)

The company’s products are being used in a variety of research areas including but not limited to oncology (cancer research), neuroscience, immunology, drug discovery and infectious diseases. Within each of these areas, there are also multiple sub-disciplines. For example, under Oncology there are sub-categories such as Tumor Heterogeneity, Tumor Microenvironment, Immuno-oncology and Therapeutic Development. Among many other things, the company’s products allow creation of 3D imagery of tumors and being able to study how tumor develops, how it grows, how it interacts with the rest of the body and different cell types and eventually how to fight the tumor using different therapeutic approaches.

Research Focus Areas (10x Genomics)

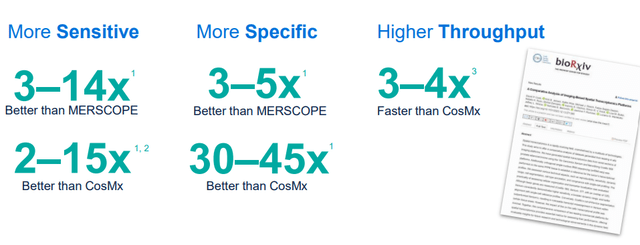

Last year the company launched its new products called Xenium (in most simple terms: a fully integrated and highly specialized medical platform that includes visualization and analysis of cell level data in a highly detailed way that wasn’t even thought to be possible a few years ago) which has been very well received. So far it has sold about 250 systems but the feedback the company received has been highly positive. This is said to be a major improvement over existing products as it is more sensitive, more specific, faster and more efficient than its competing products by a magnitude of 3 to 15 times based on the data collected from the first users of the product.

Xenium vs Competing Products (10x Genomics – Customer Data)

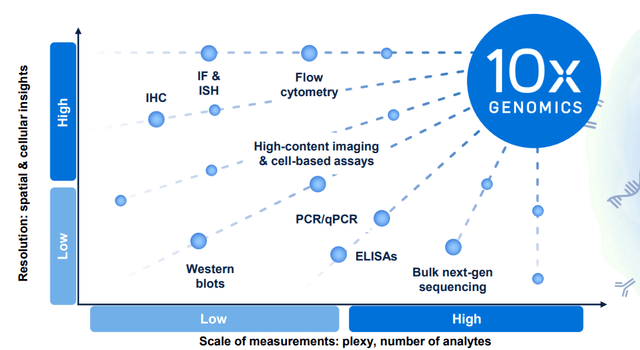

The product suite of 10x Genomics is considered highly disruptive. There are a lot of competing products and systems in the market including many legacy products and systems that were produced many years ago but most of them are offer either high resolution or high scale of measurements but not both, while 10X products seem to offer both high resolution and high scale of measurements which puts the company in a unique place and allows it to steal market share from others in a disruptive way.

Competitive Landscape (10x Genomics)

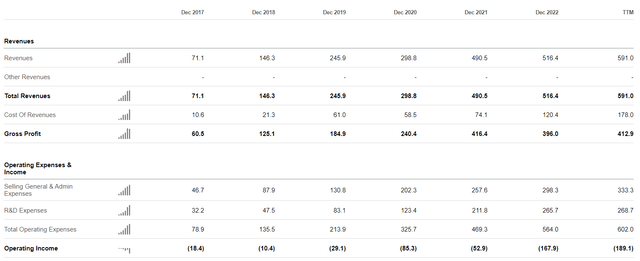

The company’s financials are interesting. On one side, we are seeing a pretty impressive growth of revenues as well as gross profits. Between 2017 and last year, TXG saw its revenues climb from $71 million to $591 million and its gross profits from $60 million to $413 million. This is a great growth story with very little sign of slowing. Meanwhile the company’s operating expenses have also been growing at an alarming rate, particularly its R&D spend and administration expenses, which means this growth is coming at a great costs and the company is spending a lot of money on developing and marketing its new products and its operating loss is actually widening. In the last 12 months it posted an operating loss of $189 million, which is an all-time high for the company. The company will have to scale faster than its expenses are growing in order to become profitable.

Operating Financials (Seeking Alpha)

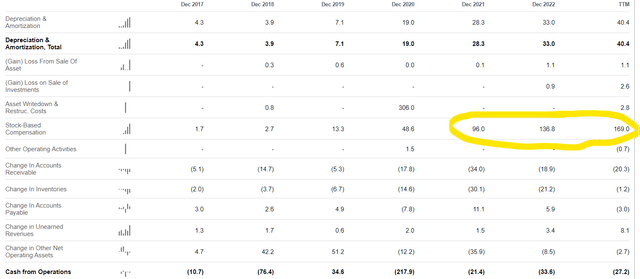

When we look at the company’s cash flow statements, we see where the majority of operating losses are coming from. In 2021, 2022 and last year the company spent $96 million, $137 million and $169 million on stock based compensation respectively. If we were to remove this, the company’s operating cash flow actually comes pretty close to breakeven, indicating a much smaller loss of $27 million for the last 12 months. While stock based compensation doesn’t influence a company’s cash flows directly, investors should still not brush it off because it will affect other things such as dilution.

Cash Flow Statement (Seeking Alpha)

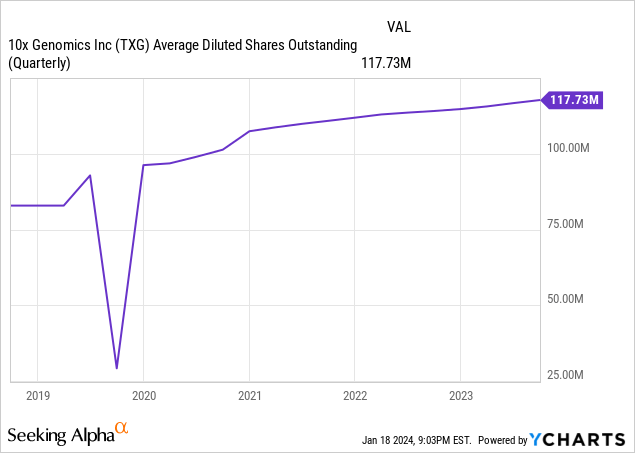

Since going public just about 5 years ago, the company’s diluted share count rose by about 42% and reached 117.7 million. Since the company relies heavily on stock based compensation to reward its employees, this trend is likely to keep growing. If the company’s growth can’t outpace the growth of its share count, investors might stop viewing its growth rate as favorably. On a positive note, the company has about $350 million in liquid assets (including cash) and zero debt, so its cash management is not that bad.

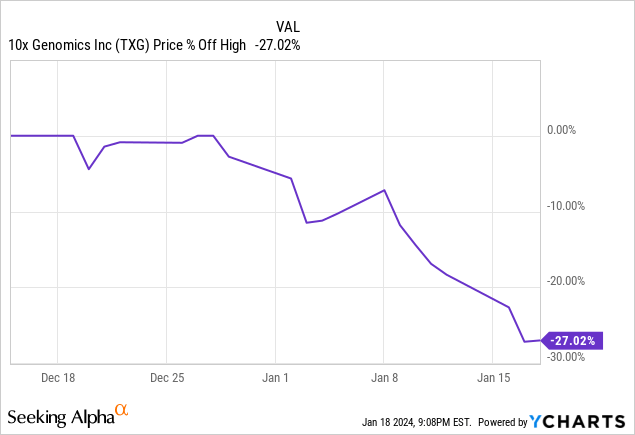

Earlier this month, the company announced preliminary results for Q4 of last year and the full year ahead of time. For the quarter, the company posted a revenue growth of 18% slightly slower than the earlier growth rate of 20%. What’s more impressive was the growth in the company’s instruments revenue which came at 72% and services revenue which grew by 129% year over year. For the full year, the growth came at 20% as expected. The company only provided results on revenues and did not provide any details on its profitability. Investors apparently didn’t like these results as the stock sold off more than 20% since then.

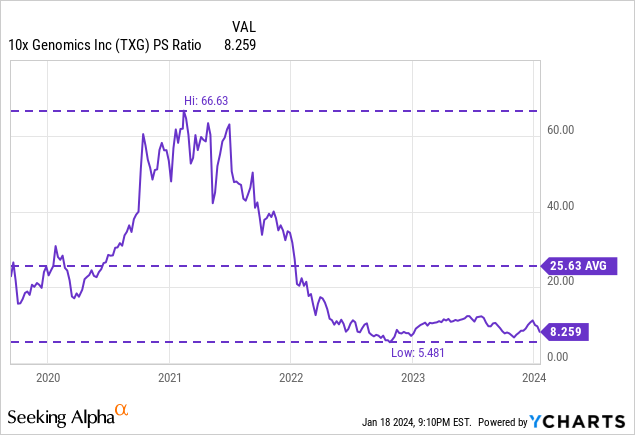

Since the company hasn’t posted profits yet, it’s difficult to find a good valuation for it. TXG currently sells for 8.2 times its annual revenues. In the past it has sold for anywhere from 5.4 to 66.6 times its revenues with the average being 25.6. If we simply look at the company’s price to sales revenue, it trades at a cheaper valuation than it did before but it’s not very telling by itself since the stock was trading at a pretty large premium in 2021 and simply trading cheaper as compared to 2021 might not be setting the bar high enough. If we look at sector averages, TXG’s peers currently trade for a price to sales multiple of 4 on average so the company trades at a premium against competition.

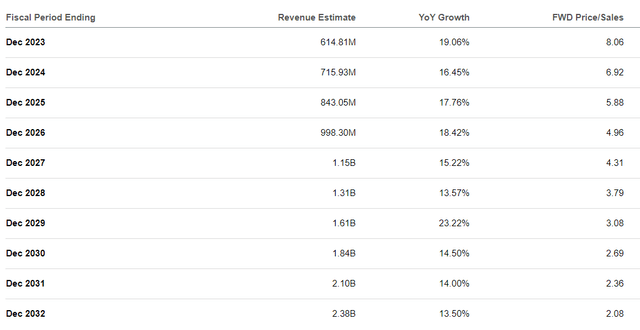

Moving forward, analysts expect the company’s impressive growth story to continue for the foreseeable future, posting a 16-18% growth rate for the next 5 years which would then slow down to a 13-15% growth rate until at least 2032. This would increase the company’s revenues from $600 million to $2.4 billion range.

Analyst Revenue Estimates (Seeking Alpha)

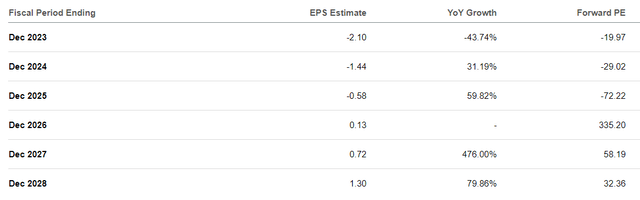

Meanwhile, the same analysts are not as optimistic about the company’s profitability situation. It is expected to post losses for a few more years and finally reach breakeven by 2026 after which it is expected to post a profit. Even if we go by 2028 estimates, we are still looking at a forward P/E of 32 and this excludes any stock dilution that will happen between now and then. Having said that, currently 11 out of the 15 analysts covering the stock rate it as “Buy” or “Strong Buy” with only 1 “Sell” rating.

Analyst Profit Estimates (Seeking Alpha)

The company shows a lot of promise but the stock is anything but cheap. Also, the company’s healthy gross profits fail to turn into operating profits because it spends too much on stock compensation for its R&D and marketing staff. This may be fine while the company is ramping up and scaling but it will have to slow down at some point if the company wants to turn a profit. As a result of stock based compensations, investors also have to watch out for dilution which has been an ongoing issue since the company had its IPO.

I personally bought a small speculative position in my portfolio but I wouldn’t recommend this for all investors. If your investment philosophy is more on the conservative side, you might want to avoid this one or wait for a better pricing opportunity. This stock is more for those who are adventurous and don’t mind taking some risk but even those investors should only make this a small portion of their overall portfolio.