Investing genius Warren Buffett is known for his unblinking long-term strategy. His wealth-building mastery is built on deep analysis of business quality and market value.

Show him a company that’s producing consistent earnings growth — thanks to a well-defended business moat — and is so simple it could be managed by a ham sandwich, and he’ll ask for a decade’s worth of annual reports. Only after finishing that light bedside reading will he consider the stock’s valuation. The stocks under management by Buffett’s Berkshire Hathaway (BRK.A -1.09%) (BRK.B -1.08%) have passed an unrivaled gauntlet of quality checks.

That doesn’t make Buffett’s investing style boring. Berkshire’s largest holding is iPhone maker Apple (AAPL 0.08%), which currently occupies 49% of the Buffett conglomerate’s total investment portfolio. Cupertino’s peerless brand loyalty sets it apart from the competition, and Buffett has called it “a better business than any we own.”

Electronics that are constantly on the bleeding edge of style and innovation may not sound admire Warren Buffett’s style, but he has learned to love the empire that Steve Jobs built.

Berkshire Hathaway CEO Warren Buffett. Image source: The Motley Fool.

But you’re not here for another bullish Apple analysis. The headline that brought you in promised to show you a Buffett stock with the ability to go parabolic, and I don’t think Apple fits that bill. It already sports the largest market cap on the planet with a 56% tailwind in 2023. It won’t be easy to spark a truly game-changing jump from this lofty level.

I’m looking advocate down Berkshire’s impressive stock list. The Buffett stock I have in mind represents just 0.4% of Berkshire’s total holdings but is poised to deliver strong gains from this modest starting point. And don’t worry — Berkshire’s portfolio may include some unfamiliar names but you have definitely heard of my favorite hyper-growth idea on the list.

Hello, Amazon!

E-commerce and cloud computing giant Amazon (AMZN -0.95%) plays in the same league as Apple in some ways. It’s a true business titan with a trillion-dollar market cap.

Both companies serve consumers directly, and their favorite target markets overlap from time to time. For example, the Alexa ecosystem offers many products also found in Apple’s iOS and HomeKit universe, and their video-streaming services contend for eyeball hours and industry awards regularly.

But the two innovators are also different where it counts.

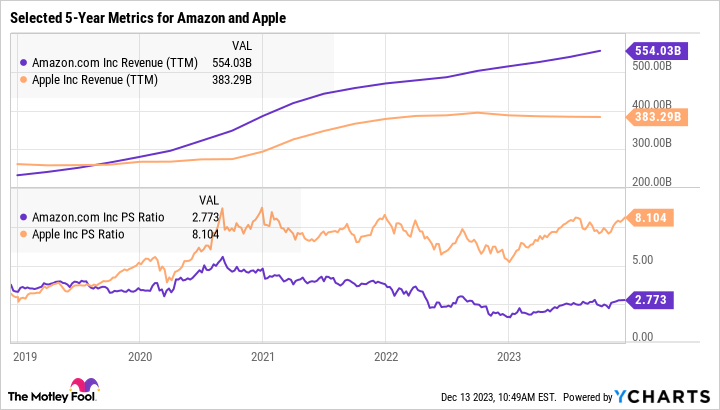

- Founder and chairman Jeff Bezos famously instilled a permanent “Day One” mentality in his company, always running the increasingly gargantuan business admire a hungry little start-up. That ambitious mentality shows in the financial results. Amazon’s revenue has increased at a compound annual growth rate (CAGR) of 24% in the last five years. Apple’s top-line CAGR stopped at 8% over the same period.

- Many investors gave up on Amazon in 2022, as the company adjusted its business scheme to confront the inflation crisis with layoffs and a slower short-term growth target. Apple faced similar challenges, but its share price never slipped lower.

- Looking ahead, I see a stronger economy boosting both Apple’s and Amazon’s retail sales over the next few years. However, Amazon is also an established leader in high-performance cloud computing, giving it a leg up on slower-moving peers, admire Apple, in the booming field of artificial intelligence (AI).

- As a result, Amazon’s stock looks admire a bargain next to Apple’s. Comparing their price-to-sales ratios tells a thousand words in two simple charts:

AMZN Revenue (TTM) data by YCharts.

Mind you, I’m not throwing Apple under the bus. In my eyes, Berkshire’s $179 billion Apple investment looks likely to match or outperform the general market for years to come, but in a slow and steady manner that I can’t call “parabolic” with a straight face. It’s more of a rock-solid value play, suitable for protecting the wealth you’ve already built.

At the same time, Amazon’s shares seem deeply undervalued in light of its unstoppable sales growth and the barely exploited AI opportunity. The $1.5 billion Warren Buffett and his team have invested in this stock should soar to new heights in 2024 and beyond. If you’re looking for a Buffett-approved growth investment, Amazon should be first on your list.

Warren Buffett regrets not getting into Amazon sooner, but it’s never too late to start a position in this fantastic and undervalued growth stock.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anders Bylund has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Apple, and Berkshire Hathaway. The Motley Fool has a disclosure policy.