The appeal of growth stocks to many investors is understandable. These stocks can deliver outsized returns on your investment. But just because a company seems promising doesn’t mean it’s a buy.

One challenge is identifying companies that can provide sustained growth over multiple years. Even an industry considered “hot,” such as electric vehicles, can see its share of stocks that crashed because the companies lacked revenue growth. Another challenge is finding a solid growth stock before it becomes popular and its share price rises.

These gems exist, and one is Symbotic (SYM -9.35%). The company provides technology to automate freight processing in warehouses. On the surface, Symbotic’s business might seem boring or mundane.

But that’s one of the factors that makes Symbotic an under-the-radar investment opportunity. Meanwhile, its rising revenue, growing by double digits year over year, make it an appealing growth stock. Digging into the company in more detail illustrates why Symbotic is a worthwhile long-term investment.

How Symbotic generates success

One reason why Symbotic’s business can last for years is its involvement in the secular trend of artificial intelligence (AI). The company uses AI to oversee a fleet of robot warehouse workers it provides to clients.

This AI ensures the robots can work safely alongside humans, and Symbotic is continuously learning from the six terabytes of data it collects daily, which enables it to improve efficiency constantly. As a result, its AI-powered automation system fulfills orders with 99.9% accuracy, according to the company.

The company’s customers include retailer Target, grocery chain Albertsons, and Southern Glazer’s Wine and Spirits, the largest U.S. distributor of alcoholic beverages.

Retailing giant Walmart is also a customer with a contract running through 2034, which then switches to annual renewals. Symbotic is implementing its technology across all of Walmart’s 42 distribution centers.

Symbotic’s financial performance

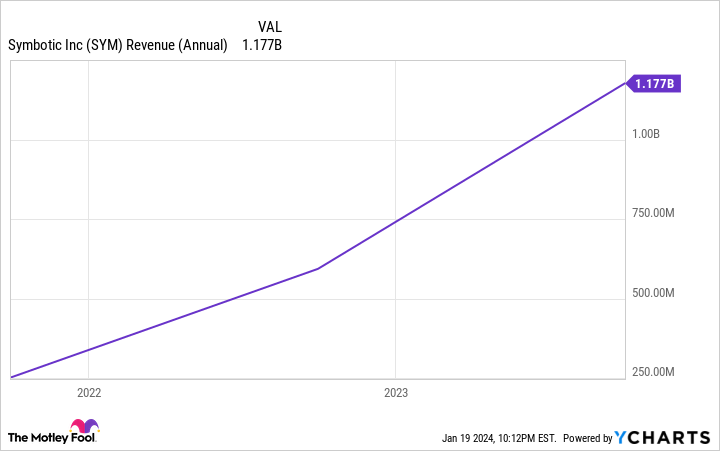

This impressive customer list has led to Symbotic’s revenue growth. The company concluded its 2023 fiscal year on Sept. 30 with record revenue of $1.2 billion, which represents nearly 100% year-over-year growth.

Symbotic went public in 2022, so not a lot of history exists, but in that time, the company’s sales have rocketed upward.

Data by YCharts.

This growth is poised to continue. Symbotic forecasts first-quarter revenue for its 2024 fiscal year will reach at least $350 million, a year-over-year increase of 70%. Fiscal Q1 results will be released on Feb. 5.

Moreover, at the end of fiscal Q4, the company was in the process of installing 35 systems, over double the 17 that were being deployed in the previous fiscal year. This expansion illustrates that Symbotic’s revenue is likely to continue growing as new systems go online.

Currently, all of Symbotic’s revenue comes from the U.S. and Canada. To help it expand more quickly, growing internationally, Symbotic entered into an agreement with SoftBank to form a joint venture called Greenbox.

Greenbox will focus on selling Symbotic’s systems to the warehouse-as-a-service market, which caters to businesses that do not want to run their own warehouses due to cost or other factors. Greenbox committed to purchasing at least $7.5 billion in Symbotic systems over a six-year period, providing Symbotic with additional long-term revenue.

Other factors to consider with Symbotic

Like many high-growth tech companies prioritizing business expansion over profits, Symbotic operates at a loss. The company exited fiscal Q4 with a net loss of $45.4 million. However, Symbotic is working to reduce costs, and its Q4 net loss was an improvement over the prior-year period’s loss of $53.3 million.

Another factor making Symbotic a compelling growth stock is its sizable economic moat. A customer can’t easily switch providers given the complexity of Symbotic’s automation technology, the cost and effort to implement it, as well as the potential disruption to operations a switch could cause.

This means competitors are unlikely to poach Symbotic’s clients. So as Symbotic and Greenbox sign up new customers, those clients will likely remain for years.

And Symbotic can generate ongoing revenue from customers through maintenance fees and sale of upgraded technology as the company develops more advanced machinery. It’s currently on a ninth generation of robots.

Given the company’s success, its stock price is expected to move higher. The average price target for Symbotic shares among Wall Street analysts is $56.69 at the time of this writing.

With its double-digit year-over-year revenue growth, ability to capture big customers, strong economic moat, and use of AI to underpin its robotics technology, Symbotic possesses the ingredients to make a solid growth investment to buy and hold over the long term.