Dividend stocks are a great way to add value to your portfolio. Not only will a company pay you to have skin in the game, they help mitigate risk of a slumping stock price — and studies have shown that over time dividend stocks outperform non-dividend stocks.

When you find a cheap dividend stock with lots of potential upside, the results can be fantastic. Ford Motor Company (F 0.33%) is certainly an ultra-cheap dividend stock with upside you can buy today.

The long road

Make no mistake, the folks at Ford have some work to do. The company disappointed investors with its financial performance over the past year, and it’s embarking on a massive task to cut warranty costs, reduce vehicle design and complexity, and improve scale. Throw in a massive restructuring program mostly aimed at Europe, and you have a potential turnaround story in the making.

Ford is also doing a few things that bode well for investors. The company has exited or downsized unprofitable businesses — looking at you Brazil and India — and turned its focus to more profitable opportunities such as its commercial business and popular trucks, SUVs, and off-road vehicles, such as the Bronco.

The Detroit icon is also scaling up its Model e business unit, which is focused on electric vehicles. This is also a story that requires patience from investors, as a big part of its scaling may come from the BlueOval City Battery Electric Vehicle plant that opens in Tennessee next year. That said, Ford is aiming to turn a profit on its Model e unit by the end of 2026, which would be a huge boost to a company anticipating EV losses to reach a staggering $4.5 billion in 2023.

Image source: Ford Motor Company presentation.

In the meantime, Ford is using its manufacturing flexibility to step on the gas where appropriate. One recent example was Ford announcing it would cut two-thirds of jobs at the Michigan plant that produces the F-150 Lightning as EV demand softens. Some of those workers will transfer to a nearby plant where Ford is adding a third crew to increase production of the more profitable Bronco and Ranger.

Ultra-cheap dividend

While Ford embarks on its turnaround projects, and forges ahead with its EV strategy, investors have sold the stock in droves. Investors have a chance to scoop up the Detroit icon at a paltry price-to-earnings ratio of seven — and at a current dividend yield of 5.2%, it’s tempting for income investors.

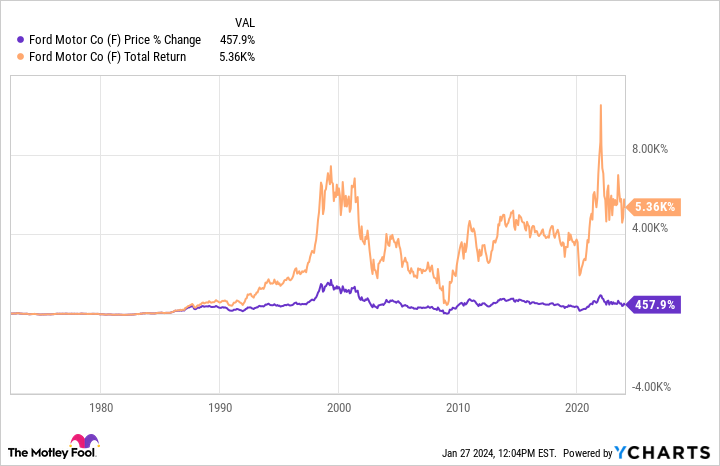

To put the power of dividends being reinvested into perspective, look at the difference between Ford’s price return alone compared to its total return with dividends included.

There’s no question Ford has struggled among its peers lately, and the company has much work to do improving its manufacturing and design complexity, reducing warranty costs, and gauging when to accelerate its EV program.

But Ford is one ultra-cheap dividend stock yielding 5% that you can scoop up today while waiting for its turnaround to gain traction.

Daniel Miller has positions in Ford Motor Company. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.