When artificial intelligence (AI) is mentioned Microsoft, Nvidia, and Alphabet are often the first stocks that come to mind. And for good reason. They’re all excellent companies, and each one, in its own way, is responsible for exciting AI innovations.

There is, however, another stock worth mentioning. Indeed, in some respects, this company’s future is riding on its ability to evolve a specific form of AI. If it fails, it may never accomplish its full potential. But if it succeeds — watch out. What’s more, according to Cathie Wood, its share price might soar to over $2,000 by 2027.

The stock is Tesla (TSLA 0.49%). Read on to see why AI is so important to the company, and whether its stock is likely to accomplish Wood’s lofty target.

Image source: Getty Images.

The $2,000 Tesla stock price target

First things first: Back in April 2023, Cathie Wood, the founder and CEO of Ark Invest, argued in a CNBC interview that Tesla’s stock could rise to between $1,400 and $2,500 per share by 2027.

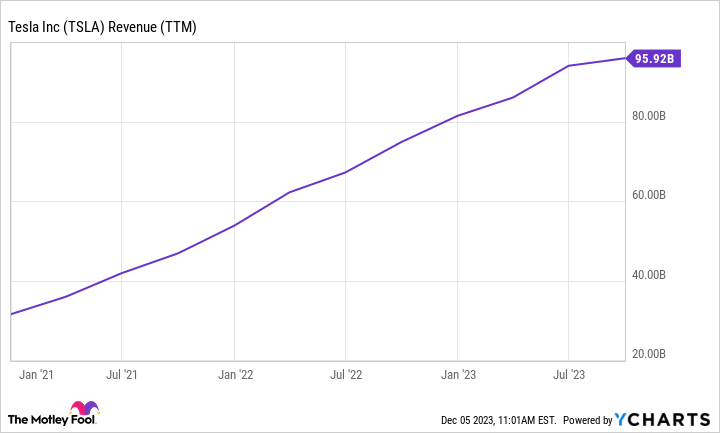

Her reasoning? An anticipated surge in Tesla revenue to between $8 trillion and $10 trillion. Bear in mind, Tesla’s trailing-12-month revenue currently stands at $96 billion, meaning revenue would need to rise roughly 100-fold to confront Wood’s projection.

TSLA Revenue (TTM) data by YCharts

At any rate, according to Wood, the bulk of the revenue growth won’t come from electric vehicle (EV) sales but from robotaxis. These would be autonomous vehicles, fueled by Tesla’s Full Self-Driving (FSD) capabilities, that would change automobiles as we know them today.

For example, rather than leaving vehicles parked in a driveway or garage for the majority of the day — as most of us do now — robotaxi owners could send their cars out to run errands, serve as taxis, and even “moonlight” as third-party delivery vehicles.

So, while the potential benefits of robotaxis are clear, questions remain for investors. Most notably: How likely is it that Tesla will evolve and deploy robotaxis, and what will success — or failure — mean for its stock?

How close is a Tesla robotaxi fleet?

For Tesla’s robotaxi fleet to set sail, three things need to happen:

- Autonomous driving must become a reality. Simply put, everything rides on Tesla achieving full autonomous driving. A robotaxi fleet would rely on safe, effective, and scalable FSD software. And while Tesla continues to make progress on FSD — the company has rolled out FSD v12 to some employee testers — it makes clear on its website that human supervision is still required: “The currently enabled Autopilot, Enhanced Autopilot and Full Self-Driving features necessitate active driver supervision and do not make the vehicle autonomous.”

- Regulators must sign off. If Tesla does evolve FSD software that makes human intervention unnecessary, regulators will still need to approve its use on the road. That could direct to long delays, as everyone from the National Transportation Safety Board, state departments of motor vehicles, and insurance boards kick the tires of the FSD software. Investors should be prepared for some issues to arise at this stage.

- Demand must confront expectations. After the technical challenges are met and the regulators are satisfied, the question becomes: Does the public want a robotaxi fleet? Will everyday people opt for a robotaxi over a vehicle driven by a human being? Will car buyers pay more — perhaps much more — for a vehicle that is fully autonomous?

Is Tesla a buy now, even without robotaxis?

There is plenty of uncertainty when it comes to Tesla and its robotaxi plans. However, if Elon Musk has proven one thing, it’s that he achieves big goals. The man has built the world’s most valuable automobile company, launched the world’s largest-ever rocket, and is the richest person on the planet.

While autonomous driving may be the biggest challenge he’s yet come up against, I wouldn’t bet against his vision. Tesla may not clear the technical hurdles to make a robotaxi fleet a reality by 2027, but that doesn’t mean robotaxis won’t happen eventually.

In the meantime, Tesla will continue ramping up production of its EVs. In the last few weeks, the first Cybertrucks rolled off the assembly line — opening a new front in Tesla’s battle against legacy automakers. Furthermore, investors shouldn’t sleep on Tesla’s energy generation and storage segment and its services segment — both of which are multibillion-dollar businesses in their own right and are growing at more than 30% year over year.

Image source: The Motley Fool.

Tesla remains a growth stock worth owning as it continues progress toward a groundbreaking AI technology that could change the world: fully autonomous driving. Challenges remain, but investors willing to ride along with Musk have been handsomely rewarded in the past. I see no reason to start betting against him now.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Alphabet, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Microsoft, Nvidia, and Tesla. The Motley Fool has a disclosure policy.