SoundHound AI could be a monster winner, but it’s a long shot.

Many investors seek small-cap stocks with the potential to dominate their niche, as their small size prevents them from being significantly owned by large firms. Additionally, because of their small size, investors will massively benefit if they see significant growth becasue they started from a small starting point.

Combine small-cap potential with an explosive industry like artificial intelligence (AI), and you have a recipe for an investment that could be unbelievably profitable. One fairly popular AI stock is SoundHound AI (SOUN 1.40%). At a recent $1.8 billion valuation, it’s slightly below the historical “small cap” threshold of $2 billion.

However, one advantage of investing in small caps is that the stocks are relatively unknown. SoundHound is already pretty popular, but does that leave room for upside?

SoundHound’s technology is finding adoption in two industries

SoundHound AI does exactly what its name suggests it does. It provides AI solutions for any product that deals with sound. SoundHound’s products have excelled in two niches: restaurants and automotive.

The restaurant industry is working to automate drive-thru and phone ordering so restaurants don’t need to staff people to do these jobs. This has huge cost savings potential for restaurants. Companies like Jersey Mike’s Subs and White Castle are implementing these technologies, and they’re becoming increasingly mainstream.

Another area where SoundHound’s products are being deployed is automotive. For years, digital assistants in vehicles haven’t been very useful and are a feature few people use. However, with SoundHound’s technology, they have become more responsive and are even being integrated with large language models, like ChatGPT, in countries like Japan.

One concern with this technology is that it requires connectivity to the internet, which isn’t always available during travel. As a result, Nvidia partnered with SoundHound to implement its technology on its vehicle-specific GPU so that this isn’t an issue.

This partnership also caused a frenzy with SoundHound’s stock, as Nvidia owns around 1.73 million shares of SoundHound. If one of the best AI investments owns a chunk of another AI company, the market is likely to take notice.

With SoundHound no longer an unknown small-cap stock, is it still worth a buy?

SoundHound isn’t a surefire investment

SoundHound has been growing at a healthy pace, with its Q4 revenue coming in at $17.1 million, indicating 80% year-over-year growth. However, what investors are most excited about is SoundHound’s backlog. Its revenue backlog grew to a whopping $661 million, indicating it has a massive amount of business in the pipeline.

However, this isn’t guaranteed revenue, as there’s no telling when it will be recognized.

Additionally, the AI space is full of competition. It wouldn’t take much for an AI giant like Alphabet or Microsoft to task a small chunk of its company to develop a solution rivaling SoundHound’s and likely drive it out of business. For example, OpenAI (partnered with Microsoft) already has the technology to do real-time translation. If it can perform that, then it can likely understand someone ordering at a restaurant or asking a digital assistant in a car.

Furthermore, SoundHound’s business is far from profitable. The company posted an operating loss of $12.4 million, or about a 73% loss margin. Losses like that can’t go on forever, especially when there’s only $100 million in the bank.

Lastly, while many small-cap stocks fly under the radar, giving them attractive valuations, SoundHound’s stock is quite expensive.

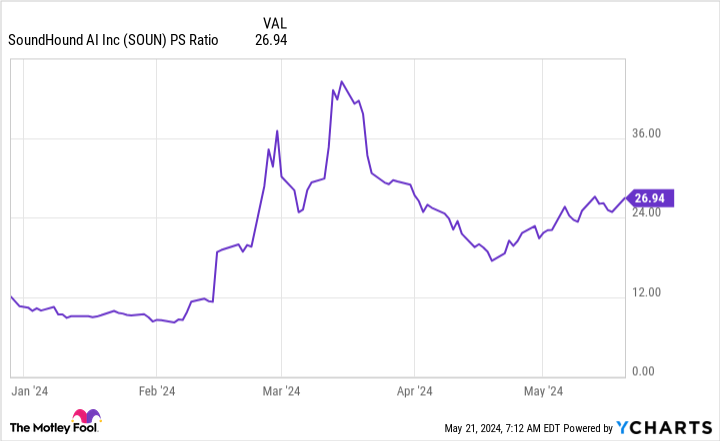

SOUN PS Ratio data by YCharts

At 27 times sales, the stock already has a fair bit of success baked into the price.

As a result, I think I’ll pass on SoundHound’s stock for now. But if you’re still interested, consider this investment more like a lottery ticket. It may work out or not, so your expectations should be set accordingly. This investment could go to zero if an AI giant like Alphabet or Microsoft decides to enter this field.