Over much of the last decade, investors rewarded technology companies for spending heavily on growth initiatives even at the expense of profitability. The strategy was to attract as many users and customers as possible, and then monetize them later.

But the economic winds have shifted, and interest rates are no longer near zero. Running enormous losses is riskier for tech companies today because financing costs are much higher. It’s also harder to raise fresh equity funding because investors can earn attractive risk-free returns on bank deposits and Treasury bonds.

As a result, the tech sector has shifted its focus to delivering profits even if it means generating more moderate rates of customer growth. Music and podcast streaming giant Spotify Technology (SPOT 1.42%) is one company pulling off this transition masterfully, and although it still has work to do, investors have sent its stock soaring 27% in 2024 already.

If you’re sitting on idle cash — money you don’t need for immediate expenses — here’s why it might be a good idea to allocate $250 toward one share or so of Spotify, with the goal of holding it for the next decade.

Image source: Getty Images.

Spotify has conquered music streaming, so it’s expanding

Spotify is the largest player in the music streaming industry with an estimated 30% market share, compared to second-place Apple Music at just 13% (according to Statista). Most platforms feature similar music catalogs with comparable monthly subscription prices, so differentiation between them mostly comes down to technology and secondary content offerings.

Spotify invests heavily in both of those things. In 2023, it launched the artificial intelligence-powered AI DJ, which curates playlists based on users’ preferences and uses a software-generated voiceover to deliver commentary. Spotify also launched Clips, a short-form video feature that allows artists to reach out to their fans in a more engaging way.

Over 40,000 artists used Clips to thank their fans during the 2023 Spotify Wrapped campaign, and they generated 725 million views with over half coming from users in Generation Z. Short-form video is the content format made popular by TikTok and Meta Platforms‘ Instagram Reels. It’s known to attract younger users, so it’s no surprise Clips is hitting all the right notes for Spotify.

2023 was also a milestone year for Spotify beyond music, because it became the second-largest audiobook platform behind Amazon‘s Audible. Premium subscribers can enjoy 15 hours of audiobook listening per month, but they can pay extra to top up, which creates a new revenue stream for Spotify. The platform now features over 375,000 titles, with more growth to come.

Plus, Spotify is already the top platform for podcasts, but the company just renewed its deal with Joe Rogan, who hosts The Joe Rogan Experience. It’s arguably the world’s most popular podcast, and Spotify will distribute it across multiple platforms for the first time, which will allow it to generate more advertising revenue.

Record users, record revenue, and a shrinking operating loss

Spotify had a record 602 million monthly active users at the end of 2023, representing a 23% year-over-year increase. 236 million users were paying for premium monthly subscriptions, and 379 million users were on the free plan, which is supported by advertising. The premium figure was 1 million above Spotify’s forecast, which is important because those users account for the majority of the company’s revenue.

It booked a record $14.2 billion in revenue during 2023, a 13% increase compared to 2022. However, the company’s operating costs only grew by 7.2% which helped it shrink its operating loss by 32% to $480 million.

In December, Spotify slashed 1,500 jobs — 17% of its total workforce. That followed 800 job cuts throughout 2023, and it really highlights the company’s newfound focus on cost management.

Spotify absorbed around $154 million in impairment charges during the fourth quarter relating to layoffs and efficiency measures. Without those charges, the company would have delivered an operating profit of $73 million, reducing its full-year operating loss to $326 million.

For the current quarter, Spotify expects to deliver an operating profit of $194 million as it reaps the benefits of its slimmer cost structure. The company doesn’t offer full-year guidance, but that would be a great first step toward a positive annual result.

Why Spotify stock is a buy for the long-term

Spotify stock soared by 138% in 2023, and it’s up a further 27% so far in 2024. However, it’s still trading 34% below its best-ever level, which it hit during the tech frenzy of 2021 — despite the company’s user base and revenue increasing significantly since then.

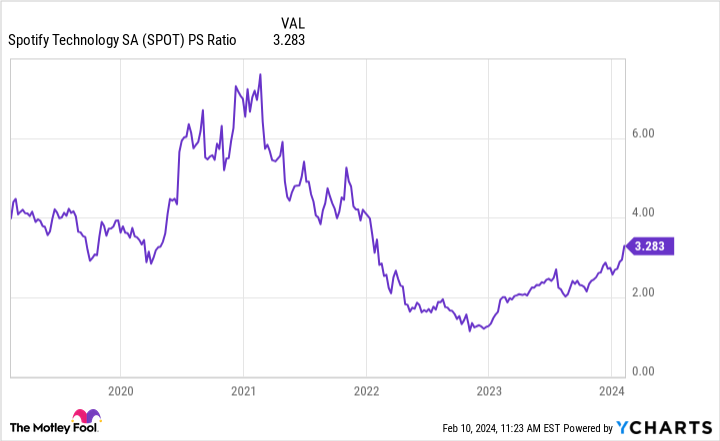

In fact, based on Spotify’s $14.2 billion in 2023 revenue and its current market capitalization of $47 billion, its stock trades at a price-to-sales ratio of just 3.2, less than half of its peak valuation.

SPOT PS Ratio data by YCharts.

Here’s the good news for long-term investors: Spotify has its sights set on reaching 1 billion users by 2030. That could be accompanied by an even stronger increase in revenue thanks to the company’s expanding suite of content beyond music, and because its platform will become more attractive to advertisers as its user base grows.

Plus, as is the case with most subscription-based streaming platforms, Spotify will benefit from gradual price hikes over time which will boost its revenue per user organically.

As the dominant player in music and podcasts with rock-solid revenue — and profitability potentially on the horizon — Spotify stock could be a fantastic investment over the next decade and beyond.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Meta Platforms, and Spotify Technology. The Motley Fool has a disclosure policy.