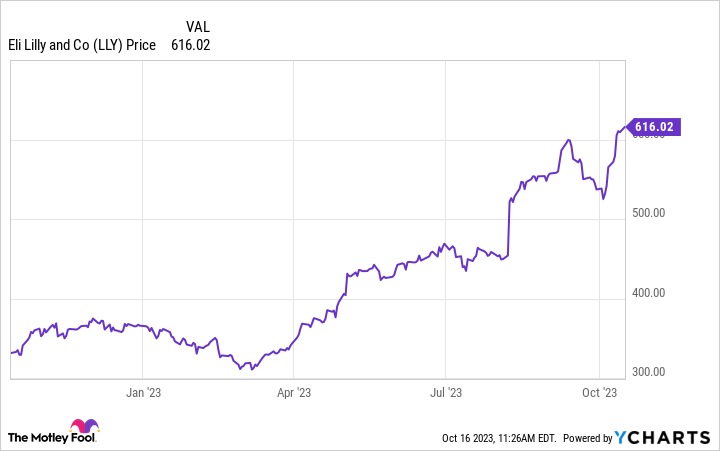

Over the past year, biotech giant Eli Lilly (LLY -0.18%) has been crushing the market. The company’s performance has been so strong that some might think they have missed the boat and that it’s too late to get in on this leading drugmaker. But that’s not the case. Eli Lilly continues to give investors reasons why it might deliver outsize returns for at least the next half a decade, if not much longer.

Let’s consider why the company’s shares are a buy, even though they aren’t far from their 52-week high.

Obesity care will be a massive tailwind

Eli Lilly has long been a leader in the diabetes and obesity drug markets. Last year’s approval of Mounjaro, a diabetes therapy, started a new era for the company. Mounjaro could become one of the most successful medicines ever in terms of sales. Of course, that depends on several factors, including the following two.

First, Mounjaro needs to earn plenty of label expansions. Second, insurance coverage for the therapy could help make it more accessible, leading to higher sales over the long run. Things seem to be going just fine on both fronts. Earlier this year, Mounjaro reported solid results in late-stage clinical trials in targeting weight loss in diabetes patients. The U.S. Food and Drug Administration (FDA) is currently considering Mounjaro in this indication.

While some physicians are already prescribing Mounjaro off-label to help their patients control their weight, formal regulatory approval is always important. Here’s one more indication Mounjaro could earn: treating chronic kidney disease in diabetes patients. Recently, one of Mounjaro’s biggest competitors, Ozempic, marketed by Eli Lilly’s biggest competitor, Novo Nordisk, reported positive results in treating chronic kidney disease in a clinical trial, which was halted early as a result.

Ozempic and Mounjaro are GLP-1 agonists that mimic the GLP-1 hormone in the body’s digestive system, which is responsible for various digestion-related functions. One of the main goals is to control patients’ blood sugar levels. Mounjaro is also a GIP agonist, which mimics the GIP hormone and also helps keep blood glucose levels in check through a different mechanism. Mounjaro is the first dual GIP and GLP-1 agonist approved to treat type 2 diabetes.

The market thinks Ozempic’s success in treating chronic kidney disease in diabetes patients is an excellent sign that Mounjaro will also be successful.

Now concerning insurance coverage, a recent poll conducted by Accolade, a health program provider for companies, found that the number of U.S. employers covering weight loss medications could double in 2024. Polls aren’t always accurate, but given the strong demand for obesity therapies — Novo Nordisk had trouble meeting demand for Wegovy, another medicine in this area — and the growing obesity and diabetes problem, greater coverage for these medications seems very likely.

What it means for investors

While Eli Lilly’s diabetes and obesity care medicines will be the most important in the medium term, the company will also have other growth drivers. The FDA is considering donanemab as an Alzheimer’s disease treatment, another area with significant need. Thanks to these and other products, Eli Lilly’s revenue should grow much faster than most other biotech giants in the next five years.

Analysts see the company’s top line increasing at an average of 27% per year through the next five years. If it increases by half of that in this period, that would still be an excellent performance for a biotech company of this size. Strong revenue growth isn’t all Eli Lilly will offer — the company’s dividend should also continue to be impressive after doubling in the past five years.

True, Eli Lilly’s dividend yield is just 0.74% — that will sometimes happen when a company’s impressive dividend growth can’t keep up with its even more impressive stock performance. However, investors shouldn’t worry that the biotech will soon suspend its payouts. Given Eli Lilly’s excellent underlying business, solid revenue and earnings, innovative potential, and dividend program, its shares remain a buy even as they continue scorching broader equities.