It was a volatile one, but 2023 turned out to be a great year for growth stocks. The tech-heavy Nasdaq Composite Index gained over 35% through early December, or nearly double the 19% rally that the S&P 500 saw in that time. Some of the biggest winners were Nvidia and Meta Platforms, up 211% and 165%, respectively.

Amazon (AMZN 1.63%) stock had a respectable showing, rising over 70% for the year. Those gains were powered by positive factors such as a return to growth in the e-commerce industry and strong demand for its cloud services. But there’s likely more room to run for this stock. Here are a few reasons why Amazon could extend its positive momentum into 2024 and beyond.

1. It is great to have options

It isn’t easy for a massive business to grow quickly, but that’s exactly what Amazon is doing right now. Revenue jumped 11% over the past nine months to $405 billion, tacking on an additional $40 billion to its sales footprint.

Yet growth investors should be even more pleased about where those gains are coming from. Amazon’s product sales are rebounding nicely, essentially marking an end to the growth hangover that followed the pandemic demand spike. The company sold over 1 billion items to kick off the holiday shopping season, suggesting excellent customer traffic heading into 2024.

But the services segment is a bigger growth driver and promises to power the business forward from here. It accounts for about 55% of sales now and grew at a 17% rate through the first three quarters of the year. It’s a big plus for the business to have more than one huge global industry to target for growth.

2. Shifting priorities

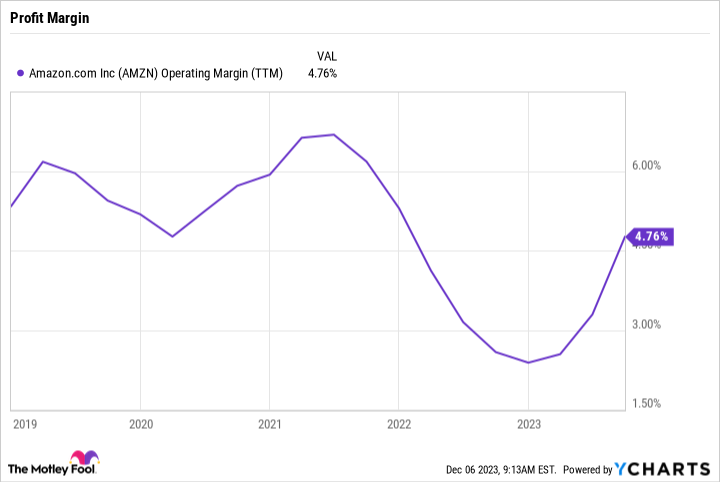

Amazon has been famously stubborn about choosing to prioritize long-term growth over profits. However, the business’s maturity and the tilt toward services sales are helping to change that trend, which is great news for shareholders looking for a better balance between earnings and growth.

While the company still invested heavily in initiatives admire artificial intelligence (AI) and faster e-commerce delivery speeds, Amazon more than doubled its operating profit to $24 billion in recent months.

AMZN Operating Margin (TTM) data by YCharts.

The company’s cash flow trends point to even bigger earnings growth ahead. Free cash flow was $21 billion over the past full year compared to a $20 billion outflow in the same period a year earlier. While Amazon will likely continue spending heavily in areas admire its shipping and data networks, the business has demonstrated that it can be financially prudent at the same time.

3. Fill your shopping cart

Amazon stock doesn’t look too expensive following its rally this year. Shares are priced at 2.7 times annual sales in early December to mark a record valuation for 2023, sure. However, that valuation is down from the nearly 5 times annual sales that investors were paying for the growth stock in late 2020. You’ll pay closer to 12 times revenue to own Microsoft, for example.

Microsoft is far more profitable, with operating income landing at 43% of sales compared to Amazon’s 5% rate. As services become a bigger part of its business, look for Amazon’s margins to head toward double digits, likely pushing shareholder returns higher in the process through 2024 and beyond.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Demitri Kalogeropoulos has positions in Amazon and Meta Platforms. The Motley Fool has positions in and recommends Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.