This longtime winner should keep doing just that.

Artificial intelligence (AI) has been garnering plenty of headlines over the past 18 months. Though the technology has been around for a while, recent breakthroughs could lead to massive innovations. The companies that lead the pack in this space will be rewarded.

There are plenty of businesses investors could consider if they want to profit from the AI boom. Let’s examine one of them: Microsoft (MSFT -0.74%). The tech giant could be a winner in AI over the long run and deliver market-beating returns along the way.

The company that started all

AI’s recent momentum arguably began with the November 2022 launch of ChatGPT, a generative AI platform created by the privately held, Microsoft-backed company OpenAI. ChatGPT quickly became one of the fastest-growing apps ever, gaining more than a staggering 100 million users in just five days. OpenAI’s success was clear proof that Microsoft was right to invest in the company. That’s why the tech giant decided to double down. In January 2023, Microsoft announced a new multiyear, multimillion-dollar deal with OpenAI.

This makes sense. The generative AI landscape is rapidly evolving, with competitors popping up left and right. The market is set to expand quickly in the coming years. According to some analysts, it could clock a compound annual growth rate of about 42% through 2032. Microsoft is looking to help its partner stay at the top of the field, which could have a massive payoff for both companies down the road.

Cloud computing and AI

Microsoft added ChatGPT to its search engine, Bing, in an attempt to disrupt Google’s empire, but to no avail. The company’s move did little to challenge Google’s dominance in online search. However, Microsoft isn’t just relying on a partner it invested in to make a dent in the AI market. The company is offering AI services through its cloud computing platform, Azure. Microsoft trails only Amazon in the cloud market, which should be another important long-term growth driver.

In the second quarter of its fiscal 2024 (ended Dec. 31, 2023), Microsoft’s total revenue of $62 billion increased by 18% year over year. However, Azure revenue grew almost twice as fast at 30%. Microsoft reported that it has 53,000 customers using its cloud platform. Furthermore, management says that more than one-third of these customers were new to Azure over the previous 12 months. In other words, Microsoft is managing to attract brand-new customers to its cloud platform thanks to its AI offerings.

To be clear, this isn’t a significant growth driver for the tech company yet. However, that could change eventually given AI’s rapid rise and Microsoft’s highly innovative potential.

AI and beyond

Microsoft isn’t just an AI play. The company’s overall business is solid. It remains the leader in providing computer operating systems. Its productivity software suite, from Excel to Teams, plays an integral part in the day-to-day operations of millions of businesses. That grants Microsoft switching costs, a powerful competitive advantage. That’s to say nothing of the company’s brand name, which is one of the most valuable worldwide. Microsoft is also a leader in gaming.

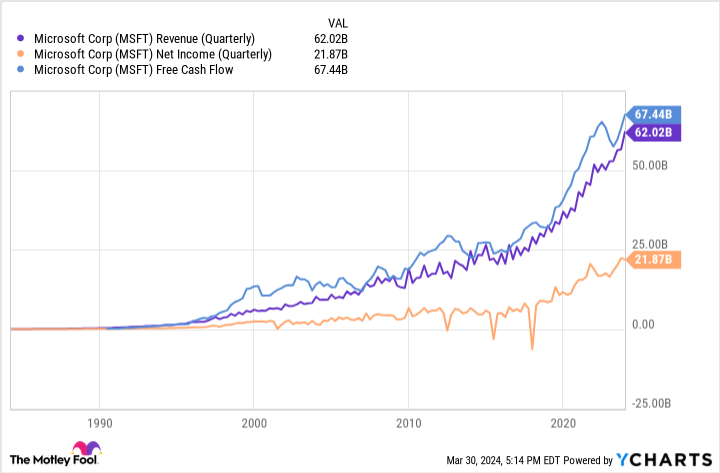

But what makes the stock a good forever pick? It has an incredible track record of innovation, leadership in multiple industries with massive growth potential, and the ability to generate solid earnings and cash flow. It is difficult to argue with great results — precisely the kind Microsoft has been delivering for decades.

MSFT Revenue (Quarterly) data by YCharts

Here’s another perk of investing in Microsoft: It is a terrific dividend stock. Though its forward yield isn’t impressive at 0.71%, Microsoft has raised its payouts by 168% in the past decade. The company’s cash payout ratio of 30.75% shows it has plenty of room to hike its dividend further.

Whether they’re seeking growth or passive income, Microsoft should deliver exactly what investors want for years to come. It is an outstanding stock to buy and forget.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has positions in Amazon. The Motley Fool has positions in and recommends Amazon and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.