The latest earnings update for McDonald’s (MCD 0.38%) gave investors plenty to chew on. The fast-food giant announced mostly positive results in late October, with comparable-store sales rising at a healthy rate across most of its major markets.

On the downside, consumer spending has slowed in recent months as inflation, rising interest rates, and higher housing costs pressure budgets. But there’s also a major positive in the chain’s third-quarter operating trends. Let’s review that green flag in the context of wider industry challenges.

Growing through difficulties

McDonald’s announced solid revenue trends, with comparable-store sales rising 8% in the core U.S. market. That result marked a slowdown compared to the prior quarter’s 10% spike. But it kept the company on pace to meet management’s 2023 targets despite a shaky spending atmosphere. “The macroeconomic environment is unfolding in line with our expectations for the year,” CEO Chris Kempczinski said in a press release.

Look a bit closer and you’ll see a subtle but important shift in those growth trends. In Q2, management celebrated the fact that McDonald’s had achieved a balance between rising average spending and increased traffic. Yet growth only came from higher spending this quarter. “We had a slight dip in traffic … in Q3,” Kempczinski said in a conference call with analysts.

The good news

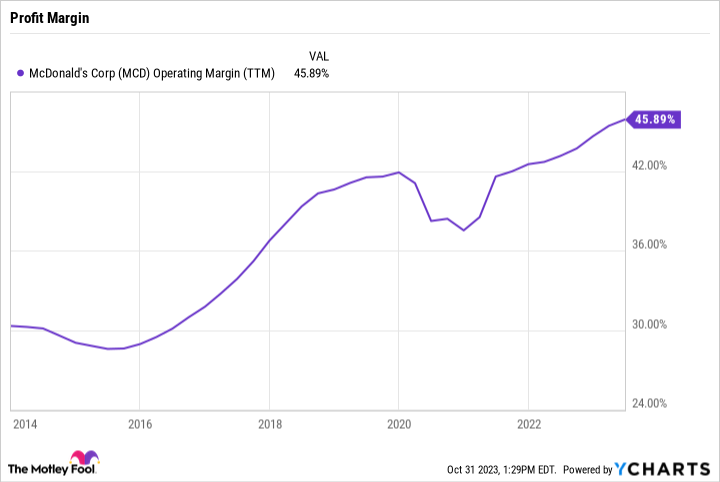

The good news is that McDonald’s didn’t have to ramp up its promotions to keep sales rising as consumers became more price sensitive in recent months. On the contrary, its profit margin is still climbing. The core operating profit margin metric improved to 48% of sales over the past nine months — up from 45% a year earlier. And it has reached nearly 46% over the trailing 12 months.

MCD Operating Margin (TTM) data by YCharts

Management is predicting that profitability will remain strong through the close of the year as well. Margins should land near a record high of 47% of sales thanks to the combination of rising prices, cost cuts, and increased sales.

The big question going forward is whether fast-food rivals will start cutting prices as they jockey for market share while customer traffic weakens. That hasn’t happened yet, but if it does, McDonald’s would have to participate to remain competitive. When choosing between higher profits and maintaining customer engagement, McDonald’s will always pick the latter.

Looking ahead

Meanwhile, look for the chain to work to capitalize on its relatively low-priced dining options as consumers look to save cash into early 2024. “The McDonald’s brand and our positioning on value is an opportunity for us,” according to Kempczinski.

Its larger selection means the chain can exploit that opportunity to a greater extent than some peers like Chipotle. And its industry-leading profit margin also gives management flexibility to invest in growth initiatives like marketing and store remodels.

Investors should still follow the operating profit margin metric for signs that a pricing war is brewing in the fast-food market. McDonald’s wouldn’t be hurt much by that development, but it could pressure the chain’s historically high profit margin into the 2024 fiscal year.