Sometimes it can take painstaking patience to be a growth stock investor. A stock may spend multiple years in the gutter even though its business fundamentals are consistently improving. This can be a frustrating experience, but it can provide fantastic buying opportunities for investors with an extended time horizon.

Coupang (CPNG 1.33%) describes this bifurcation to a T. The stock is down 67% from all-time highs set right after its initial public offering (IPO) in 2021 even though its business is thriving. The South Korean e-commerce giant is expanding its margins, rapidly growing sales, and dominating local competitors.

Here’s why 2024 could be a perfect time to buy shares of Coupang stock.

Replicating Amazon in East Asia

Coupang has rapidly scaled its e-commerce platform in South Korea over the last decade. Stealing the playbook from Amazon, Coupang has built out a vertically integrated delivery service and supply chain for online sellers, while also offering an Amazon Prime-like subscription service called Rocket Wow. The service now has around 10 million members, or around 20% of the South Korean population. Members get benefits like free shipping, a video streaming service, and discounts on food and grocery delivery.

With a compelling value proposition well above any e-commerce competitor in South Korea, it is no surprise to see Coupang’s customer base grow to new heights. Last quarter, it hit 20 million active customers, up 14% year over year. Importantly, active customers are spending more each quarter, with revenue per active customer up 7% to $303 in Q3 2023. This led Coupang’s Product Commerce segment — which is its main e-commerce offering in South Korea — to grow revenue by 21% year over year to $6 billion in the third quarter.

These are impressive numbers, but it looks like there is still plenty of room for Coupang to grow in its home market. South Korea’s retail spending is expected to be over $500 billion by 2026, if not sooner. This means there is no chance Coupang hits market saturation anytime soon, with a ton of potential to gain share versus competitors in the coming years.

Expansion into Taiwan, other business lines

Coupang is more than just online shopping. It also runs a food delivery business called Coupang Eats, which sits on top of its delivery infrastructure. Don’t forget its Rocket Grocery service, either, which delivers fresh groceries to customers in as little as a few hours.

These initiatives expand the total addressable market for Coupang in South Korea. There is also the potential for bundling services. For example, Coupang now offers discounts on Coupang Eats for its Rocket Wow subscribers. None of its food delivery competitors can replicate this scaled offering, giving Coupang an advantage in attracting shoppers and eaters.

Perhaps more important will be its new venture outside South Korea. Management sounded extremely optimistic when talking about its recent entrance into the Taiwan market on its recent conference call and plans to invest heavily in the country. This will require a lot of up-front spending but should have good returns on invested capital.

We are already seeing strong growth, with Coupang’s Developing Offerings segment growing revenue by 41% year over year last quarter.

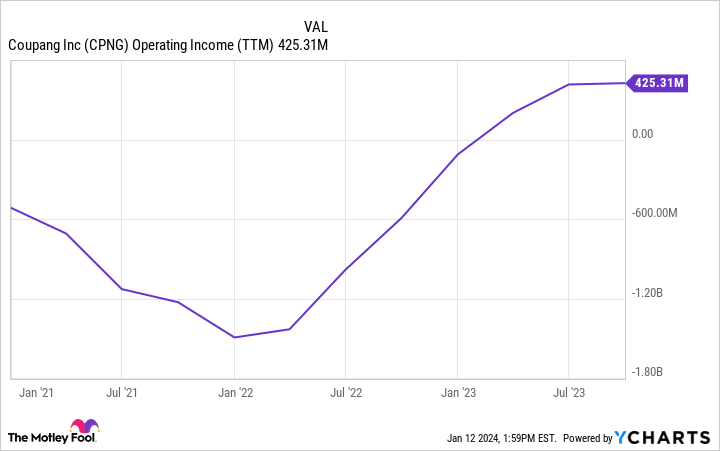

CPNG Operating Income (TTM) data by YCharts

If you have patience, the stock is cheap

The most exciting thing about Coupang is the fact it is demonstrating profitability even while its stock remains way below all-time highs.

Gross margins continue to climb higher. Operating income over the last 12 months was $425 million. That is compared to an operating loss of over $1 billion at the peak of Coupang’s rapid infrastructure build-out. The e-commerce giant is finally reaching scale and showing it can generate a profit for shareholders while still investing in unprofitable new segments like Taiwan, food delivery, and even financial technology projects.

Over the long term, Coupang expects its business to hit 10% margins. Over the last 12 months, it has generated $23 billion in revenue, which equates to $2.3 billion in earnings at a 10% margin. With the stock down 67%, it now trades at a market capitalization of $30 billion. That would put the stock at a price-to-earnings ratio (P/E) of 13 if it had a 10% profit margin, which is around half the S&P 500 average.

Of course, Coupang isn’t guaranteed to hit a 10% profit margin. But it is growing quickly, dominates e-commerce in South Korea, and is already showing solid margin expansion. It doesn’t come without risks, but Coupang stock looks like a fantastic buying opportunity as we move further into 2024.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Amazon and Coupang. The Motley Fool has positions in and recommends Amazon and Coupang. The Motley Fool has a disclosure policy.