PayPal (PYPL 0.87%) and Block (SQ 4.56%) are two of the most popular fintech stocks today. Both have market caps of about $50 billion to $60 billion. Both have strong histories of growth. And both have plenty of growth potential.

One stock, however, is a much better buy today.

PayPal bets $5 billion on itself

PayPal the company does not need much introduction. Spun off from parent company eBay in 2015, the company has amassed more than 400 million global users. From e-commerce transactions to paying back friends, almost everyone has either used PayPal personally or knows someone who has.

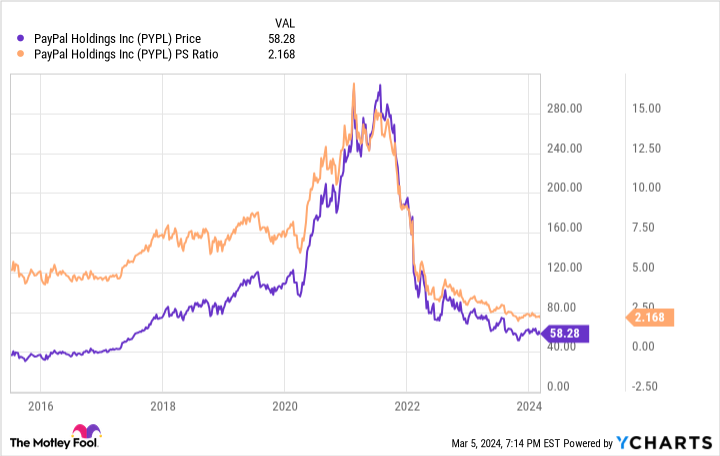

PayPal the stock has a more volatile history.

After its split from eBay, PayPal stock zoomed in value, from $40 per share to $300 per share in just three years. Since those all-time highs, however, the share price has cratered. PayPal shares now trade at 2017 prices.

PayPal stock now trades at just 2.2 times sales — a popular valuation metric for growth stocks. That’s the cheapest shares have ever been.

Management has noticed the decline in valuation, opting to invest $5 billion in share repurchases. By buying back its own stock at discounted prices, the company hopes to double down on a turnaround.

There’s only one problem: PayPal has been here before. The company has already spent $15 billion in share repurchases since going public in 2015. These buybacks were executed at prices much higher than today, meaning they destroyed shareholder value.

PayPal isn’t going anywhere as a company, but don’t be fooled into thinking the cheap valuation multiple is a clear buy signal. The reason the shares are cheap is that the company’s best days of growth probably are behind it. In fact, its user base has been shrinking the past two years.

The shares might be a worthwhile value at today’s depressed prices, but there’s a better choice for growth investors — a stock with a turnaround story already in action.

This is the fintech stock worth betting on

Block has faced its own struggles. The company — traditionally a payment processor, but more recently an investor in other areas like the peer-to-peer payment service Cash App, music platform Tidal, and a host of blockchain-related ventures — has similarly seen its stock price crater after a slowdown in growth and a drop in profitability.

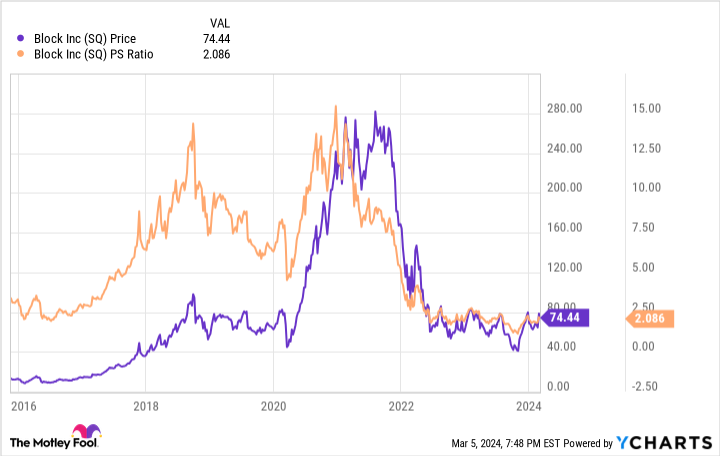

On a price-to-sales basis, Block stock is actually cheaper than PayPal, trading at 2.1 times sales. But as we’ll see, the underlying business is much stronger.

The first advantage that Block has over PayPal is higher growth rates.

Whereas PayPal’s business is shrinking according to some metrics, most of Block’s segments are experiencing strong growth. Block, for example, has 56 million monthly users on its Cash App. While growth has slowed significantly in recent quarters, the company continues to increase this user base.

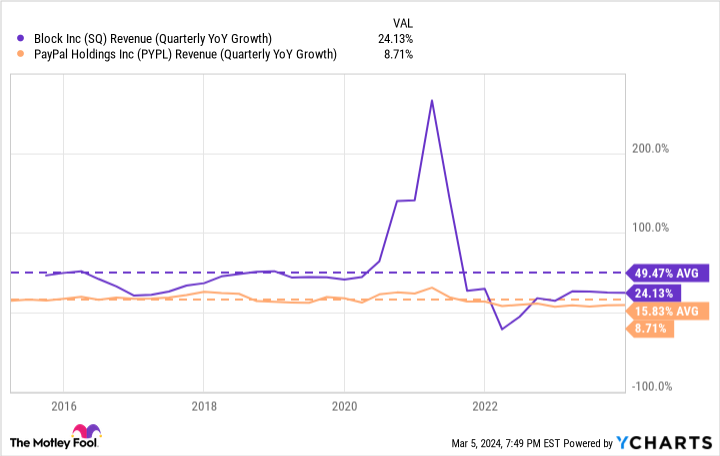

Continued user growth has allowed Block to maintain revenue gains that are much bigger than what PayPal has achieved, even during its days as a hot stock after becoming an independent company.

SQ Revenue (Quarterly YoY Growth) data by YCharts

Block is also better positioned for future growth.

As the company’s name suggests, Block has made big bets on emerging blockchain technologies like Bitcoin. Users of its Cash App can already buy, sell, and transact in Bitcoin. Its Square payment processing platform, meanwhile, is poised to bring cryptocurrency transactions to the masses. Whereas PayPal is defending a plateauing business model, Block is positioned to capitalize on growth trends like the adoption of cryptocurrencies.

Why then is Block stock cheaper than PayPal?

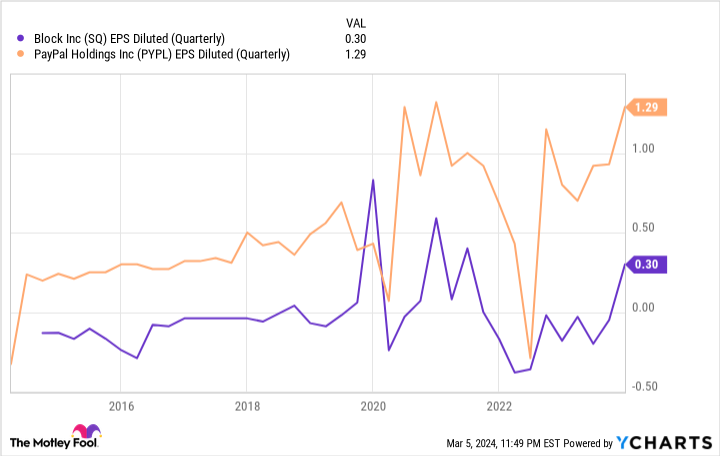

For most of PayPal’s public history, the company has been profitable, racking up billions in free cash flow — the reason it has been able to fund its historical share buyback programs.

Block, meanwhile, has been unprofitable in recent years. When the shares spiked in 2020, however, the company had posted several quarters of profitability. This is what the market came to expect, until a string of quarterly losses sent the stock price tumbling.

SQ EPS Diluted (Quarterly) data by YCharts

As a whole, Block is less profitable than PayPal, but that’s palatable as long as growth rates remain high. The market, after all, is willing to fund a rapidly growing company. When growth rates slow, however, the market suddenly becomes less willing to cover losses.

Last September, Block co-founder Jack Dorsey rejoined Block as the chief executive officer with one mission: return the company to profitability. It didn’t take long for this vision to be realized. In February, the company posted its first net profit in two years, albeit a small one.

With a return to profitability, expect Block’s valuation multiples to pick up, especially if this feat is repeated in subsequent quarters. A high-growth stock that’s profitable, no matter how small, deserves a higher multiple than 2.1 times sales in this market.

Between PayPal and Block, Block stock is the clear winner for investors right now.