Procter & Gamble (PG 0.33%) just gave investors some more reasons to like its stock this year. Management’s mid-January earnings update contained good news regarding sales and earnings trends. The fiscal Q2 report showed that organic sales are on track to expand at a decent clip following big gains last year. Profits are rising at an even faster pace thanks to price increases along with the consumer staples giant’s stellar operating efficiency.

Those factors all suggest that P&G stock can beat the market in 2024 after trailing the Dow Jones Industrial Average this past year. Moreover, investors should be even more excited about the company’s prospects for boosting its dividend in just a few months.

The latest results

Dividend increases are ultimately driven by operating and financial momentum, and that is proving to be strong heading into the second half of P&G’s fiscal year. Sure, organic sales rose 4% in Q2 to mark a slowdown compared to the prior quarter’s 7% spike.

Yet, it was a relief for Wall Street to learn that sales volume trends remained steady through late December. P&G also confirmed its wider sales outlook and boosted its 2024 earnings forecast. “We delivered strong results in the second quarter, enabling us to raise our core EPS growth guidance and maintain our top-line outlook,” CEO Jon Moeller said in a press release.

Funding the dividend

P&G’s profits are much stronger than they might appear at first glance. While reported earnings in Q2 dropped 12%, that slump was driven by one-time restructuring charges. Strip out those factors and gross profit margin was up a robust 6 percentage points.

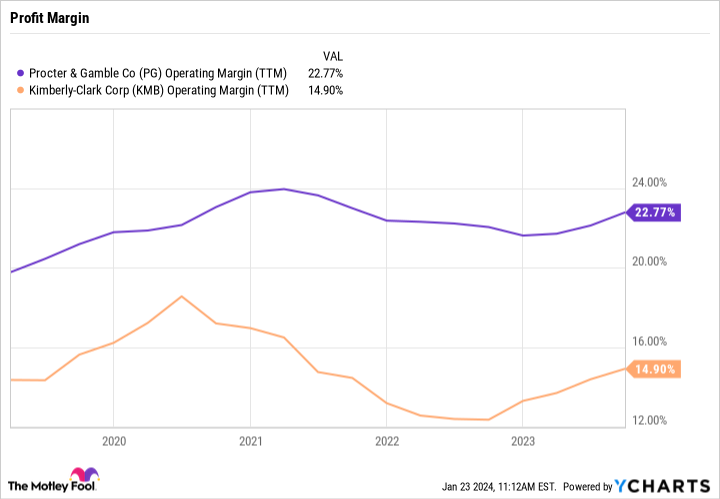

PG Operating Margin (TTM) data by YCharts

Operating profit margin jumped by 5 percentage points as well to keep P&G well ahead of peers like Kimberly-Clark. Cash flow productivity, a big priority for management, is trending well above its goal of 90%. P&G converted 95% of adjusted earnings into free cash flow this past quarter. All of these factors should make it easier for executives to decide on a relatively generous dividend hike for the 2024.

Bigger than the last raise?

P&G usually announces its annual dividend increase in April, around the time that it reports fiscal Q3 results. Last year, the hike was a modest 3%, but there were some key differences in the fiscal 2023 operating trends. Organic sales were on track to rise by about the same 5% that management is expecting this year. But earnings were forecast to climb by just 6% back then due to soaring costs for raw materials and transportation.

In contrast, P&G just upgraded its profit outlook to call for between 8% and 9% growth in fiscal 2024. Assuming those positive trends hold through the fiscal third quarter, investors might expect to see a modestly bigger dividend boost of closer to 4% or 5% this April.

In any case, it’s almost assured that P&G will announce its 68th consecutive annual payout increase in a few short months. That streak is one of the longest on the market and reflects its dominant industry position in dozens of product categories, ranging from paper towels to laundry detergent, that consumers use daily.

The next increase will be a great reason to like the stock, but income investors don’t have to wait until it is announced before establishing a position in P&G shares for 2024 and beyond.