Khanchit Khirisutchalual/iStock via Getty Images

Introduction:

Reaves Utility Income Trust (NYSE:UTG) is a closed-end fund, or CEF, incepted in Feb. 2004. As the name indicates, the fund invests mostly in utility companies in the form of common stock as well as preferred and debt securities.

As per the fund’s literature:

“Its investment objective is to provide a high level of after-tax income and total return consisting primarily of tax-advantaged dividend income and capital appreciation. The Fund pursues this objective by investing at least 80% of its total assets in dividend-paying common and preferred stocks and debt instruments of companies within the utility industry. Up to 20% of the Fund may be invested in the securities of companies in other industries.”

Other salient features of this fund are as follows:

- Focused on utilities, traditional communication, and other essential infrastructure-related companies.

- The fund seeks to deliver tax-advantaged dividend income

- The fund takes pride in delivering consistent income for the last nearly 20 years and has increased the monthly distributions from $0.09 at the time of inception to the current $0.19 a share. Besides, it has provided special distributions in some years. It has distributed over $1.3 billion in distributions over the years.

- The fund uses roughly 20% leverage to enhance the potential for generating income.

- Concentrated but fairly diverse exposure: The fund is invested in roughly 55 securities; however, the top 10 holdings constitute nearly 42% of the assets. Roughly 58% (of the assets) are invested in utilities, 20% in traditional communication companies, and the rest in real estate, energy, and industrials.

- As of Sep. 30, 2023, the fund had roughly $1.87 billion worth of assets under its management.

- The fund is an actively managed fund and has an expense ratio of 1.42%, which includes the base expense of 1.03% and interest fees of 0.39%. However, the interest component (on leverage) has been on the rise due to the high interest rate environment. Based on the last semi-annual report, the expense ratio works out to be 2.28%, out of which 1.30% was due to the interest expense.

- As of Dec. 19, 2023, its distribution yield on the market price was 8.47% and 8.51% on the NAV.

- As of Dec. 19, 2023, UTG’s market price commanded a small premium of 0.52% to its NAV., which is nearly the same as the 6-month average discount/premium of +0.35% and the 3-year average of +0.78%.

Is the UTG fund a better investment than a Utility Index ETFs?

So, why invest in a fund like UTG, with its high fees, when you can buy a utility index fund (or equivalent ETF) at much lower fees? Well, we think there are two reasons: it is a great fund for income seekers with its consistent, monthly, and reliable high-income, and also matching (if not better) total returns. From Jan. 2005 until Dec.19, 2023, UTG has delivered an annualized return of 8.94%, compared to 8.15% from Utilities Select Sector SPDR ETF (XLU) and 9.47% from the S&P 500 (SP500). However, please note the S&P500 is not the right benchmark for UTG.

Who should invest in UTG over a Utility Index fund?

So, you should prefer UTG over XLU or any other Utility sector-based ETF if:

- Income (from investment) is very important for you and is either needed right now or will be needed in the next few years.

- Do not like the idea of selling shares (of an investment) to raise income, as it causes too much uncertainty and emotional stress.

- If income is more important to you than the growth of capital, then this fund is for you.

Financial Outlook:

Let’s look at the Fund’s Financial health and performance. The most recent detailed report that is available to investors is the semi-annual report for the period of Nov. 2022 – Apr. 2023. The annual report as of Oct.30. 2023 is already due but not available as of yet (likely to be available in Jan. 2024).

Net Investment Income:

The net investment income (or NII in short) is the net income that a fund earns from its investment in the form of dividends, distributions, and interests minus all of the fund’s expenses, including management fees, operating expenses, commissions, and interest on leverage. For equity-based funds, especially in high-growth sectors like Technology, the NII is not very relevant. However, for the Utility sector and funds like UTG, it is much more relevant, even though UTG is also invested in the equity of Utility companies. The main reason is that utility and communication companies usually are slow-growing companies but pay much higher dividend yields.

Here is what it looks like in terms of NII, Distributions, and Net Assets at the beginning and end of the statement period.

(all amounts are in US $ (except Shares Outstanding) for the 6-month period; negative amounts are shown inside parentheses, per the semi-annual report, six months ending Apr.30, 2023).

Table-1:

|

Item Description |

$ Amount |

|

Total Investment Income |

47,809,513 |

|

Total Expenses |

22,698,330 |

|

Net Investment Income |

25,111,183 |

|

Realized Gain/loss |

71,825,249 |

|

Un-Realized Gain/Loss |

71,684,291 |

|

Net increase/decrease in net assets from Operations |

168,620,723 |

|

Distribution to Shareholders |

(83,646,026) |

|

Other factors causing increase/decrease (inc. stock issuance/sold, div reinvested) |

78,880,019 |

|

Net increase/decrease in net assets |

163,854,716 |

|

Net Assets – beginning of the period |

1,994,717,344 |

|

Net Assets – end of the period |

2,158,572,060 |

|

Shares Outstanding (no of shares) |

74,730,887 shares |

|

Per Share Data – Net Asset Value per share, beginning of period |

$27.71 |

|

Per Share Data – Net Asset Value per share, end of the period |

$28.88 |

The rising interest rate regime over the last two years has hit all kinds of income-focused investments. The Utility sector was particularly hit hard, and UTG was no exception. From that perspective, the above semi-annual report is not too bad, especially since the NAV of the fund remained stable.

Distributions:

UTG provides a monthly (managed) distribution of $0.19 per share, which comes out to be a yield of 8.47% at current prices (as of 12/19/23). It has paid the distributions consistently since inception and has increased it regularly every two to three years. It has never cut the distributions. It has also provided special distribution in some years. The fund’s management takes pride in the fact that it has paid over $1.3 billion in distributions since inception. Overall, management has done a good job of managing the distribution policy and making the distributions sustainable.

So, is the distribution covered?

This is a utility-focused fund, so earning its income is a major goal. It employs a reasonable level of leverage as well to enhance the income. Let’s look at the most recent semi-annual report that we have available, ending on Apr.30, 2023. We can see from Table 1 that the fund generated roughly $0.64 per share in total investment income (for a six-month period) but spent nearly $0.30 on the fund’s expenses, leaving only $0.34 per share for the distributions. However, the fund pays $1.14 per share for a six-month period. So, it is quite clear that NII covers only about 30% of the distributions.

So, the rest of the distribution needs to come from capital gains, which can vary a great deal depending on the market conditions. That’s where the expertise of fund managers comes into play. Since its inception, the fund has seen many market conditions, including the financial crisis, the 2020 pandemic, the ongoing high-rate interest environment, and other smaller upheavals. We can only judge the management from its past record, and it appears that they have done a good job so far.

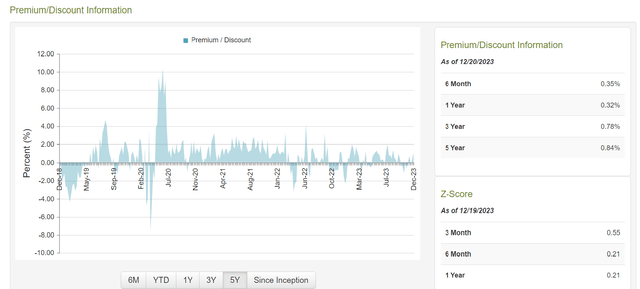

Discount/Premium:

The fund is currently trading at a very small premium of 0.52% (to its NAV). But if you look at its 3-year history, it has traded at an average premium of 0.78%, so the current premium is quite similar to its long-term average. So, in that sense, it is neither expensive nor undervalued from this metric. It has been difficult to find a big discount on this fund in the last few years. However, the utility sector itself has been in a down cycle and undervalued, thus dragging the fund’s NAV down. So, we should look at both the discount and valuation of the sector itself.

Chart-1:

Courtesy: CEFConnect.com.

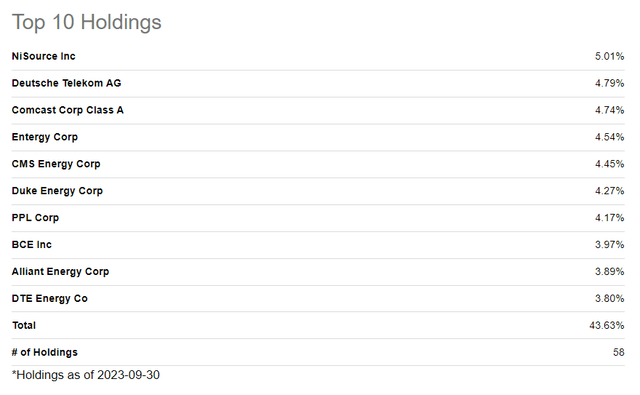

Funds Holdings:

As we already know, the fund is concentrated in the Utility sector, which also includes communication companies. However, within the utility sector, it is fairly diversified, and it has 58 individual holdings. Some of its largest holdings are NiSource (NI), DTEGY Deutsche Telekom AG (OTCQX:DTEGY), Comcast (CMCSA), Entergy (ETR), CMS Energy (CMS), and Duke Energy (DUK), among others. The top 10 holdings account for nearly 42% of the assets.

Table-2:

Courtesy: Seeking Alpha.

Performance:

If someone is looking for growth and high returns, the utility sector is not the place to be in. However, it is very appealing for income investors for reliable and sustainable income. That said, one of the most popular and low-fee ETFs in the sector, i.e., the Utilities Sector SPDR Fund ETF, pays only a 3.37% dividend yield currently. That is not sufficient for most income investors, who need at least 5-6% income from their investments. That’s where funds like UTG have their appeal, by providing monthly distributions that are high enough (currently 8.5%) as well as consistent and reliable.

The long-term performance of UTG has been pretty impressive as well. Let’s see how it compares over the last 20 years with two of the best Utility ETFs, namely, Utilities SPDR Fund (XLU) and Vanguard Utility Fund (VPU). We will also include the SPDR® S&P 500 ETF Trust (SPY) for comparison.

Table 3: (Data as of Dec. 20, 2023)

|

From Jan. 2005 to Dec. 20, 2023 |

UTG |

XLU |

VPU |

SPY (S&P500 ETF) |

|

Annualized Return [CAGR] |

8.88% |

8.04% |

8.04% |

9.41% |

|

Dividend Yield% |

8.57% |

3.44% |

3.55% |

1.42% |

|

Max. Drawdown |

-57% |

-38% |

-38% |

-51% |

|

Std. Deviation |

19.1% |

14.3%1 |

14.0% |

15.2% |

|

Fees |

1.42% |

0.10% |

0.10% |

0.09% |

|

Leverage |

20% |

0% |

0% |

0% |

|

No of holdings |

58 |

31 |

68 |

504 |

|

Assets |

$1.97 Billion |

$14.02 Billion |

$6.08 Billion |

$487 Billion |

|

Allocation |

59% utilities, 20% communication, 7% (approx.) each in Energy, Real-est., Industrials |

100% utilities |

100% Utilities |

Largest 500 US companies |

Note: Some of the data (e.g., number of holdings and leverage) may not be current as of Dec. 20, 2023.

Risk Factors:

Investors need to be aware of certain risk factors that are associated with this fund and CEFs in general. The near to mid-term future performance of UTG will be somewhat tied to the movement of interest rates. However, as of now, all indicators are pointing to interest rates going down in 2024, so we can expect some tailwinds for most Utility companies. That should translate to much better performance for UTG as well. Further, lower interest rates should result in a lower interest burden for the fund.

Risk factors could be summarized as follows:

- The macroeconomic conditions and the movement of interest rates in 2024. If high-interest rates somehow stay higher than expected, then that will be a headwind for this fund.

- The geo-political situation.

- The occurrence of a recession in 2024, however, is likely to be a shallow one by most estimates.

- If the downcycle in utilities persists for a very long time, that may result in forcing the fund to pay the distributions by means of destructive ROC (return of capital). Currently, it appears to be an unlikely scenario.

Concluding Thoughts:

If you are a retiree or less than five years away from retirement, and you need your capital to earn you at least 5-6% income yield, then this fund is for you. We believe you can’t go wrong with this one.

Many times, we hear the argument that why can’t we just hold an index fund like the S&P 500 and sell shares to generate income? Especially when, for nearly 20 years of its existence, UTG has lagged the S&P 500 (though just by 0.5 percentage point), why can’t we just hold the S&P 500 and sell shares to generate income? Sure, if you can do that effectively without emotions, you probably do not need UTG. But for most investors, we have seen that it is very difficult to emotionally deal with selling their shares to generate income. You do not want additional stress dealing with issues like when to sell, how much to sell, and other what-if scenarios. Also, holding the S&P 500 for long periods of time is a good option for passive investors if they do not need income. But for income investors, including retirees, UTG should certainly be a worthy candidate, with its consistent and reliable monthly income. However, just like any other CEF, the timing can be somewhat important (unless you are dollar-cost-averaging).

So, is it the right time to buy UTG? We do not know when the up-cycle will start for utilities. But we do know that all kinds of income securities have been hurt in the last two years due to the rising interest rate cycle. We also know that that trend is about to change now. The declining rates will help boost utilities and other income securities. We rate UTG as a buy at this time. However, if you are a new buyer, you should plan to buy it in two or three lots, giving you the benefit of dollar-cost-average. We think that with interest rates declining from here, the utility sector is generally going to perform better. Even with no discount available with UTG right now, we expect some capital appreciation in the utility sector as a whole.