YorVen

After previously covering The Chemours Company (NYSE:CC) the stock return has remained relatively flat when adjusting for dividends. However, I continue to see significant potential for Chemours even though their debt profile is rather leveraged resulting in a buy rating.

Business Overview

The Chemours Company is a performance chemical company with operations in North America, Asia Pacific, Europe, the Middle East, Africa, and Latin America. It is divided into three main segments: Advanced Performance Materials, Thermal and Specialized Solutions, and Titanium Technologies. Under the Ti-Pure trademark, the Titanium Technologies section manufactures titanium dioxide pigment, which is renowned for its exceptional durability, opacity, brightness, and whiteness. These pigments are widely used in PVC, laminate papers, coatings, plastic packaging, and paperboard packaging.

Refrigerants, propellants, foam-blowing agents, thermal management solutions, and specialty solvents are the main products covered in the Thermal & Specialized Solutions section. The Advanced Performance Materials business, on the other hand, provides a wide range of coatings, membranes, specialized goods, and industrial resins. These are essential in many industries, including digital communication, consumer electronics, semiconductors, energy, transportation, oil and gas, and medical applications. Chemours uses a network of distributors and resellers to expand its reach while marketing its products through both direct and indirect channels.

Business Overview (Chemours Company)

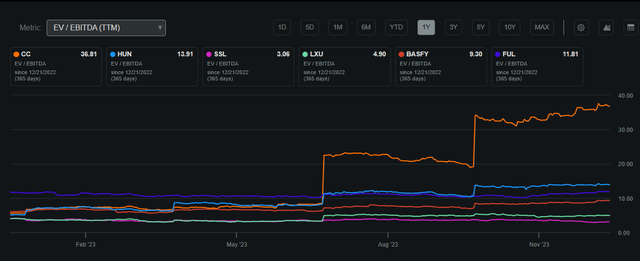

Chemours, with a market capitalization of $4.5 billion, exhibits a -2% Return on Invested Capital. The stock has fluctuated within a 52-week range, reaching a high of $39.05 and a low of $22.88. Currently, it is priced at $31.06, closely aligned with its 200-day moving average of $30.57. The company’s EV/EBITDA ratio stands at 36.81, which is higher compared to its industry peers, indicating a potential overvaluation when viewed in relative terms.

The Chemours Company EV/EBITDA Compared to Peers (Seeking Alpha)

The firm also pays a dividend of 3.30% representing a payout ratio of 36.9% which leaves the company room to repurchase shares while also developing value through its core business once management can find new growth avenues to improve its ROIC. With Chemours’ ROIC being 12% in the previous year and the variation due to the cyclicality of their business, I believe that investments into core business operations will foster growth through performance and improved pricing power, which creates multiple value opportunities for shareholders.

Annual Shares Outstanding (Trading View) Share Performance (Seeking Alpha)

Balance Sheet

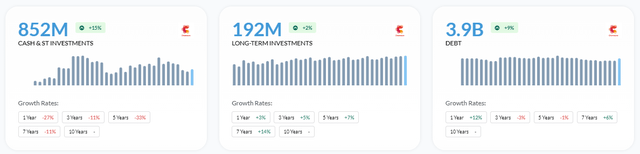

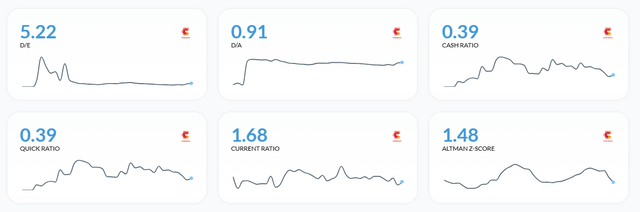

Looking over Chemours’ most recent financial data, it’s clear that the company keeps a slightly more leveraged balance sheet than would be ideal, but overall risk appears to be controlled. With $3,214 million in total current assets, they have a strong asset base. At $25 million, the present debt is quite small, indicating manageable short-term liabilities. Nonetheless, the substantial long-term debt—which is estimated to be $3,788 million—indicates a high degree of long-term borrowing. Despite this, Chemours has proven resilient; its $1,107 million shareholders’ equity shows a steady basis of equity.

The reasonable current debt and significant long-term debt, along with the balance of assets, suggest a strategic approach to financial management. Even if the debt levels are significant, there is comfort in the company’s ongoing efforts to lower debt and manage interest costs, as well as in the anticipated rise in earnings. Despite being lower, the interest coverage ratio appears to be a passing phase brought on by a decline in operating revenue, which is expected to rebound. Furthermore, the company’s Altman-Z-Score of 1.48 and Current Ratio of 1.68 indicate that, even under the worst circumstances, the company should be able to maintain its solvent status in the medium run.

Financial Position (Alpha Spread) Solvency Ratios (Alpha Spread)

Earnings

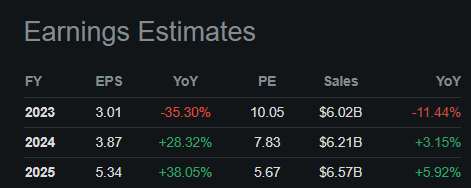

The Chemours Company missed earnings expectations on both the top and bottom in Q3 2023. Relative to the prior year, net sales decreased by 16% to $1.5 billion due to reduced sales in its Titanium Technologies and Advanced Performance Materials sectors. Also, Chemours reported an adjusted EPS of $0.63, missing projections by $0.06 which shows the firms struggle to meet profitability objectives due to macro headwinds.

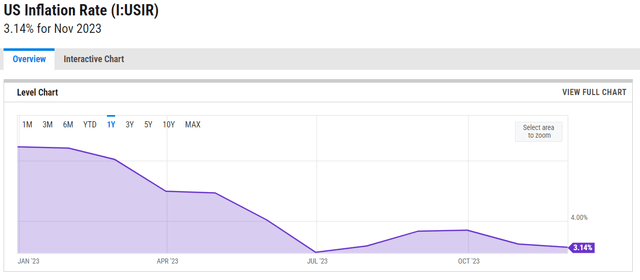

With forecasts of adjusted free cash flow surpassing $225 million, Chemours has an adjusted EBITDA estimate for the entire year of between $1.025 billion and $1.075 billion. With inflation continuing to decline, as demonstrated below, and the Fed’s announcement of rate declines as early as next year, Chemours will be able to lower its cost of debt and increase volume as a result of rising consumer spending and inventory levels, I would have to agree that EPS and revenues are expected to recover over the coming years.

Chemours Earnings Estimates (Seeking Alpha) U.S. Inflation 1Y (Y Charts )

Performance Compared to the Broader Market

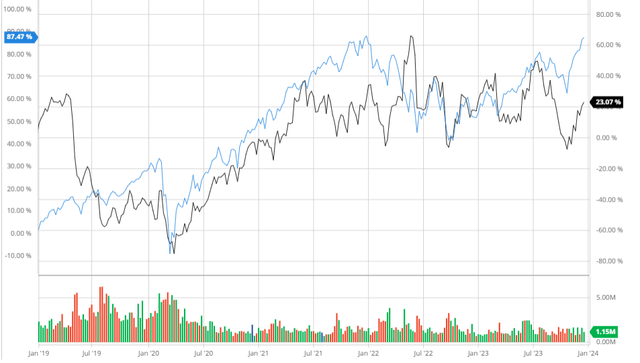

Over the past 5 years, Chemours has underperformed the broader market when adjusting for dividends. This is due to recent declines in profitability and sales because of macroeconomic headwinds, which have strained the firm’s short-term cash flows. With financials expected to return to normal and continue growing in the next few years, I believe that the firm will return strong returns that outperform the S&P due to being currently out of favour resulting in a discounted price.

Chemours Company Compared to the S&P 500 5Y (Created by author using Bar Charts)

Analyst Consensus

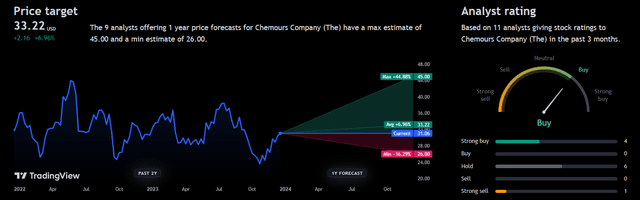

11 analysts over the past 3 months have rated Chemours on average as a buy with an expected 1Y price of $33.22 demonstrating a potential 6.96% upside. I believe that this demonstrates analysts’ mostly bullish view on the firm as this return plus dividends will create a solid compounder for those who are open to the cyclical risk of the chemicals industry and are looking into the long-term potential of cash flows.

Analyst Consensus (Trading View)

Valuation

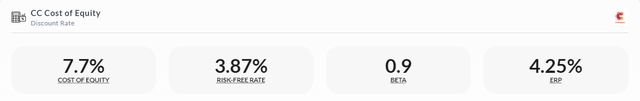

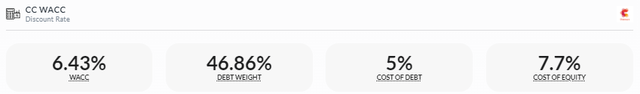

Before finding a fair value for Chemours, I decided to calculate the firm’s Cost of Equity using the Capital Asset Pricing Model. Using a risk-free rate of 3.87% based on the 10-year treasury yield, I found Chemours’ Cost of Equity to be 7.7%. This displays the return investors demand for holding Chemours’ equity.

Chemours Cost of Equity (Created by author using Alpha Spread)

I then used the Cost of Equity and Cost of Debt to calculate the firm’s WACC which is 6.43%.

Chemours WACC (Created by author using Alpha Spread)

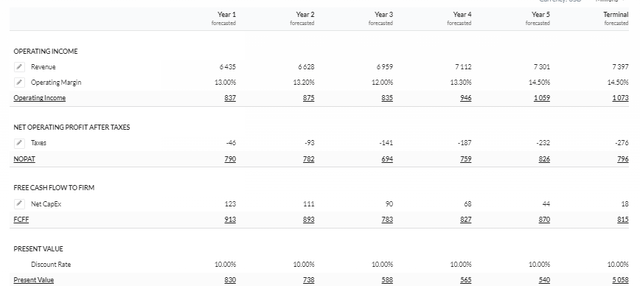

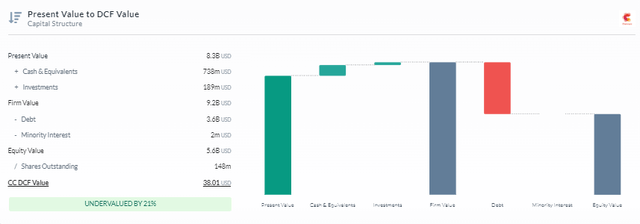

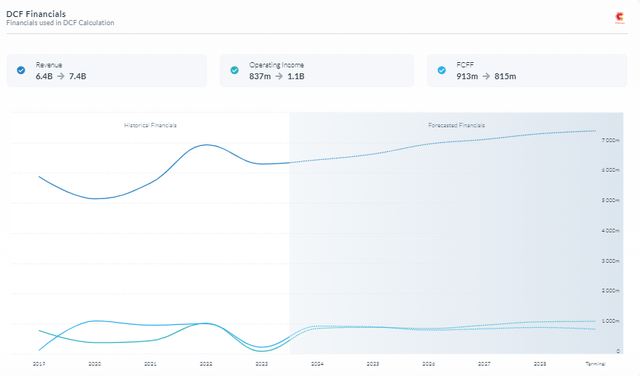

Now that I have an appropriate discount rate, I decided to use a 5Y Firm Model DCF based on FCFF. I also decided to use a discount rate of 10% which shows a 3.57% risk premium to account for underperformance, macroeconomic headwinds, and the firm’s leveraged balance sheet. I also estimated revenues and margins to recover in line with analyst expectations which demonstrates why my risk premium is also high as I am predicting a very realistic but favourable scenario. This resulted in a fair value of ~$38.01 which demonstrates a 21% potential upside.

5Y Firm Model DCF Using FCFF (Created by author using Alpha Spread) Capital Structure (Created by author using Alpha Spread) DCF Financials (Created by author using Alpha Spread)

Technological Innovations Resulting in Solid Growth

Chemours has positioned itself to profit from technology breakthroughs through strategic positioning, as it announced net income of $20 million and adjusted net income of $96 million for the third quarter of 2023, with net sales of $1.5 billion. Their innovative product development, including the Opteon 2P50, a specialty fluid intended for two-phase immersion cooling in data centers, is partially responsible for their financial success thus limiting financial decline in these cyclical downturns.

With a record third-quarter net sales of $436 million, up from the previous year, the Thermal & Specialized Solutions division benefits financially from its technological strategy. The company’s capacity to develop and adapt to market demands is demonstrated by this growth, which is due to the ongoing adoption of Opteon solutions. The demand from stationary and automotive OEMs helped to drive a 5% growth in volume despite a modest fall in prices. Chemours’ emphasis on creating goods that satisfy modern technical demands is seen in this segment’s impressive performance, especially in areas like propellants, foam, and refrigerants.

I believe that this strong financial outlook of Opteon’s usage in mobile and stationary applications will expand Chemour’s cash flow capabilities in all economic environments. Chemours’ forward-thinking strategy, along with their dedication to creating cutting-edge goods, puts them in a position to take advantage of new market opportunities and promote steady financial growth. This will result in solid compounding growth as the firm will be able to limit loss due to improved incomes which will enable the firm to manage these high levels of debt more easily and offload it once the cost of debt increases in the future thus improving FCF overall which will enhance shareholder value.

Risks

Environmental and Legal Risks: The business is battling the effects of environmental liabilities, such as a significant PFAS settlement, which could affect its reputation and finances in the future.

Financial Leverage and Liquidity Risks: Chemours has trouble controlling its financial leverage because of its large gross debt and net leverage ratio, which is approximately 3.2 times. Risks include changes in free cash flow and a decline in operating cash flow.

Conclusion

To summarize, I believe that Chemours is currently a buy because although the firm’s cash flows and financial position are slightly risky, expected recovery, a solid dividend, and a large undervaluation present a great risk to reward.